Acle

Letting details

- Let available date:

- Now

- Deposit:

- £1,096A deposit provides security for a landlord against damage, or unpaid rent by a tenant.Read more about deposit in our glossary page.

- Min. Tenancy:

- Ask agent How long the landlord offers to let the property for.Read more about tenancy length in our glossary page.

- Let type:

- Long term

- Furnish type:

- Unfurnished

- Council Tax:

- Ask agent

- PROPERTY TYPE

Detached

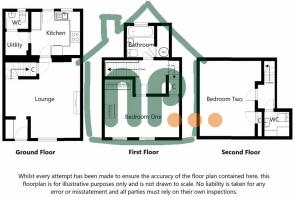

- BEDROOMS

2

- SIZE

Ask agent

Key features

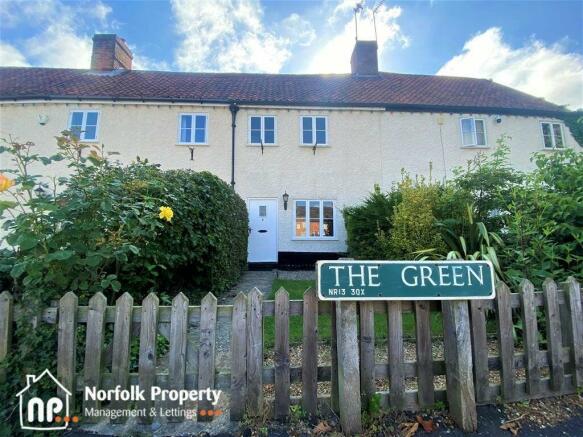

- Acle

- Detached House

- Unfurnished Property

- Tax Band C

- 12 Month Tenancy

- EPC Rating E

- Small Garden

- Sorry No Students

- Allocated Parking

- 2 Bedrooms

Description

Brochures

Brochure- COUNCIL TAXA payment made to your local authority in order to pay for local services like schools, libraries, and refuse collection. The amount you pay depends on the value of the property.Read more about council Tax in our glossary page.

- Ask agent

- PARKINGDetails of how and where vehicles can be parked, and any associated costs.Read more about parking in our glossary page.

- Yes

- GARDENA property has access to an outdoor space, which could be private or shared.

- Yes

- ACCESSIBILITYHow a property has been adapted to meet the needs of vulnerable or disabled individuals.Read more about accessibility in our glossary page.

- Ask agent

Add your favourite places to see how long it takes you to get there.

__mins driving to your place

Creating a better service for landlords

INTRODUCTION

• Norfolk Property Management and Lettings has been exclusively managing properties for many years throughout Norwich and the surrounding areas.

• We endeavour to provide our clients with the best possible service, and pride ourselves on our total commitment and professionalism, coupled with extensive local knowledge.

• Norfolk Property Management and Lettings are members of the

• National Association of Estate Agents

• National Approved Letting Scheme

• Client Money Protection Scheme

• Professional Indemnity Insurance

• 24 hr hotline service at any time.

Since the 1988 Housing Act, home owners have been able to let their properties with the confidence of an Assured Shorthold Tenancy contract allowing them to gain possession at the end of the term, provided the legal documentation is drawn up and acted upon correctly.

Many people are investing in property, moving due to job relocation, travelling overseas, have sold their property and are waiting to buy or simply have a need for larger or smaller accommodation. Most building societies and banks will allow mortgaged properties to be let with the assured Shorthold contract which gives you the flexibility to let your own property and rent another.

Norfolk Property Management has the benefit of local knowledge and a vast depth of experience. Great care is taken in recruitment and development. Everyone - Letting, Secretarial Staff and Partners receives professional training throughout their career at Norfolk Property Management

SPECIALISED LEGAL ADVICE

With legislation constantly under review and the Housing Act radically changing, it is imperative that you receive sound advice that will not prejudice your rights as a Landlord now or in the future. We pride ourselves on being specialists; our knowledge of the law and its implications is the result of many years practical experience. You cannot afford to leave things to chance in the business of Letting.

We have all the latest technology at our fingertips enabling staff, landlords and tenants to contact everyone involved in the letting transaction with speed and efficiency both before and throughout the tenancy. One of the most important decisions is to choose the best tenant for your property.

