- Key quarterly data

- Q4 2024 overview

- Experts’ views

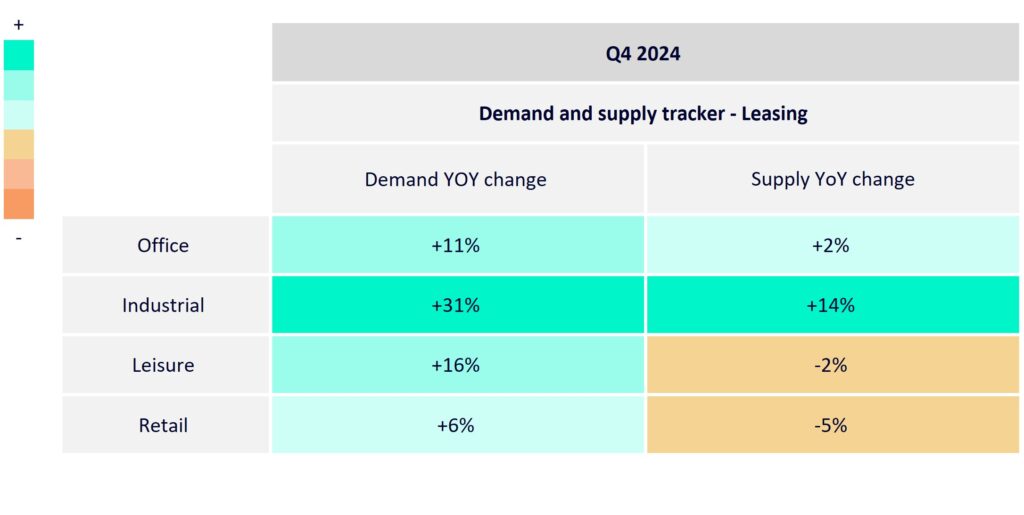

- Leasing trends

- Investment trends

- About the Commercial Insights Tracker

Key quarterly data

Leasing

Investment

Q4 2024 overview

Surge in demand for investment sector as interest rates drop

The latest insights from the UK’s number one commercial property website Rightmove reveals that there has been a surge in demand to invest in commercial property compared with the same period a year ago, as interest rates drop following the second Bank Rate cut.

The trend marks a continued recovery for the investment sector as opportunities become more affordable and attractive.

Rightmove’s Quarterly Commercial Insights Tracker analyses millions of data points from the largest and most engaged commercial audience in the UK, to track supply and demand over time.

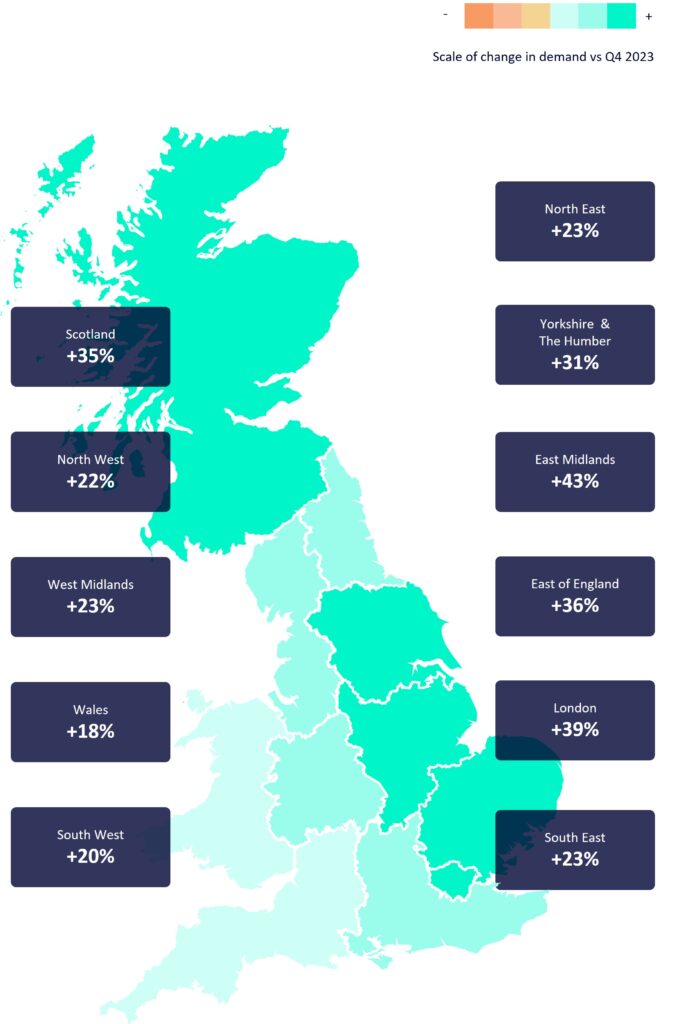

Demand is measured by enquiries to commercial agents about listings for lease, or to invest in via Rightmove. The data for Q4 2024 shows that demand to invest in commercial property of all types was up by 28% by the end of last year, the biggest year-on-year shift since Q2 2021.

