House Price Index

Upwards price pressure resumes as demand grows while new sellers pause

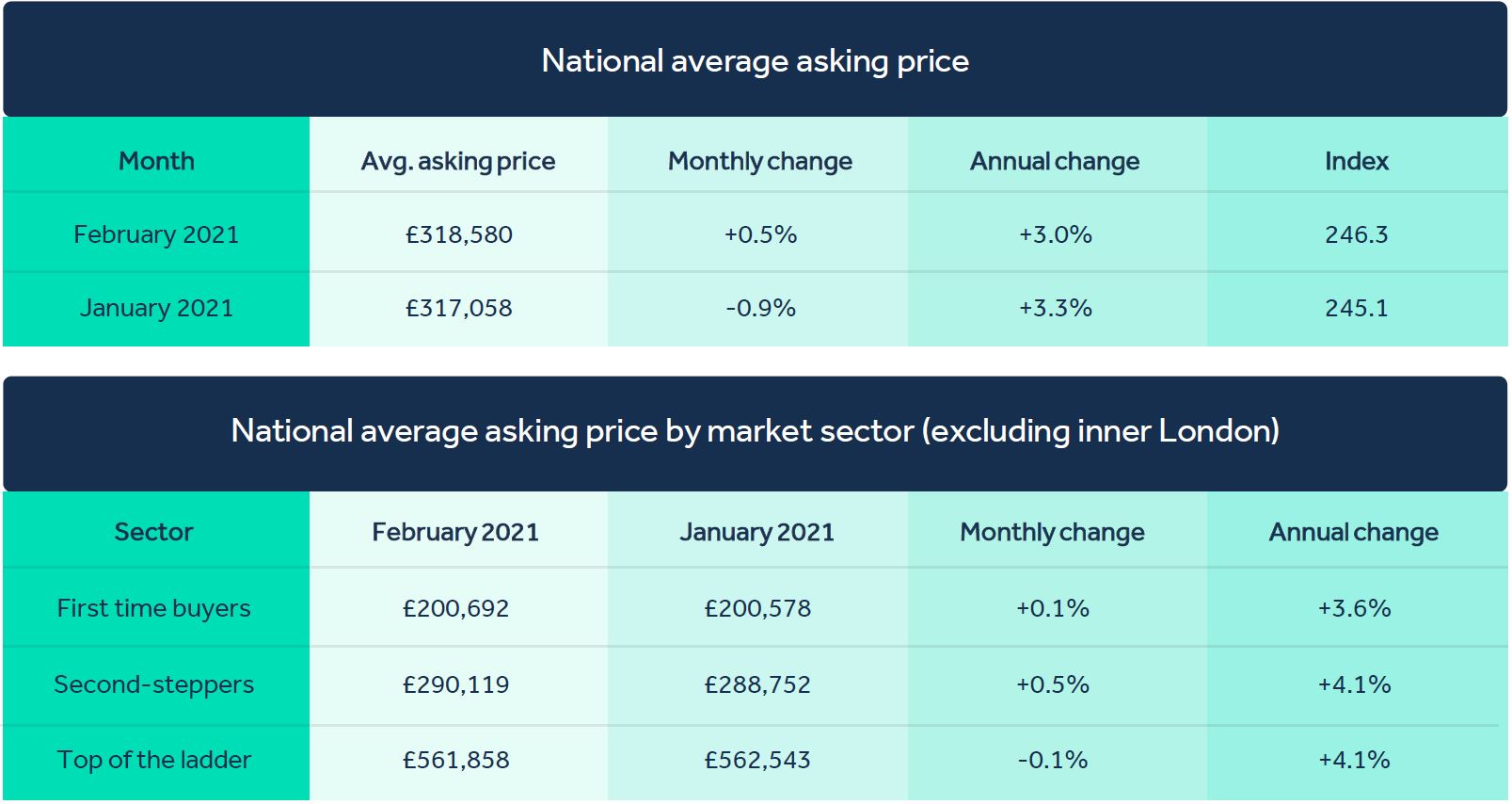

- After three consecutive monthly falls the average price of property coming to market surprisingly increases by 0.5% (+£1,522) this month, as upwards price pressure resumes

- One in five buyers who agreed a purchase in July last year have still not completed more than six months later, with an estimated 100,000 buyers in total still likely to miss out on their expected tax saving

- Number of new buyers continues to grow despite it now being too late for most to beat stamp duty deadline

- First week in February versus 2020 sees Rightmove visits up 45%, with keen home-hunters sending 18% more enquiries, and the number of purchases agreed up by 7%

- High demand outstripping supply and pushing up prices: new seller numbers are 21% down on prior year as owners of family homes delay coming to market, perhaps due to home-schooling distractions