Once the tenancy has commenced, we will ensure that the property is efficiently and economically managed and maintained throughout the tenancy. The Staff at Norfolk Property Management is committed to understanding your needs and making your decision to let as successful as possible. In the unlikely event of a problem, your concern would be handled quickly and efficiently.

LETTING YOUR PROPERTY

Letting can help cover mortgage repayments and general outgoings and provide a profit. When considering letting for investment purposes, there are a large number of benefits under the current Rent Act Legislation. The main one is to enable landlords to charge open market rents. Furthermore, those landlords unable to commit themselves long-term have an exit route when they need it.

Norfolk Property Management has experience of letting and managing all kinds of accommodation from one bedroom flats, to properties rented by families or approved multiple and corporate tenants. Many large companies have recognised the advantage of renting property for staff, to ease relocation and provide a temporary base for trainees and secondment personnel.

DON'T LEAVE YOUR PROPERTY EMPTY

If left vacant, what is probably your most valuable single asset could become the target for potential squatters, vandals and general deterioration. Repairs left untouched could worsen and prove costly if not attended to.

You may have an investment or retirement property and while you live elsewhere, a responsible tenant can help to protect your asset and contribute to its upkeep.

VACANT PROPERTY MINDING SERVICE

In the event that your property is vacant between tenancies or you are not wishing to let, we offer a full service to include regular inspections, monthly reports, dilapidation and maintenance reports, redirection of mail, cleaning and preparation of the property including reconnection of services and switching on central heating.

Please note that your written instruction is required in the event that you wish the property to be drained down during the winter period. Norfolk Property Management take no responsibility for damage to the property during this period and we advise you to inform your insurance company in order that your policy may be updated.

LEGAL ADVICE and RENTAL VALUATION

We act for you the Landlord. Letting accommodation without experienced staff can be a legal minefield. We are specialists, able to offer you our expertise, advice and legal knowledge.

Before you commit to any service or charges, we will discuss with you all aspects relating to the letting of your property. In addition we will advise and update new regulations and their implications. Update you on all aspects of the law and inspect the accommodation as well as advising on the rent likely to be achieved and suggest how to leave or equip your property.

Creating a better service for landlords

We will comment on the legal and tax implications of your letting and when you decide to let and have appointed us as your agent, we will actively promote your property and, as part of our service, contact the large number of applicants on our register Advertise through local proven sources (Specialist publications by arrangement) Place the details on our property list - this is circulated to potential tenants Photograph your property for advertising purposes.

All of this is done to ensure that your property receives the maximum exposure possible, so that we can obtain maximum rental income and a suitable tenant for you.

We encourage our landlords to ensure their properties are in a lettable condition before our agreement commences and therefore should be: In good decorative condition, Furnished or Unfurnished (although the biggest demand is for properties with furniture, equipment and appliances), Self-contained and preferably with a telephone.

QUESTIONS ANSWERED

How much rent can I expect? What happens if the rent is not paid?

Will I have to pay Income Tax? Can I be sure of getting my property back?

If the tenants damage my property, who pays? Will my existing insurance policy cover my contents?

We will be glad to answer these questions and any further questions that may not be covered in the brochure or that may differ with individual circumstances. If you have not received a free rental appraisal and update on the current laws, please contact the office.

FURNITURE & FURNISHINGS (FIRE) (SAFETY)

REGULATIONS 1988 (AMENDED 1989 and 1993)

Following the above regulations landlords must ensure that all furniture such as settees, chairs, beds, headboards, mattresses, nursery furniture, scatter cushions and pillows etc. pass the cigarette/match test.

To comply with the Fire Regulations your furniture must have been manufactured after 1988 and will therefore include Combustion Modified Foam, which will pass the cigarette/match test and will have a fire safety label if it complies. If the furniture in the property was manufactured before 1950 the regulations do not apply to those particular items.

It is a criminal offence to let your property with sub-standard furniture and the maximum penalty is £5,000 fine and/or 6 months imprisonment.

GAS SAFETY REGULATIONS 1994 (amended1996)

It is law for gas appliances in rented accommodation to be checked annually by a CORGI registered engineer and for records to be kept of all work carried out on each appliance. A copy of a current gas safety certificate should be attached to the agreement or sent to the tenant within 28 days.