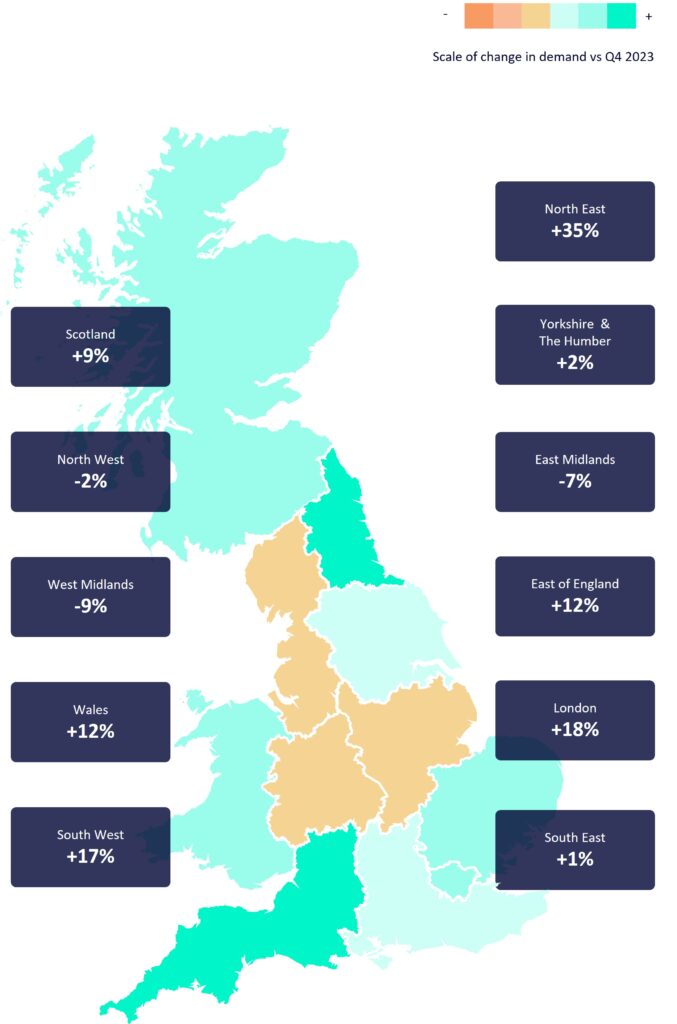

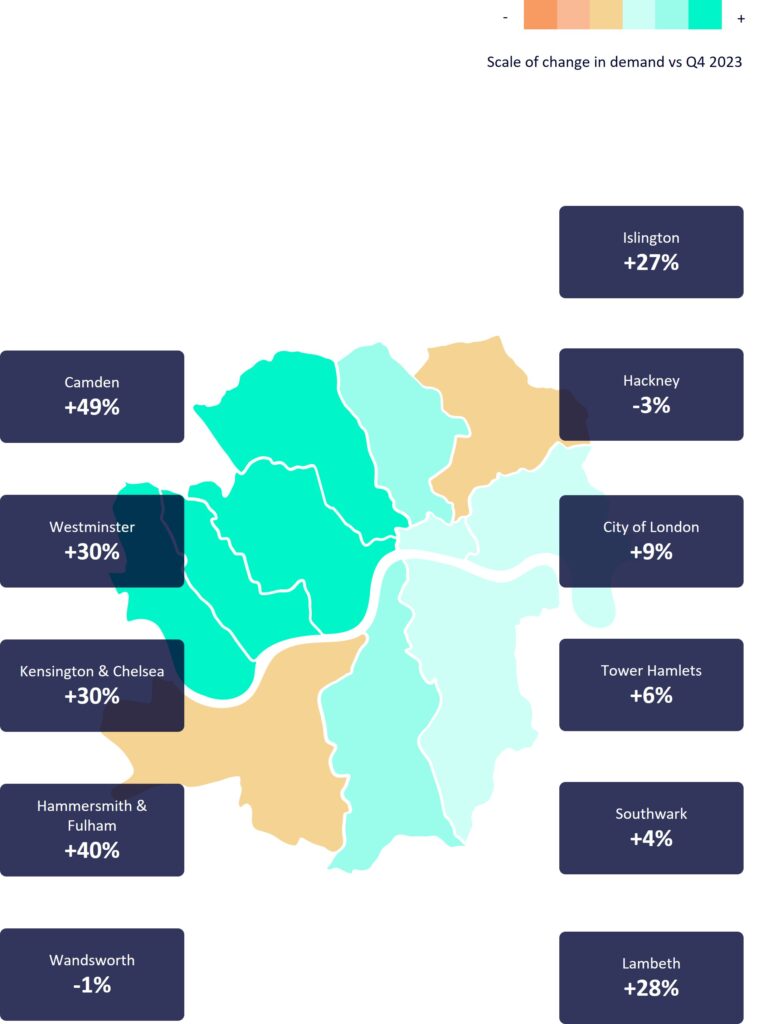

At a regional level, the biggest increases to invest in commercial property overall are the East Midlands and London.

The trend is led by the industrial sector, where Rightmove recorded record demand to invest in the sector. Demand for industrial listings to invest in was 72% higher than in Q4 2023.

