FirstBuy – The stepping stone into home ownership

Are you a UK resident struggling to secure a mortgage as a result of the large deposits required?

Are you a UK resident struggling to secure a mortgage as a result of the large deposits required?

FirstBuy, a brand new government scheme could be the perfect option to get you on the property ladder more affordably.

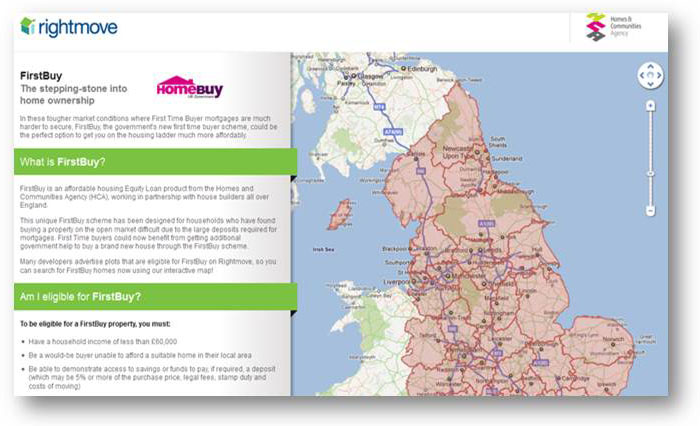

Visit our FirstBuy microsite now to see what’s on offer near you!

For years, home-ownership has been unattainable for many first-time buyers. A £180million government pledge could see the end these problems and help around 10,000 families to get onto the housing ladder for the first time.

FirstBuy is an affordable housing Equity Loan from the Homes and Communities Agency, working in partnership with house builders all over England. If your household earnings are under £60,000, you could secure a mortgage for a brand new home in your neighbourhood with as little as 5% deposit.

Loans are free of charge for the first five years and repaid when the property is resold; the funds will then be recycled to fund more homes in the scheme.

Are you eligible for FirstBuy?

To be eligible for a FirstBuy property, you must:

Where can you find a FirstBuy property?

Many house-builders on Rightmove have fantastic properties to buy through FirstBuy.

Check out FirstBuy property in your area now!

The Government FirstBuy scheme is available only from approved, participating house-builders, (many of whom advertise on Rightmove) and is available until March 2013.