Creating a better service for landlords

This regulation applies to all landlords of domestic property and it is their responsibility to keep an accurate record of each gas appliance - date checked, any defects found and remedial action taken. Where it can be shown that a landlord has breached these regulations he/she can be found guilty of the offence under section 36(1) of the Health and Safety at Work Act 1974 and may be prosecuted. The maximum penalty for non-compliance is a fine of £5,000 or imprisonment.

ELECTRICAL EQUIPMENT (SAFETY) REGULATIONS 1994

These regulations impose the obligation on the supplier of such goods to ensure that they are 'safe' as defined by section 19 of the Act - so that there is no risk of injury or death to humans or pets, or risk of damage to property. Cover includes all mains voltage household electrical goods including cookers, kettles, toasters, electric blankets, washing machines, immersion heaters etc. The maximum penalty for non-compliance is a fine of £5000 and/or imprisonment.

We recommend a qualified electrician attend the property and provide a record of all appliances for our files. In the event of a change of tenancy, the records should be updated.

BUILDING SOCIETY/MORTGAGE CONSENT

If your property is mortgaged, you will need to seek approval to the letting from your mortgagee. This is normally readily given if sought before letting arrangements are too far advanced. A fee is sometimes payable to the lender, subject to your own lenders' terms.

LEASEHOLD PROPERTIES

It is wise to check your lease does not contain a covenant to prohibiting letting. You should inform your master landlord of your intention to let; as it is likely your lease requires you to do so. You can check with your solicitor if necessary.

INSURANCE

We recommend you inform your insurance company of your intention to let at an early stage to ensure cover for the property and contents is not prejudiced in any way. Some insurance companies restrict the cover on tenanted property while others will increase your premium to cover the change of requirement. Additionally, it is essential to ensure your policy covers third party claims such as injury caused by a loose fitting carpet, for example. We will be pleased to advise you on a policy and arrange competitive quotes if required.

LEGAL COVER AND RENT GUARANTEE

We can arrange complete peace of mind with Homelet. This insurance will pay the rent you are expecting from your property until vacant possession is obtained for up to 12 months and all related legal expenses.

Creating a better service for landlords

ACCOUNTANCY

We prepare monthly statements showing rent received, less expenditure incurred on your behalf. These statements are essential for taxation. We can prepare an end of year report. Professional advice and assistance can be obtained when required. (Please note, even when a landlord is overseas VAT has to be paid on all fees.)

INCOME TAX

Unless you are in the letting business, your rental income will be unearned or investment income and is liable to tax whether you are resident in the UK or not. When Norfolk Property Management acts as either rent collection or management agents for a landlord abroad, the Inland Revenue will raise an Income Tax assessment against us as your agent in this country.

The Taxes Management Act 1970 requires sufficient funds to be retained to meet your tax liabilities, if any. The new self-assessment regulations require that you should apply for exemption and approval must be received from the Inland Revenue if deductions are not to be collected. Professional help may be required to calculate rental profits to ensure that maximum expenditure is claimed and to consider this profit in relation to any other income or charges you may have. We recommend you appoint an accountant and we will liase with them and the Inland Revenue on your behalf if required.

OVERSEAS LANDLORDS

Our specialised service prepares the detail for your accountant and comes within the regulations set by the Inland Revenue under the Taxes and Management Act 1970. Norfolk Property Management acts for you, in your best interest to maximise the income and minimise the taxes payable. Under the new self-assessment laws you are responsible for advising the Inland Revenue of your circumstances and, as your agent, we are required by law to withhold tax unless specifically exempted by written authority from the Inland Revenue.

This service includes:

1. Liasing with accountants

2. Advising Inland Revenue of setting up a file

3. Supplying Non Resident Landlord tax forms

4. Retaining a percentage of rental income for Inland Revenue, if applicable

5. Pay tax to Inland Revenue from your tax reserve to avoid interest charges.

6. Preparing schedule of income/expenditure for purposes of completing tax returns

7. Supplying Inland Revenue with schedule of income and expenditure

8. Supplying a copy of schedule of income/expenditure, breakdown of reserve account to you

9. Liasing with Inland Revenue regarding your case

10. Advising Inland Revenue when letting ceases

Creating a better service for landlords

FORWARDING OF MAIL

Please arrange for all your mail to be forwarded by the Post Office. This avoids having to rely on tenants passing on your correspondence to our Letting Department. In the event of the department having to forward substantial amounts of correspondence, a handling charge will be levied. Redirection forms can be obtained from the Post Office.