Overview

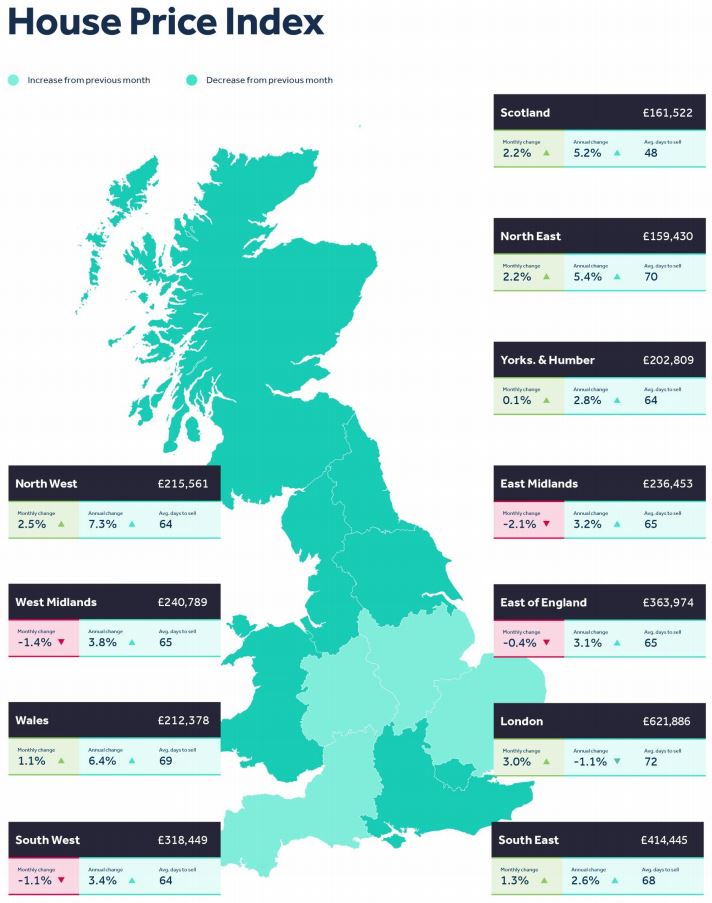

Given the expected loss of market momentum with the impending end of the tax holidays, Rightmove’s whole-of-market view shows some surprisingly buoyant data. After three consecutive monthly falls, the average price of property coming to market has risen by 0.5% (+£1,522) this month. This is being fuelled by both a shortage of supply with fewer new sellers coming to market, and increased demand, with all our indicators of buyer activity being ahead of the same period last year. This new buyer demand surge is building momentum, and as it is now far too late to realistically complete a new purchase before the stamp duty holiday ends on the 31st March, it would appear that many buyers’ desires to move are not dependent on the potential saving.

Tim Bannister, Rightmove’s Director of Property Data comments: “Last year the market was unexpectedly buoyed by buyers’ determination to move and satisfy their new lockdown-induced housing needs. We may well be seeing a continuation of that this year. Rightmove’s early 2021 buyer data shows that despite the imminent end of the stamp duty incentive, all of the key buyer metrics are ahead of early 2020, itself an active period as the market was boosted by the post-election ‘Boris bounce’. As well as the current lockdown motivating buyer demand again, the restrictions have also been a factor in limiting new supply, leading to some modest upwards price pressure. These are strong signs that new buyer demand is not facing a cliff-edge after the 31st of March. It remains to be seen if this momentum will be enough to make up for the removal of the stamp duty savings that are benefitting many buyers and have been adding a sense of urgency to the whole market.”

Rightmove estimates that there are around 100,000 buyers who agreed a purchase before Christmas but will fail to complete by the stamp duty deadline, and will be faced with a tax bill that they may not have factored in when they agreed to buy the property. Our latest analysis shows that of those buyers who agreed a purchase during the month the stamp duty announcement was made in July last year, one in five of them are still stuck in the logjam, more than six months later. This is double the proportion of the previous year when only one in ten purchases that were agreed in July 2019 were still waiting to complete at this time last year. Even if you agreed a purchase the day after the stamp duty holiday was announced, with just six weeks to go, you may still be at risk of losing out by not having enough time to meet the deadline.

Buyer demand was ahead of the same period in 2020 throughout January, and is even stronger in all key metrics for the first week in February compared to a year ago. Despite the very minimal chance of benefitting from the stamp duty savings, the number of purchases agreed is currently up by 7%. The pipeline for future sales is looking even stronger, with the number of prospective buyers sending enquiries to estate agents up by 18%, and the number of visits to Rightmove up by 45%. This high buyer demand is outstripping new supply and helping to edge up prices despite the challenging economic backdrop.

The number of new sellers coming to market is 21% down over the last four weeks when compared with the prior year. Worst affected are the sectors one might expect to be juggling home-schooling responsibilities alongside daily life, which appear to be delaying some owners of family homes from coming to market. The ‘second-stepper’ and ‘top of the ladder’ sectors with three bedrooms or more see 25% fewer new listings between them. In contrast, properties with two bedrooms or fewer are only down by 16%.

