- Key quarterly data

- Q2 2025 overview

- Experts’ views

- Leasing trends

- Investment trends

- About the Commercial Insights Tracker

Key quarterly data

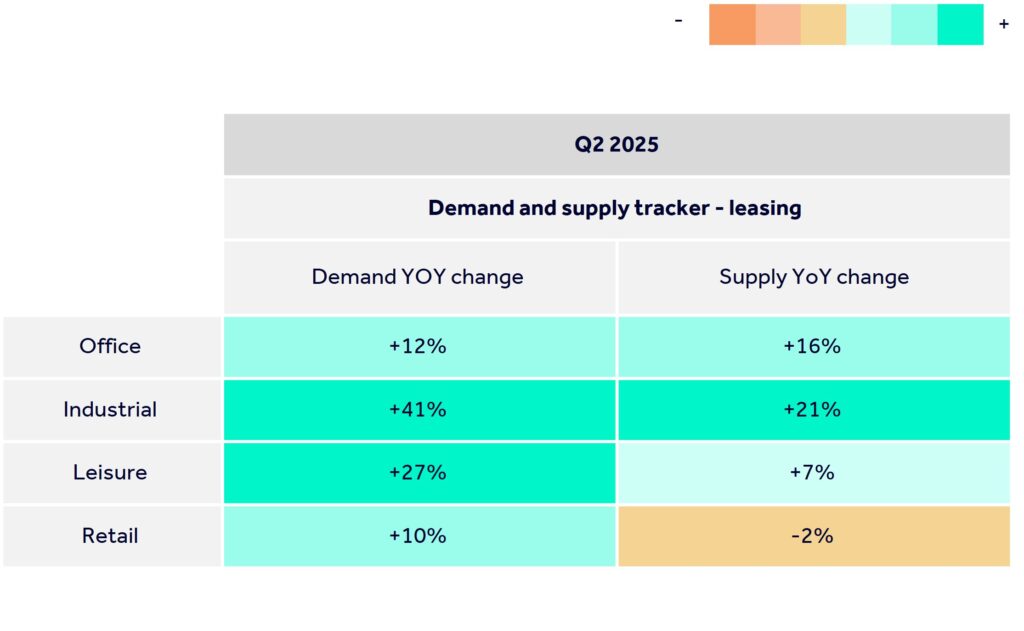

Leasing

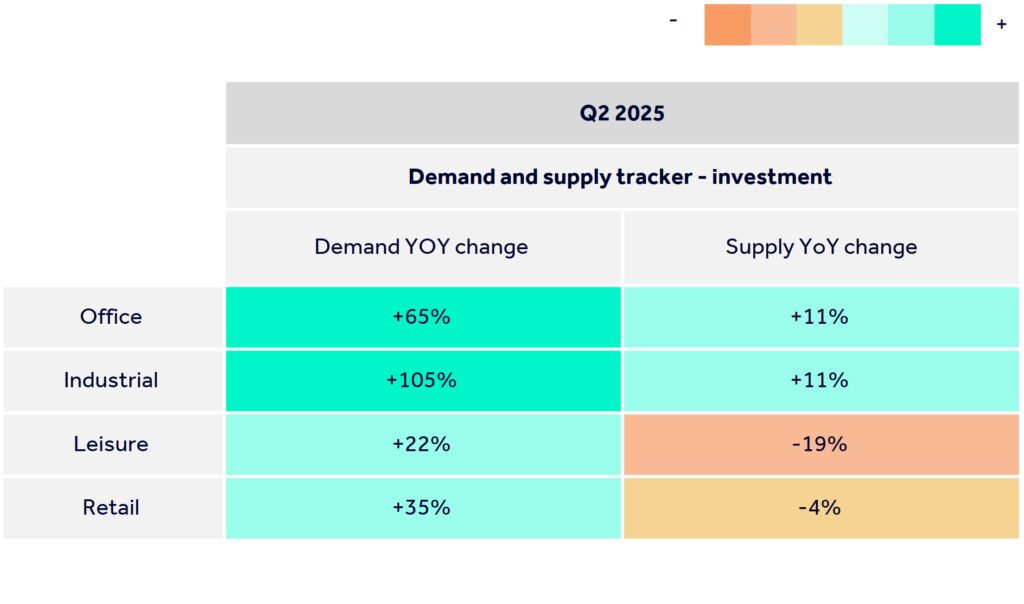

Investment

Q2 2025 Overview

Retail investment bounces back as Bank Rate cut again

•Demand to invest in retail commercial property is up by 35% compared to a year ago, shifting from being 15% down year-on-year in 2024

•Overall demand to invest in commercial property is up by 20% as the interest rate environment improves, and the Bank Rate is cut for the second time this year

•Office sector also seeing improvements, with demand to invest in office sector up by 65% year-on-year, and demand to lease office space up by 12%

The latest insights from the UK’s number one commercial property website Rightmove, reveals a bounce back in demand to invest in the retail sector.