DEDUCTIONS

Several items of expenditure may be allowed as a deduction from the rents;

1. Insurance of property and contents

2. Repairs, maintenance and cleaning

3. Agents fees including VAT and sundries

4. General and water rates

5. Mortgage interest paid gross, when not under MIRAS

6. Accountancy charges for preparing statement

7. Depreciation of furniture and fittings (wear and tear)

(Inland Revenue practice is to allow a percentage of the gross rent receivable less general wear and tear)

PROPERTY MAINTENANCE

It is most important that your property is maintained to the highest standard and we therefore use professional contractors to estimate the total cost of repair and completing the instruction quickly and efficiently. Many of our contractors are registered or licensed within their particular trade and all understand that if they are not realistically priced, they will not receive further instructions from us.

DOMESTIC HEATING

If you want us to manage the property on your behalf, it is necessary that you have made arrangements with a firm of heating engineers for the boiler to be serviced annually. A maintenance contract is ideal and if necessary we can arrange one on your behalf. Any existing contract should be left with us to initiate on your behalf.

CLEANING

It is the tenant’s responsibility to ensure they leave the property in the same condition as they found it. Fair wear and tear is accepted. It is essential that the property be left in a clean and tidy order throughout, prior to the tenant’s moving in. Should professional cleaners have to be used to get your property ready for re-letting, the cost will come from the tenant’s damage deposit. In the event that the property is vacant between lets it may be necessary to instruct a cleaner to prepare the property for the new let. This will be at your expense.

Creating a better service for landlords

GARDEN

If the property has a garden, under the terms of the tenancy agreement, the tenants are obliged to maintain it in accordance with the seasons of the year. It is your responsibility to ensure it is in a maintainable condition at the start of the agreement and to leave sufficient tools to enable tenants to do the work. We will inspect the garden during our management agreement to ensure compliance. You may wish to consider employing a gardener and this extra cost can be incorporated in the rental price.

UTILITIES

You are advised to arrange for the gas, electricity, water and telephone meters to be read and accounts settled prior to the commencement of the tenancy. In addition, you should advise the authorities/suppliers that you would not be responsible for payment of these accounts from a given date. In the event that your property is vacant between tenancies, we will liase with the companies to ensure that the services are not disconnected. There may be a standing charge made to you during this period.

OTHER EQUIPMENT

Landlords are requested to leave an information file regarding any idiosyncrasies of the property and how to deal with them i.e. location of meters, stopcocks etc. Instruction leaflets relating to central heating programmer, electrical equipment, gas appliances etc. Should also be left as problems often arise when machines are not being used properly due to lack of instructions.

HOUSING ACT 1988

The housing act 1988, as amended in 1996, brought about changes to allow fixed term contracts to be used under the assured or assured Shorthold tenancy. Briefly outlined below is the current legislation.

1 All new tenancies will be assured or assured Shorthold (provided that for the tenant the property is their only or principal home)

2.The Rent Act 1977 and Housing Act 1980 are now superseded although existing tenancies under the acts (prior to 15th January 1989) are not affected.

The contract we use is an Assured Shorthold Tenancy (AST) and although there is now no minimum length for this type of tenancy, a Possession Order will not be granted by a Court to come into effect within a period of six months from the start of the tenancy. We therefore recommend that the minimum term is six months.

TENANCY AGREEMENT

This is a written contract between the landlord and tenants, which is both legally binding and enforceable. The term set out in this document is not flexible and must be strictly adhered to by all parties. Although some of the obligations within the tenancy agreement are determined by statute, additional clauses can be included for the landlord and tenant, subject to their legal enforceability.

Creating a better service for landlords

The tenancy agreement will contain such things as the commencement and expiry date, length of tenancy, amount and frequency of rental payments, property address, landlord's and tenant's names.

Norfolk Property Management uses a tenancy agreement drafted by specialists, which is constantly reviewed to ensure its suitability to our clients and to include all amendments to the law. Therefore we recommend that landlords use our agreements as a further safeguard.

