- Key quarterly data

- Q4 2025 overview

- Leasing trends

- Investment trends

- About the Commercial Insights Tracker

Key quarterly data

Leasing

Investment

Q4 2025 overview

Autumn Budget doesn’t dampen commercial property outlook for 2026

- Demand in both leasing and investment remained in largely positive territory, despite Budget uncertainty

- Industrial sector continued to lead the way with demand to lease up 11% year on year and demand to invest up 12%

- 2026 outlook shows positive signs alongside predicted interest rate cuts

Demand in terms of both leasing and investment for commercial real estate in the UK largely remained in positive territory in Q4 2025, despite the uncertainty caused by November’s Budget, according to Rightmove’s latest Commercial Insights Tracker.

Growth in demand was lower than in both the previous quarter and the same period last year. However, this was in part down to the timing of – and extensive speculation about – the Labour government’s second Budget, which took place unusually late on 26 November.

There was speculation in the months leading up to the Budget that there would be significant changes to the tax code, giving business leaders a reason to wait and see what would happen.

“It seems that uncertainty in the run up to the Budget suppressed demand in some areas, but it’s positive that it mostly continued to grow year-on-year,” said Andy Miles, Managing Director, Commercial, at Rightmove. “Some business leaders understandably delay their decision making when potentially large financial changes are just around the corner.”

Figures for the last quarter of 2025 remain robust, perhaps surprisingly given the uncertainty caused by the Budget.

He added: “There are positive signs ahead for the rest of 2026. Not only is demand largely higher than last year, but we are expecting to see further interest rate cuts starting later this year, which would help to make commercial property investment more attractive and viable to some investors.

“It’s still a difficult cost climate for many businesses, but stable demand to lease commercial space and interest rate reductions for investors would help to create some momentum for the 2026 market.”

The Budget did indeed include a major shake-up of the business rates regime. From April 2026, a new five-category multiplier structure will apply. Perhaps most prominently, it introduced a clear distinction between retail, hospitality and leisure properties and all other commercial properties, as well as a new band for high-value premises.

Demand to lease industrial property increased the most year on year, at 11%, followed by offices (2%) and leisure (1%). Leasing demand for retail properties fell by 4% over the same period. When it comes to investment demand, industrial fared best at a 12% increase, followed offices (4%) and retail (3%). Demand for leisure fell by 7%.

At the same time, supply across all sectors ticked up when it came to leasing and all but leisure in terms of investment. At a time when demand is muted – or at least more muted – this is, perhaps, to be expected.

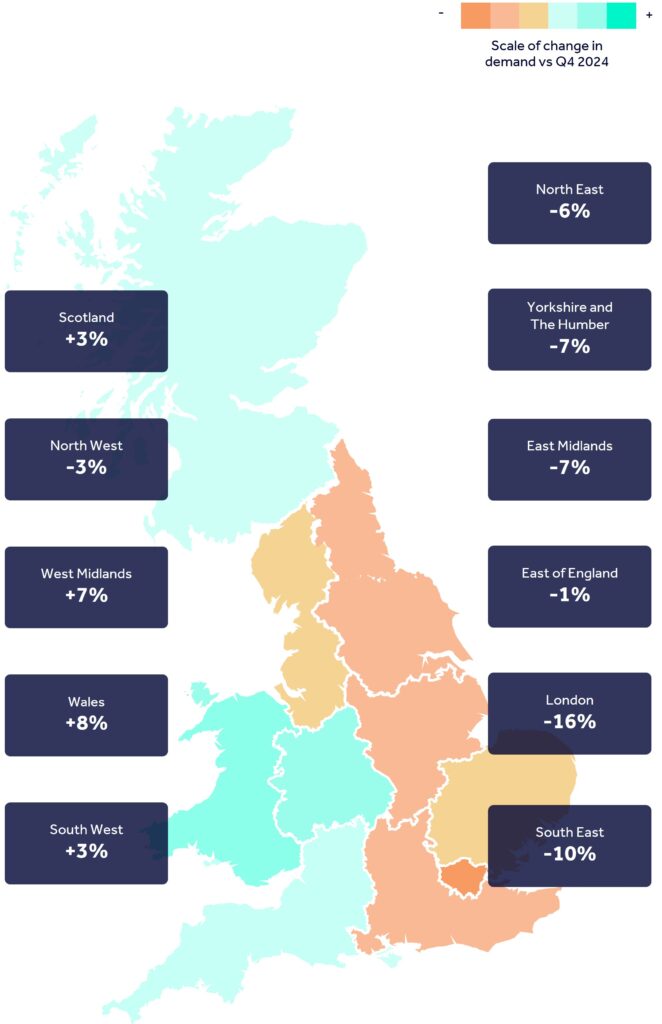

Demand to lease office space in some of London’s key business locations dropped by more than the national average, another signal that some business leaders adopted a wait and see approach at the end of 2025 due to the Budget – although this could also be due to tight supply at the prime end of the market.

Demand to lease office space in the City of London dropped by nearly a quarter compared to the same period a year ago (-24%), while in Westminster it was a drop of 8%.

Darren Bond, Global Managing Director at Christie & Co, comments, “We are optimistic about the market outlook for our specialist sectors. The visibility and pipeline of transactions anticipated to happen in the first half of the year are encouraging when compared with the same period a year ago.

“There is no doubt that cost pressures will continue to put a strain on businesses, and the economic environment will be more challenging in the year ahead.

“As long as demand remains at the current level, with bank funding readily available, then we see no reason why market sentiment shouldn’t be maintained and even surpass the levels seen in 2025.”

