New data on the UKs investors and landlords

Over the last 12 months we have seen a dramatic increase in the number of investors registering to receive our investor newsletter.

They regularly receive updates on property opportunities and we hope to share some research on the trends we have seen over the last few months and what motivates them to invest.

Growth in our database

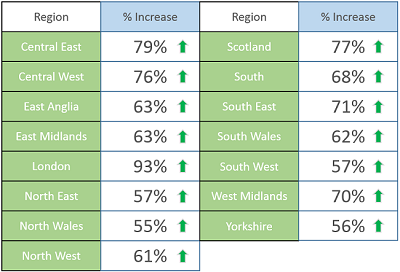

We have seen our investor database grow from 80,000 to 189,000 in twelve months. The figures below display the increase in interest in each region, displaying a national trend towards more interest in investing and on a regional level highlighting particularly impressive growth in London and Scotland.

Who are they?

The common misconception is that when we talk about investors we are discussing large scale organisations with hundreds of properties, who are looking for large discounts and incentives to invest.

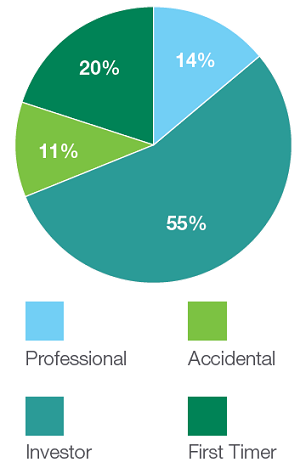

The reality is that while 14% of investors that research on Rightmove describe themselves as “professionals” and list property investment as their full time occupation, the majority fall into other categories.

We thought we’d breakdown these catagories to give you a clear overview of the investor landscape in the UK.

Investment landlords make up 55%, who generally invest in property to provide a secondary income to their primary occupation, or as pension planning.

First timers account for 20%, this group are typically looking to invest close to their home, in an area they know and require advice and education on the entire process.

11% are Accidental landlords, who initially rent out their properties due to a change in circumstances. They will most likely sell when the market improves, however interestingly many of them go on to purchase additional investments once they have gained experience in renting property.

Overseas Investors are also prevalent within the market, they tend to be cash rich and prefer new build property. They see the UK as a safe haven for their funds and are attracted by the track record of capital growth.

We have also seen many enquiries from parents of students, both from the UK and aboard, looking to purchase accommodation for their children whilst they are at University, rather than them paying rent. University Towns feature strongly amongst the most requested areas in our database.

For more information on landlords, where to find them and what motivates them to invest or choose a letting agent, click here for an overview of our research.

Why are they investing?

Interest rates have now been at 0.5% for over 5 years, since March 2009. In the current economic environment people have looked to the potential returns property can offer them, either to boost their current income or help with their retirement planning.

The top 10 locations for rental yield in the UK

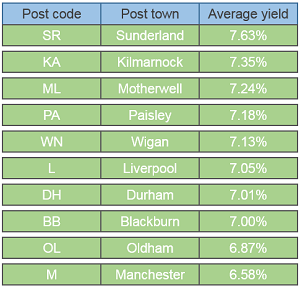

For those looking for extra income from their investment rental yield is important.

When we asked what type of yield investors are looking for the most common response was 5% so we thought we’d share where in the UK that target is current far exceeded.

If your would like to register for our investor newsletter please visit our property investment page here.