Demand to invest in the retail property sector is up by 35% compared with the same three-month period last year and is measured by enquiries to commercial agents about listings on Rightmove.

High-street retail investment demand, which makes up a large proportion of the retail sector, is up by 56% compared to the same quarter last year, the highest this figure has been since 2021.

The trend marks a shift for retail investment. At this time last year, demand to invest in the retail sector was down by 15% compared with the previous year, and investor interest in the sector had seen a lull period since 2022.

Interest rate cuts are a key driver of the bounce back in both retail investment, and investment in commercial property more broadly, boosted by the Bank of England’s second rate cut of the year in May.

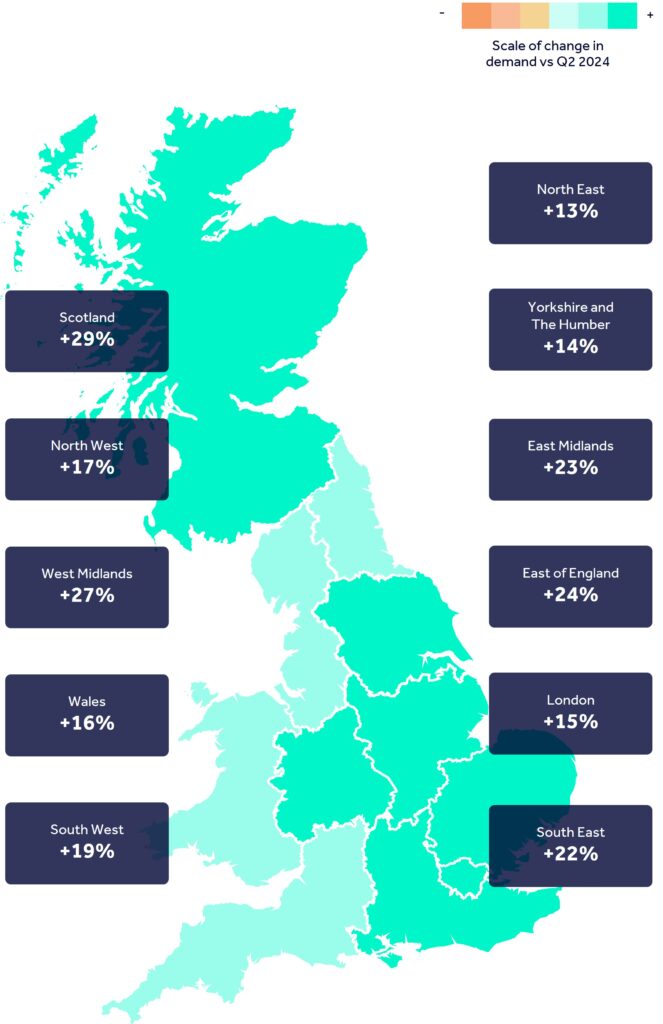

Overall demand to invest in commercial property is up by 20% versus Q2 2024, further highlighting the growth in action from investors in the commercial property sector.

Decreasing supply levels in the retail sector may also be helping to boost demand for available listings. The number of retail properties available to invest in is down by 4% compared to last year and has been on a downward trend since the start of 2024.

Demand from businesses to lease retail space is also up by 10% compared to last year, signalling an improvement in businesses wanting physical retail spaces despite the growth of online commerce.

Outside of the retail sector, the office sector has seen a similar bounce back in investment demand. Demand to invest in office space is now 65% higher than the same three-month period a year ago. Comparatively, at this time last year, this year-on-year trend was down by 13%.

As the conversation around in-person, remote and hybrid working continues, demand from businesses to lease office space is now 12% ahead of this time last year.

