Explore Mortgage Calculators

Use our UK mortgage calculators to see how much you could borrow, what your repayments might be, and how much stamp duty you'll pay. Whether you're buying your first home or remortgaging, our tools can help you plan confidently.

Benefits of using our calculators

Clear breakdown of your monthly payments

We use live rates from UK's top lenders

Speak to professionals if you need advice

Confidently refine your property search

Your questions about mortgages answered

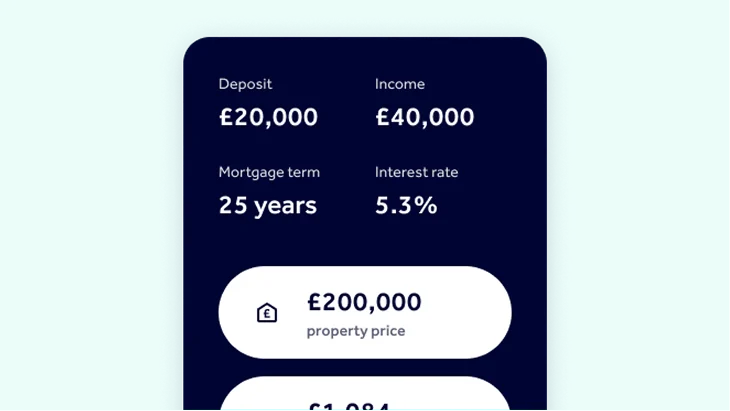

Use our Mortgage Calculator to understand your affordability, find out how much you could borrow and what your estimated monthly payments will be. If you're thinking of remortgaging, you can check your rate options early, see your new estimated monthly repayments and access the best deals from our broker partner when your fixed term is coming to an end.

When you buy a home with a mortgage, you'll need to consider the assets you have - like savings, which you might be able to use for your deposit - as well as the money that's coming in and going out. Your income forms the basis of how much you can borrow with a mortgage. Generally, the maximum loan amount is capped at a multiple of around 4.5 times your income. There are exceptions to this, and the cap can be higher, but this can depend on a range of factors, the main one being how much you earn.

Using our mortgage calculators won't affect your credit score. The calculators will provide you with an estimate of how much your monthly payments will be.

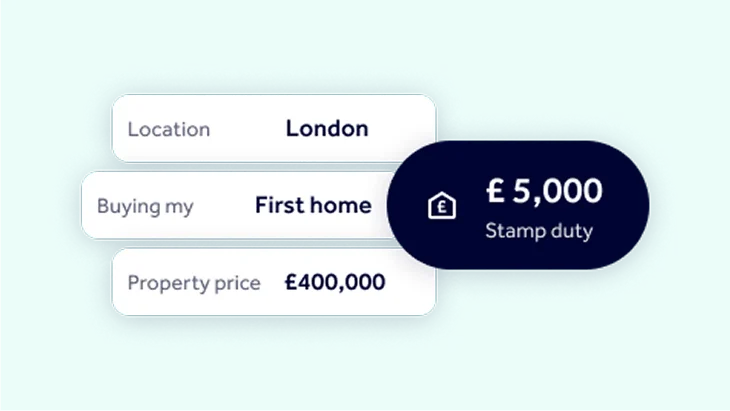

Stamp Duty Land Tax (SDLT) is a form of tax that is paid to the government when you purchase property or land, above a certain price threshold, in England or Northern Ireland. There are also equivalent taxes in Scotland and Wales.

The amount of stamp duty tax you will need to pay depends on a wide range of factors, including how much you pay for the property, the location of the property, whether you're a UK resident, and whether you're a first-time buyer. It also depends on whether you're buying a main home, a holiday home or an investment property.

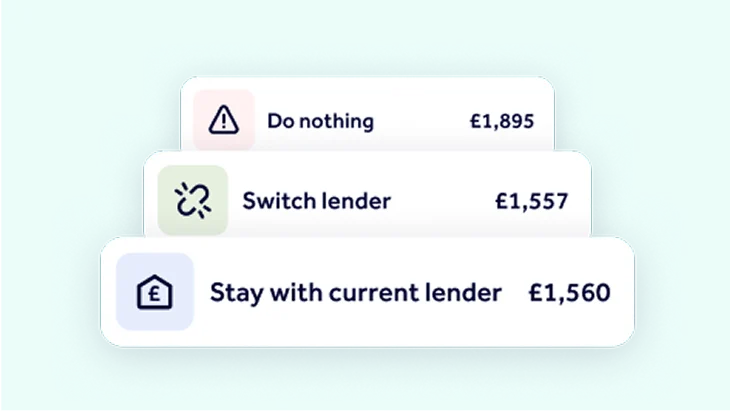

If your mortgage is coming to an end soon, or you're looking to move to a different type of mortgage, you might be thinking about remortgaging. You could also consider remortgaging if you want to borrow more, so you can take out some of the equity in your property for things like home improvements.

When you remortgage, you'll be applying for a new mortgage for the home you currently own from a new lender. If you're switching to a new product with the same lender when your current mortgage deal is ending, this is called a product transfer. Some lenders offer better rates if you already have a mortgage with them, but you may also find a better deal with a new lender.

Yes you can, but you're thinking of leaving an existing mortgage deal, it's a good idea to check if you'll need to pay an ERC. The cost of an ERC is based on the outstanding mortgage amount and how long you have left on your current deal. This is usually a percentage of your outstanding balance and often reduces over time.

Rightmove Group Limited (RMG), Firm Reference No. 491645, is an Appointed Representative of Rightmove Landlord and Tenant Services Limited (RLTS), which is authorised and regulated by the Financial Conduct Authority, Firm Reference No. 522050, and Rightmove Financial Services Limited (RMFS), which is authorised and regulated by the Financial Conduct Authority, Firm Reference No. 805415. This can be checked on the FCA register at www.fca.org.uk/register.

Your home may be repossessed if you do not keep up repayments on the mortgage. Early Repayment Charges may apply if you leave your current mortgage during the fixed-rate period. Rightmove is not authorised to give financial advice. Please seek advice from a regulated mortgage adviser.