Leasing trends

Industrial demand

Leisure demand

Retail demand

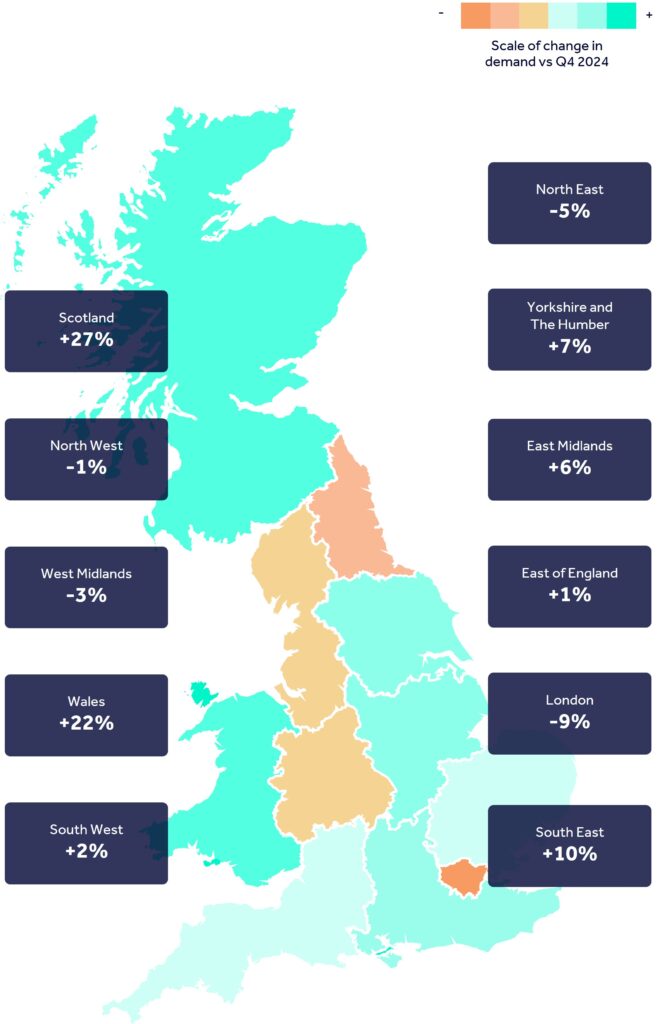

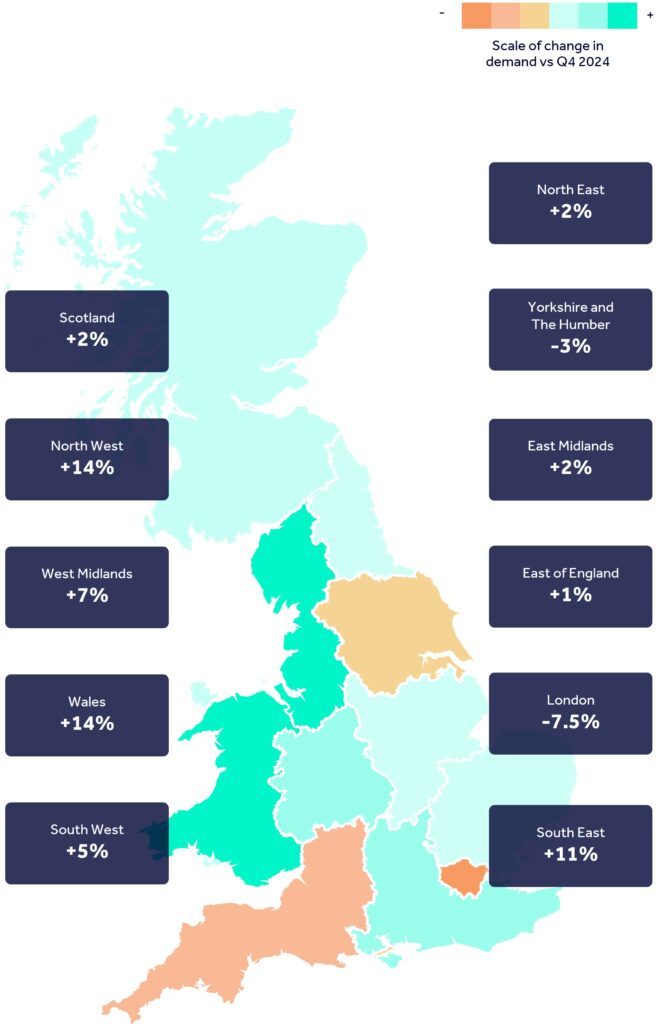

Office demand

London office demand

Investment trends

Investment demand

About the Commercial Insights Tracker

• All data compares October 1st 2025 – December 30th 2025 with the same period a year ago

• Demand definition: Enquiries to commercial agents about listings for lease, or to invest in via Rightmove

• Supply definition: the number of available commercial real estate listings for lease or investment on Rightmove, adjusted to strip out the effect of any growth in our customer base

• Sectors used to compile data: Office, Industrial, Leisure and Retail. Unless stated that it’s an overall number

• Colour key: Teal colours represent areas with more growth in demand or available listings than a year ago, while red shaded areas represent less demand or available listings than a year ago

• We acknowledge that some market participants will look at demand and supply differently, for example as an aggregate of active searches by tenant representatives, measured in square feet. We aim to provide an alternative lens that makes the best use of our unique dataset

Copyright © 2000-2026 Rightmove Group Limited. All rights reserved. Rightmove prohibits the scraping of its content. You can find further details here.