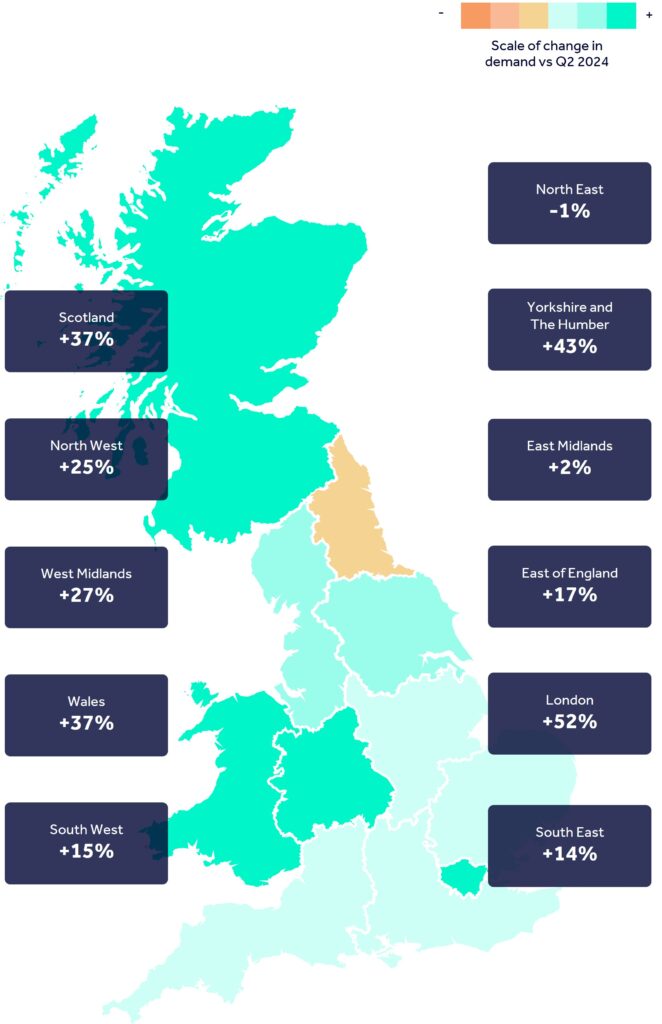

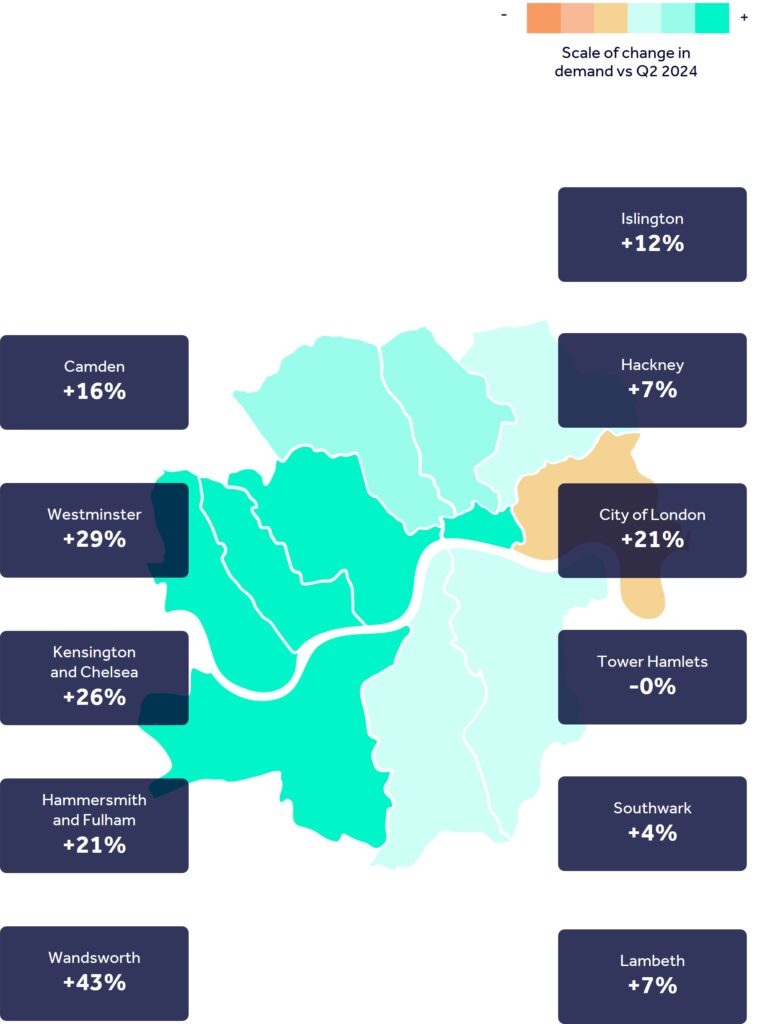

In London, demand to lease office space is 14% higher than this time last year, with some key office hotspots like Westminster (+29%) and the City of London (+21%) even higher.

