10 house price hotspots of 2024

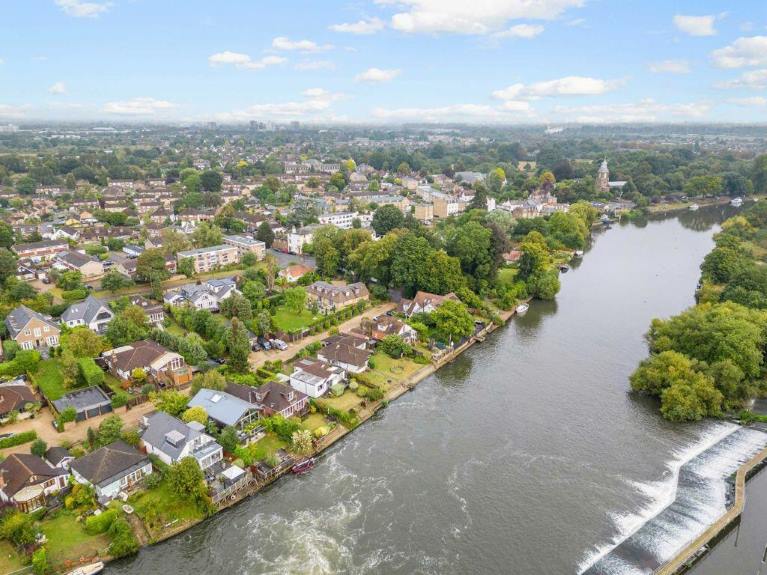

Wondering which areas have seen the biggest house price increases in the past year? We can reveal that the town of Sunbury-on-Thames in Surrey has been crowned 2024’s property price hotspot, where prices have climbed by an average of 12.5%. This is a jump from £527,005 in 2023, to £592,976 in 2024.

Our top 10 list sees its entries dotted all over Great Britain, with the North, South, Scotland and Wales all represented. Bristol City Centre ranked second, with a 9% increase bringing the average price to £391,042. Swinton in Greater Manchester followed closely, also seeing a 9% rise, to £264,081.

These figures contrast with the more muted price growth of 1.4% across Great Britain. Nationally, the average asking price edged up from £355,177 in 2023, to £360,197 by the end of 2024.

10 property price hotspots

| Area | Average asking price 2024 | Average asking price 2023 | Year-on-year price change |

|---|---|---|---|

| Sunbury-On-Thames, Surrey | £592,976 | £527,005 | +12.5% |

| Bristol City Centre, Bristol | £391,042 | £358,654 | +9.0% |

| Swinton, Greater Manchester | £264,081 | £242,303 | +9.0% |

| Skelmersdale, Lancashire | £154,004 | £142,058 | +8.4% |

| Gosforth, Newcastle Upon Tyne | £302,189 | £280,886 | +7.6% |

| Swansea, Wales | £208,709 | £194,439 | +7.3% |

| Merthyr Tydfil, South Glamorgan | £183,550 | £171,007 | +7.3% |

| Darwen, Lancashire | £177,631 | £166,179 | +6.9% |

| North Shields, Tyne & Wear | £247,479 | £231,533 | +6.9% |

| Glenrothes, Fife | £155,240 | £145,337 | +6.8% |

What about regional average house price growth?

Regionally, the North East saw the biggest average price growth last year, with a 4.2% increase in asking prices. This was followed by the North West (3.8%) and Wales (2.9%). London was the only region to record a decline, with average prices falling by 0.8%. However, our experts are predicting that London will see a resurgence this year, with prices bouncing back in 2025.

| Area | Average asking price 2024 | Average asking price 2023 | Year-on-year price change |

|---|---|---|---|

| North East | £186,013 | £178,574 | 4.2% |

| North West | £258,205 | £248,770 | 3.8% |

| Wales | £258,487 | £251,198 | 2.9% |

| Scotland | £185,573 | £180,733 | 2.7% |

| South East | £466,971 | £455,580 | 2.5% |

| Yorkshire and The Humber | £243,456 | £237,547 | 2.5% |

| East Midlands | £280,153 | £275,866 | 1.6% |

| South West | £373,223 | £369,690 | 1.0% |

| West Midlands | £283,733 | £281,696 | 0.7% |

| East of England | £407,464 | £405,158 | 0.6% |

| London | £661,444 | £667,019 | -0.8% |

What’s the average price growth by property type?

Looking at the average of different property types, terraced houses saw the strongest growth in 2024, with average prices increasing by 2.2%. Flats had the most muted price growth in 2024, with prices rising by 0.5% on average.

What could happen next?

Looking ahead, we’re predicting a 4% rise in average asking prices across Great Britain in 2025. We’re also expecting to see more activity this year, of around 1.15 million transactions, as many people who’d put off moves in previous years have 2025 the year they make their move.

Steve Pimblett, Rightmove’s Chief Data Officer, explained: “Even in a year of modest overall growth, there are always locations that outperform. The 2024 hotspots reflect strong demand for quality homes in desirable areas, despite broader economic pressures. As we move into 2025, we expect increased stability in the market, particularly if mortgage rates decline further.”

The header image for this article was provided courtesy of Dexters, Sunbury.

READ MORE: Our 2025 housing market forecast