Bannister adds: “So far in 2021 home-schooling has taken priority over home-selling for some people. Family properties are suffering most, with the difficulty of preparing a property for marketing and viewings while it’s in use and occupied 24/7 by the whole family likely to give you cause to delay. Ironically, whilst it’s too late for the stamp duty holiday, there are good reasons to come to market now, especially if selling a property suitable for a family. There are more possible buyers looking and fewer suitable alternatives to divert their attention away from yours. An early start to the selling process will also help to get you sold, moved, and settled in before the new school year. With the current speed of the vaccine roll-out, that new school year will hopefully be spent in schools and out of the home, but many of the other new needs for more space both indoors and out will remain.”

Agents’ Views

Aldo Sotgiu, Managing Director of Operations at Arun Estates, said: “We’re seeing high levels of buyer activity and demand remains strong but the number of new listings coming to the market is a concern with many potential sellers preoccupied with the wider problems associated with the pandemic. In addition sellers now realise that they won’t now complete before the end of March and be faced once more with a full stamp duty bill on their onward purchase. All things considered it’s encouraging to see the current demand for property with the levels of new enquiries outstripping the supply of new listings coming to the market so prices are holding up well. Moves may be jeopardised by the time it’s taking to progress from offer to completion having extended dramatically as the vital supporting services struggle to cope with the huge increase in sales last year. It really is a perfect storm of unprecedented activity and economic stimulation colliding with limitations brought about by the shift to home working and reduced capacity in conveyancing firms, local authorities, mortgage lenders and surveyors. With the budget looming there is significant pressure on the Chancellor to leave the door open and extend the stamp duty holiday or to make a concession for sales already agreed. As the vaccine roll out gains momentum, we suspect the supply of properties will get back to more normal levels in Q2 and beyond.”

Michelle Gallagher, Sales Director at JDG Estate Agents in Lancaster, said: “2020 saw a mini-boom in Lancaster and this has continued in 2021, with our sales activity in January being up 23% in the LA1 postcode, and we’re seeing a trend of prices rising more quickly in our rural locations. Buyer demand is up, fuelled by the need for more space as more people are having to work from home. For many, homes are shrinking with the kids being home due to home-schooling. The problem now is the lack of supply, and as such we’re seeing inflated asking prices on some properties. There is no doubt many home sellers have delayed moving plans due to covid, lockdown 3.0, furlough and home-schooling. It’s more important now than ever that agents continue to demonstrate safe viewings and valuations with online videos and virtual viewings as a first viewing step. We’re now doing 95% of all our valuation appointments by video call.”

Richard Freshwater, Director at Cheffins in Cambridge said: “Lockdown #3 brought with it a drop in the number of property valuations taking place. This has created a lack of new available stock in the market, particularly in the higher price brackets, which we forecast will bring with it a rise in property values. As valuations are currently down by around 20 per cent in comparison to January 2020, we are seeing increased competition in the market as there continues to be a ferocious appetite from buyers. As the shortage of supply is unlikely to be addressed until the vaccine roll out is in its later stages, frustrated buyers will continue to struggle to find the type of home which they are looking for. Until the demand vs supply equation is balanced out, competitive bidding is likely to increase causing inflated property values. It is also therefore possible that any deflation to the market caused by the end of the stamp duty holiday will be stabilised by an increase in prices, unless stock levels begin to rise. Whilst looking into a crystal ball it is difficult to predict the behaviour of the market for this year, there is a very real issue with stock levels, particularly for the larger homes which tick all the boxes for buyers, especially those leaving London. As momentum builds behind the calls to extend the stamp duty holiday, the Chancellor’s announcement on the 3rd March ought to help bring some clarity to how market trends might take shape throughout 2021. For us in Cambridge, we have an incredibly active buyer base looking for both city centre and countryside homes, all of whom are competing for the best properties on the market at the moment.”

Kate Eales, Head of Regional Residential Agency at Strutt & Parker, said: “We’re seeing some would be sellers concerned about viewings and the practicalities of putting their property on the market right now. Some are waiting until restrictions ease before marketing their home and as a result stock levels are down. Last year we saw demand rise for family homes off the back of people’s experiences in lockdown and this is where we are seeing the biggest shortage of stock. But at the same time buyers are still out there and we are still registering a large number of new applicants. With this demand there is an opportunity for sellers who want to get ahead of the race likely to come when government restrictions ease, to start thinking now about marketing their home. We’ve seen solicitors being swamped with business and unable to cope with the increased demand, in some cases they are turning away customers. This has been exacerbated by the time in which it’s taking some local authority searches to come back too.”

The House Price Index is the largest, most up-to-date monthly sample of residential property asking prices. The index monitors changes in house prices both annually and monthly, providing a comprehensive view on the current state of the property market in England, Scotland and Wales.

Based on circa 95% of newly marketed property, the Rightmove House Price Index is the leading indicator of residential property prices in England, Scotland and Wales.

Contact our press team

Email: press@rightmove.co.uk

Financial PR team

Sodali: Rob Greening / Elly Williamson

Tel: 0207 250 1446

Email: rightmove@sodali.com