The industrial sector leads the way this quarter in both the leasing and investment sectors. Demand to invest in the industrial sector has more than doubled (+105%) compared with the same period a year ago, while demand to lease industrial space is up by 41%.

Experts’ views

“The growth of the industrial sector has been one of the main stories so far this year, but we can see a resurgence to invest in retail and office space too. Rate cuts are helping investment into commercial property, and after a period of decline it appears that retail and office spaces are becoming more attractive to invest in.

Andy Miles, Rightmove’s MD of Commercial Real Estate

“Bank of England Base Rate has fallen as expected over the past 12 months and general consensus is that we’ll see further reductions this year. The reduction in Base Rate is much welcomed and coupled with a narrowing of interest rate margins, the overall cost of borrowing continues to fall making investment more attractive.

“We continue to see strong levels of demand from investors across a broad spectrum of asset classes with recent transactions spanning the leisure and hospitality, retail and student accommodation sectors.”

John Mitchell, Managing Director at Christie Finance

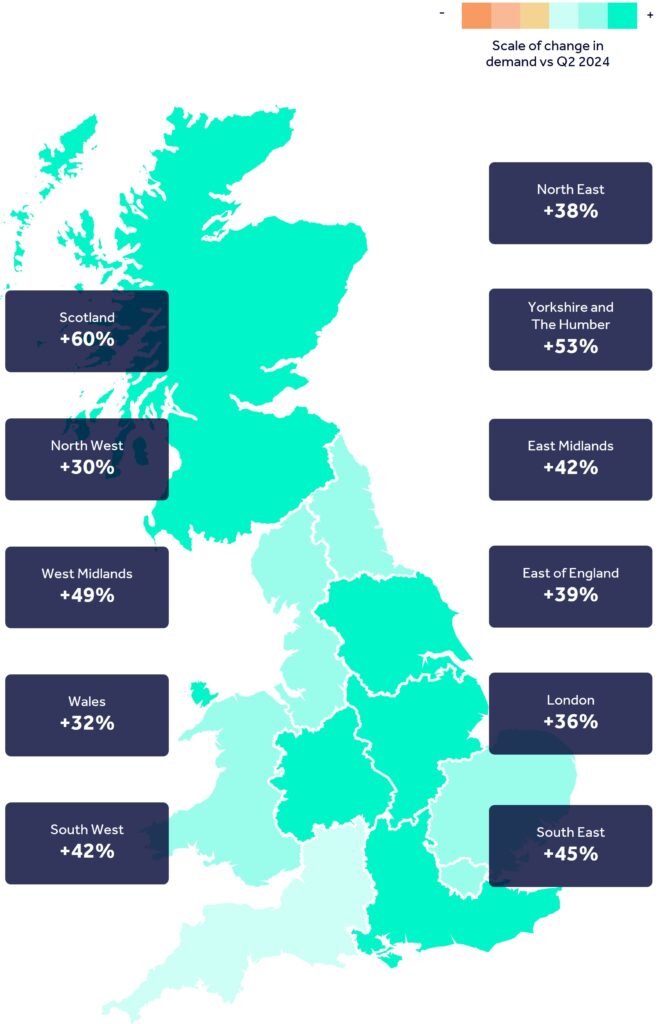