NOTICES

Notice Requiring Possession must be presented to the tenant in the prescribed form at least two months prior to the end of the agreement. It is a requirement of the tenant to present the landlord with one month's notice requiring the termination of the tenancy.

In the event that the tenant does not leave the property after the notice has been served, a court order must be obtained for repossession and in this case neither the landlord, nor his agent can attempt to evict the tenant. We will make every effort to obtain possession, however we cannot take responsibility for the tenant's refusal to leave.

DEPOSIT

A deposit is taken at the commencement of the tenancy to be held against dilapidations. Normally, a deposit equal to one month's rent is taken from the tenant and is held by us in our clients' account. Interest is not paid on monies held in our client’s account.

The deposit is refundable at the end of the tenancy when the tenant vacates subject to any claim by the landlord. Therefore, it is essential to prepare a detailed inventory and dilapidation report at the outset of the tenancy. In the event of a dispute, the tenant should be served with a schedule of dilapidations and the deposit should be withheld until both parties have negotiated a suitable settlement.

POSSESSION

Under Part 1 of Schedule 2 of the Housing Act 1988, owner-occupiers are guaranteed repossession of the domiciles once a tenancy has legally expired. This provision for mandatory repossession has been extended to include those landlords who have purchased their new homes, but have yet to take up residence there. Previous legislation would not allow the right of repossession to those owners who had not occupied their homes prior to letting them.

If you are unsure about any aspect of letting and property management, please do not hesitate to contact us and we will be pleased to be of assistance.

RENT COLLECTION SERVICE

We can 'collect' rent and account to your bank or other nominated professionals. This takes away the unnecessary burden of you making sure the rent is promptly paid. Usually rental payments are made on a calendar monthly basis, however frequency of payment can be determined prior to the tenancy commencing. We actively encourage tenants to pay by Standing Order because of its simplicity and speed. We would prepare to pay you by Auto Pay direct to your account.

Creating a better service for landlords

OUR SERVICE WITH THREE KEYS

We are able to offer a flexible service to suit your needs from Introduction only to Full Management. Please decide the service required and contact the office so that we may confirm our terms of business.

KEY 1. TENANT FINDING SERVICE

This service is ideally suited to landlords who wish to carry out their own rent collection and overall management of the property, but require professional consultancy in the early stages of the letting process.

Pre- letting Functions

• Visit property, analyse requirements and appraise the letting potential

• Finalising all details and obtaining your written instructions

• Preparation of property particulars

• Circulating the information to our contracts

• Placing details on our letting register and computer database

• Marketing your property

• Introducing Tenants to you.

KEYS 2. TENANT FINDING SERVICE - CONTRACT AND REFERANCES

We believe that the most important aspect of letting your property is the suitability of the tenant. We act in the Landlord's interest, so we are as selective as we can be about tenants. We strive to maximise the income on your property and reduce the potential risks. We obtain and thoroughly check written references, to include bank, employer, character and any previous landlord and prepare full screening to outline any county court judgements through a credit search. We secure an advance rental payment and a dilapidation deposit on or before the day of signing contracts.

Tenant Finding Selection

• Status Enquiries

• Taking up references on each tenant

• Arranging Viewings

• Collecting payments of the first account, forwarding money and a statement to you net of our fee.

• Collecting deposit and passing this to you

Transfer Arrangements

• Guidelines on current legislation affecting Landlords

• Arranging redirection of mail

End of Tenancy

• Supervision at the end of the tenancy (tenant’s utility bills: checking of inventory: deposit deductions and refund of balance)

• Automatic listing of your property and negotiation of rent where appropriate when current tenancy expires

• Recommendation of any additional work required to re-letting

Creating a better service for landlords

KEYS 3 FULL MANAGEMENT SERVICE

This service includes all functions outlined under 2 Keys Service plus the following:

Prior to moving in

• Supervision of the tenant’s signing of the Tenancy Agreement

• Transfer of utility accounts

• Preparation of a detailed inventory (subject to your instruction)

• Check In of tenant – explanation of how to operate major appliances and assistance with the inventory

• Holding a deposit against damages and non payment of bills held in a separate account

• Guidelines on current legislation affecting Landlords

• Rent collection throughout the tenancy

• Regular inspections of the property and written reports

• Monthly rental payments with statements

• Organisation of repairs and maintenance of the property subject to an agreed expenditure limit

