How much have asking prices risen?

For the past few months we’ve seen asking prices continue to rise across Britain, as more people than ever look to find a home that suits how our lives are now, more than a year on from the first lockdown period.

At Rightmove, we track what’s happening to prices and levels of buyer demand, and our most recent data shows that the first six months of this year have been the busiest we’ve ever recorded.

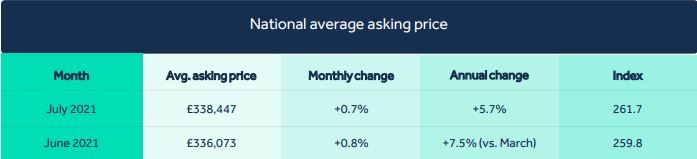

This huge level of demand from buyers has now pushed up the national average asking price of homes to an all-time high of £338,447 – which is an increase of £21,389 (6.7%) since the start of 2021. July’s monthly rise is also the biggest monthly rise at this time of year since 2007.

You can read our full House Price Index report here, and also check what’s happening to asking prices in your region.

Why do house prices keep rising?

There are more people looking to move than there are homes for sale, which is why prices are rising.

Between January and June this year, 140,000 more sales were agreed on average than in the same period in previous years, but there were 85,000 fewer properties that came to market.

This means that there has been a massive shortage of 225,000 homes for sale. If there had been enough homes to make up this shortfall, more people would have been able to move this year, which would in turn have stabilised price growth.

If you’ve been looking for a home with three or four bedrooms, you’ve no doubt noticed how fast they are being snapped up. So for homeowners looking to sell at a good price, it’s a great time to put a property on the market.

Our property expert Tim Bannister says: “It’s still a great sellers’ market despite the end of the tax holiday in Scotland and Wales, and its scaling back in England and Northern Ireland. We’ve seen strong buyer demand leading to a much higher percentage of sellers finding a buyer for their home, and fewer unsold homes being withdrawn from the market.”

What does this mean if you’re looking to move?

Large, detached homes with big outdoor spaces are in high demand from buyers who can now work from home more often and commute less.

Our best advice if you’re looking to buy is to be ready to move as soon as possible to show sellers that you’re serious. You can see our top tips for buyers in a busy property market here.

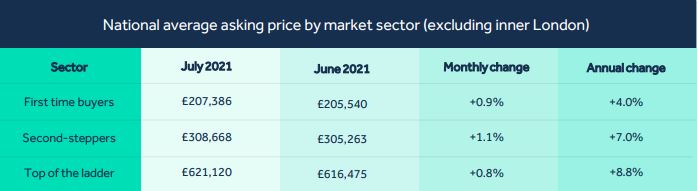

If you’re looking to find a home with two bedrooms or fewer, the good news is that prices haven’t risen by as much in this sector, however the choice of properties is still more limited when compared to the same period in 2019.

Tim Bannister says this could be a relative buying opportunity for those looking to get onto the property ladder. “First-time buyers are currently benefiting from their sector having the most buyer-friendly conditions. Saving for a deposit is still very hard, but 5% is now an option, and with many paying rising rents, buying your own home on a lower deposit is becoming an opportunity again,” he says.

You can view this month’s House Price Index report here.

READ MORE: What can £300,000 buy across Britain?

The header image for this article is provided courtesy of Chestertons Estate Agents, Islington.