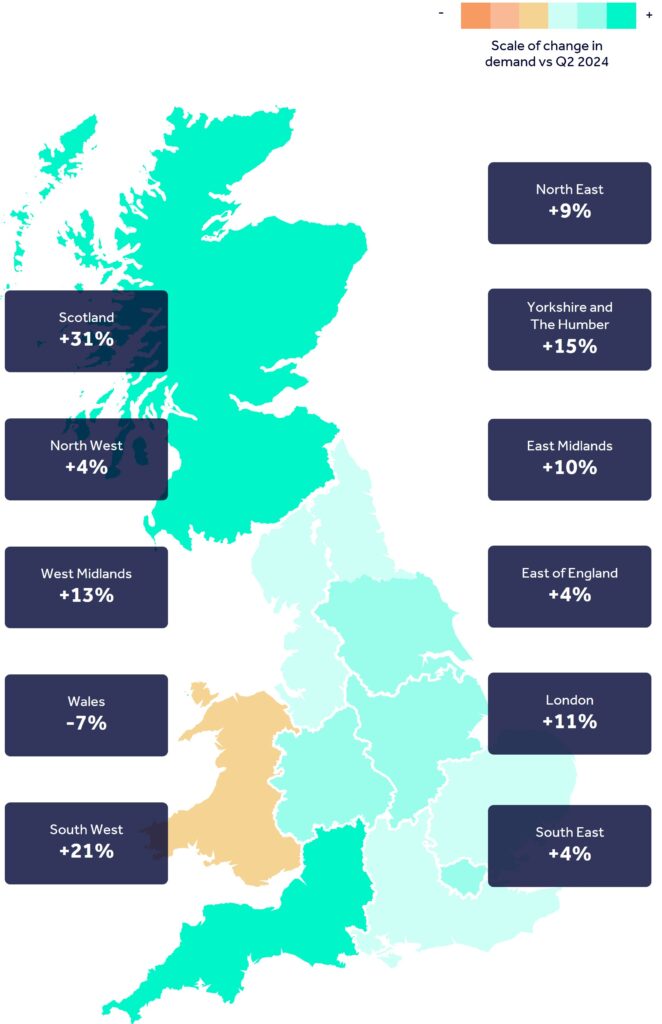

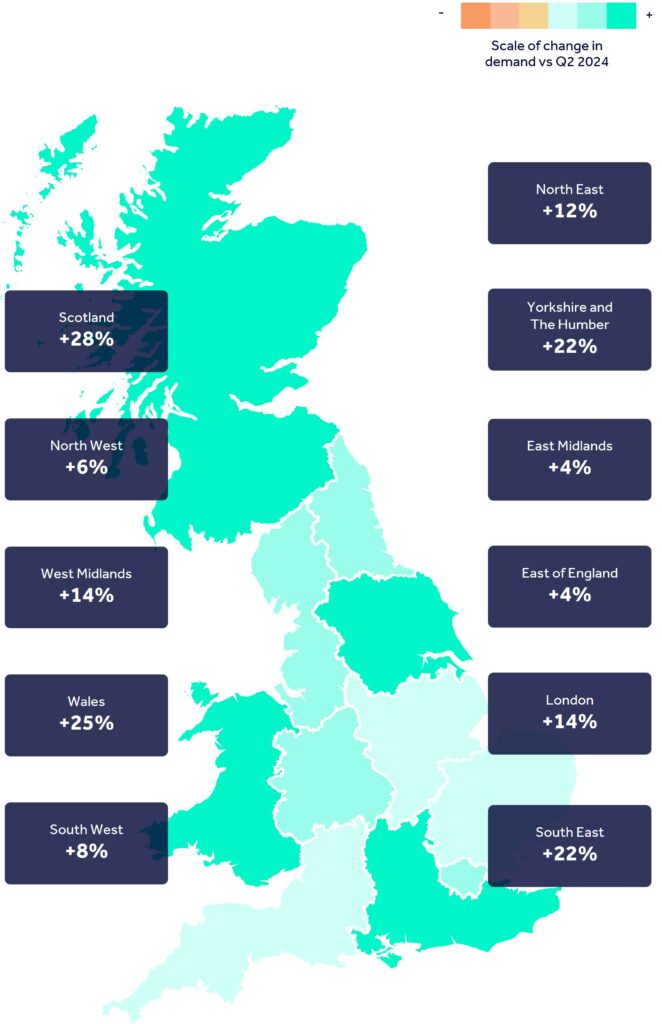

Leasing trends

Industrial demand

Leisure demand

Retail demand

Office demand

London office demand

Investment trends

Investment demand

About the Commercial Insights Tracker

•All data compares April 1st 2025 – June 30th 2025 with the same period a year ago

•Demand definition: all enquiries to commercial agents about listings for l ease, or to invest in via Rightmove

•Supply definition: Supply definition: the number of available commercial real estate listings for lease or investment on Rightmove, adjusted to strip out the effect of any growth in our customer base

•Colour key: Teal colours represent areas with more growth in demand or available listings than a year ago, while red shaded areas represent less demand or available listings than a year ago

•We acknowledge that some market participants will look at demand and supply differently, for example as an aggregate of active searches by tenant representatives, measured in square feet. We aim to provide an alternative lens that makes the best use of our unique dataset.

Copyright © 2000-2026 Rightmove Group Limited. All rights reserved. Rightmove prohibits the scraping of its content. You can find further details here.