• Commissioning and supervision of major repairs to the property (this can be subject to an additional charge)

• End of Tenancy

• Supervision at the end of the tenancy (tenant’s utility bills: checking of inventory: deposit deductions and refund of balance)

• Automatic listing of your property and negotiating of rent where appropriate when current tenancy expires

• Recommendation of any additional work required prior to re-letting

• Full professional management is by far the best way to ensure your property is maintained to the highest level and returned to you at the end of the term

Landlords who are difficult to contact during the term of the tenancy should consider giving a responsible person Power of Attorney to act on their behalf. In this way decisions and instructions can be acted upon promptly. In the event that we are unable to contact the landlord we will on some occasions make decisions on your behalf in order to protect your asset.

INVENTORIES

A detailed inventory is essential for both landlord and tenant whether the property is to be let furnished or unfurnished. It lists fixtures and fittings, furniture and equipment belonging to the landlord and also their condition. The ingoing tenant will have a copy of the inventory and this forms part of the agreement between landlord and tenant. It is therefore essential that enough time, care and attention be given to compiling the inventory to safeguard your interests. We can prepare this if you wish.

PHOTOGRAPHIC BACK UP

To support the inventory and dilapidation we offer a photographic service, which will provide visual reference of the property before and after the tenancy. Photographs are taken of each room to include furniture and general condition of the rooms. Photographic evidence may be used during the final inspection to negotiate with the tenants and can be used in the event of court proceedings.

DILAPIDATION

These are works, which are needed to bring a property to the standard it was at the beginning of the tenancy. Fair wear and tear accepted. Tenants are responsible for the cost of these works if they happened during the period of occupancy. In residential leases the tenants responsibility only extends to interior fixtures and fittings.

FULL PROFESSIONAL ESTATE AGENCY

Norfolk Property Management offer a complete estate agency service to include valuation, marketing and sale advice together with the opportunity of opening files for sale and letting giving us the opportunity to advertise your property to both markets and enabling you to benefit from your asset quickly.

FINANCIAL SERVICES

Norfolk Property Management is able to offer a full service to landlords with our in house adviser. Please contact the address below for more details

PROPERTY PURCHASING SERVICE

With the current climate, many people are considering purchasing properties to let for long-term investment purposes. We are able to offer full service including advice on suitable properties to purchase, accompanied viewings to discuss on site alterations/improvements required, advising on raising capital, instructing solicitors and mortgage companies through to preparation and completion of tenancies. Further details can be discussed with our trained staff.

FREE RENTAL APPRAISAL

Please call the office for an appointment. We can advise on all aspects of letting your properties.

Tel 01603 219319

Mob 07885 373020

E-mail info@norfolkpropertymanagement.co.uk

www.norfolkpropertymanagement.co.uk

Notes

Staying secure when looking for property

Ensure you're up to date with our latest advice on how to avoid fraud or scams when looking for property online.

Visit our security centre to find out moreDisclaimer - Property reference 33425108. The information displayed about this property comprises a property advertisement. Rightmove.co.uk makes no warranty as to the accuracy or completeness of the advertisement or any linked or associated information, and Rightmove has no control over the content. This property advertisement does not constitute property particulars. The information is provided and maintained by Norfolk Property Management, Norwich. Please contact the selling agent or developer directly to obtain any information which may be available under the terms of The Energy Performance of Buildings (Certificates and Inspections) (England and Wales) Regulations 2007 or the Home Report if in relation to a residential property in Scotland.

*This is the average speed from the provider with the fastest broadband package available at this postcode. The average speed displayed is based on the download speeds of at least 50% of customers at peak time (8pm to 10pm). Fibre/cable services at the postcode are subject to availability and may differ between properties within a postcode. Speeds can be affected by a range of technical and environmental factors. The speed at the property may be lower than that listed above. You can check the estimated speed and confirm availability to a property prior to purchasing on the broadband provider's website. Providers may increase charges. The information is provided and maintained by Decision Technologies Limited. **This is indicative only and based on a 2-person household with multiple devices and simultaneous usage. Broadband performance is affected by multiple factors including number of occupants and devices, simultaneous usage, router range etc. For more information speak to your broadband provider.

Map data ©OpenStreetMap contributors.