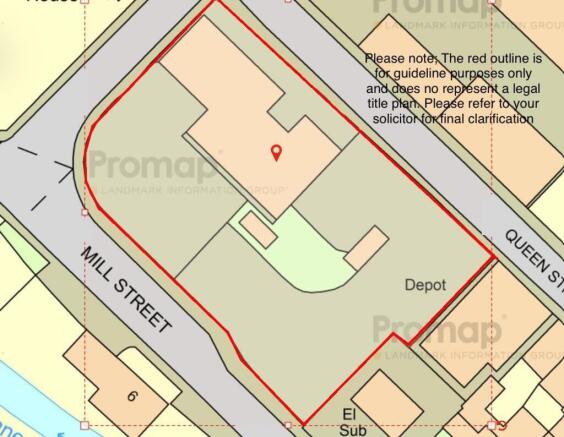

Queen Street, Congleton, CW12

- PROPERTY TYPE

Workshop

- SIZE

Ask agent

Key features

- Approx 3000 square feet of internal space across three units

- Yard and mechanic sheds plus office area

- Buildings in need of general upgrading

- Entire site measures approx 1/3 acre

- Convenient location close to Congleton town centre and main road access

- Currently a busy mechanics business operating from the site, vacant possession on completion

Description

Located in a convenient part of town close to commuter access links as well as the ever growing town centre of Congleton, this commercial premises comprises three main buildings currently used for vehicle servicing. The remainder of the approx 1/3 acre plot is made up of compound parking areas that are all street facing. The three units measure approx 3000 sqft internally and are in various degrees of condition.

It's worthy of note that the current owner historically had plans drawn up for a scheme of housing and whilst no residential planning permission has been granted, prospective purchasers are to make their own investigations with regard to obtaining permissions.

Small Business Rate Relief

Small business rate relief You can get small business rate relief if: your property’s rateable value is less than £15,000 your business only uses one property - you may still be able to get relief if you use more You cannot get small business rate relief and charitable rate relief at the same time. Your local council will decide which type of relief you’re eligible for. What you’ll get How much small business rate relief you get depends on your property’s rateable value. You will not pay business rates on a property with a rateable value of £12,000 or less, if that’s the only property your business uses. For properties with a rateable value of £12,001 to £15,000, the rate of relief will go down gradually from 100% to 0%. Example If your rateable value is £13,500, you’ll get 50% off your bill. If your rateable value is £14,000, you’ll get 33% off. If you use more than one property When you get a second property, you’ll keep getting any existing relief on your main property for 12 months. You can still get small business rate relief on your main property after this if both the following apply: none of your other properties have a rateable value above £2,899 the total rateable value of all your properties is less than £20,000 (£28,000 in London) How to get small business rate relief Contact your local council to: check if you’re eligible find out how to get small business rate relief check if you can get any other types of business rates relief on top of small business rate relief If your circumstances change Report changes to make sure you’re paying the right amount and do not get a backdated increase in your bill or overpay. Contact your local council if: your property becomes empty you get another property you make any changes to your property that would increase its value - for example, extending or renovating it the nature of your business changes or it moves to different premises The amount of small business rate relief you’re eligible for may change. For example, it may decrease if the rateable value of your property has increased. You’ll usually need to pay your new rate starting from the day your circumstances changed.

Queen Street, Congleton, CW12

NEAREST STATIONS

Distances are straight line measurements from the centre of the postcode- Congleton Station0.9 miles

- Alsager Station6.2 miles

- Goostrey Station6.2 miles

Notes

Disclaimer - Property reference a0d17e39-6644-4a49-9f4f-840feb36c899. The information displayed about this property comprises a property advertisement. Rightmove.co.uk makes no warranty as to the accuracy or completeness of the advertisement or any linked or associated information, and Rightmove has no control over the content. This property advertisement does not constitute property particulars. The information is provided and maintained by Chris Hamriding Lettings & Estates, Congleton. Please contact the selling agent or developer directly to obtain any information which may be available under the terms of The Energy Performance of Buildings (Certificates and Inspections) (England and Wales) Regulations 2007 or the Home Report if in relation to a residential property in Scotland.

Map data ©OpenStreetMap contributors.