After the industrial sector, the office sector has seen the biggest jump in investment demand versus the same period a year ago at +57%.

Experts suggest the continued strength of the industrial sector’s performance comes as online shopping trends and e-commerce continue to grow, explaining why data movements are mirrored within the leasing market.

Rightmove also recorded record demand within the industrial sector for leasing and is 31% ahead of the same three-month period a year ago.

In other trends, supply and demand in the office sector remains robust as the UK workforce begins 2025 and some head back to the office more frequently.

Demand to lease office space is up by 11% compared to the same three-month period a year ago, the biggest year-on-year jump since 2022, while supply is up by 2%.

“The second Bank Rate cut has further fuelled the attractiveness to invest in commercial property after a couple of tough years for the sector. The industrial sector continues to lead the way, with the growth in e-commerce and online shopping turbocharging demand to both invest in and lease industrial space.”

Andy Miles, Rightmove’s MD of Commercial Real Estate

Experts’ views

“We’re still near the beginning of a global rate-cutting cycle, which is bringing more and more investors back to the commercial property market. As investors look to diversify their portfolio or take strategic views based on planning reforms, commercial property investments are again becoming a popular choice.

“With the future of the office market still in transition, and retail assets declining in popularity, investors continue to be drawn to the industrial sector, as businesses continue to seek out bigger and modern warehouse space.

“There is also still a major shortage of good quality commercial space that is energy efficient, creating opportunities for the value-add investors. For example, in the office sector, top quality, modern office space is still in high demand from companies, particularly if they are trying to encourage employees to spend more time there.”

Ian Humphreys, Founder & CEO at Brickflow, the digital marketplace for specialist property finance

“We saw a relatively strong and better than expected end to the year, despite the market challenges which remained throughout 2024. We saw enquiry numbers increase from start of Q4 right up until Christmas, which bodes well for the start of 2025 and we wait to see if the momentum continues. In the industrial sector, we’re seeing good take up of larger distribution facilities over 400,000 square feet, and we’re also seeing healthy levels of take up at around 100,000-200,000 square feet.

“The outlook for 2025 is fairly positive, with more stability and improvements in wider macro-economic factors.

“Beneath the headline figures for industrial, the warehouses and logistics sector continues to be the strongest performer compared to the office and retail sectors and we’re also seeing surprising resilience in the manufacturing market. The shift from traditional retail to online is continuing to grow, driving ongoing demand for warehouse space.

“Businesses are increasingly looking for more comfortable spaces for their employees, leading to many companies upgrading to more modern commercial units. We’re also seeing energy efficiency trends play out, with many companies also looking for more up-to-date space which is more insulated and efficient.”

Christian Smith, Director at Savills

Leasing trends

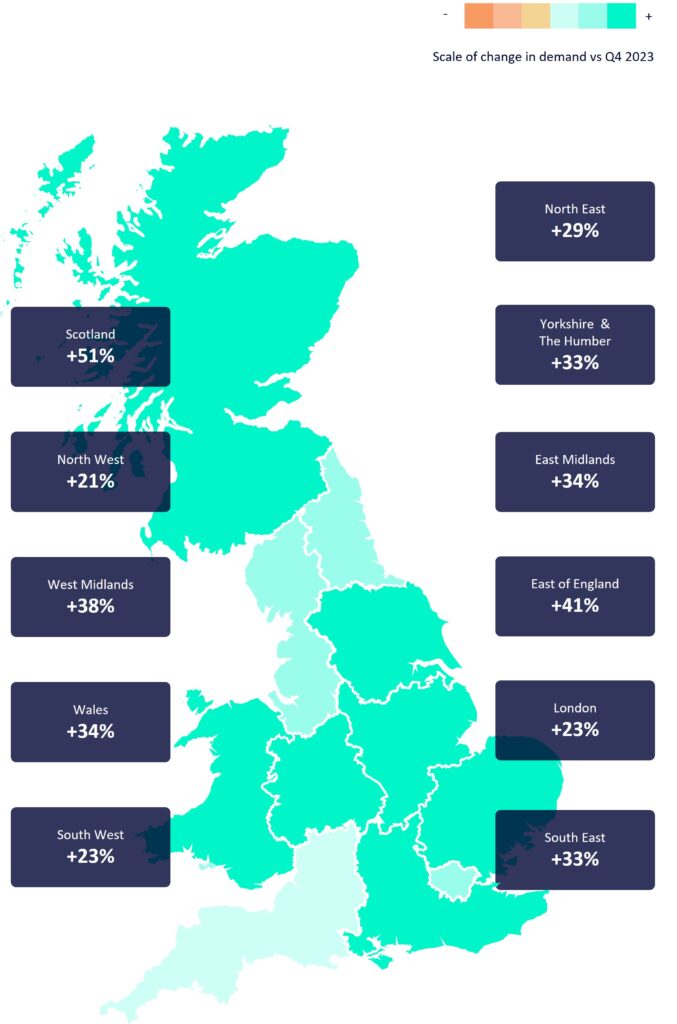

Industrial demand

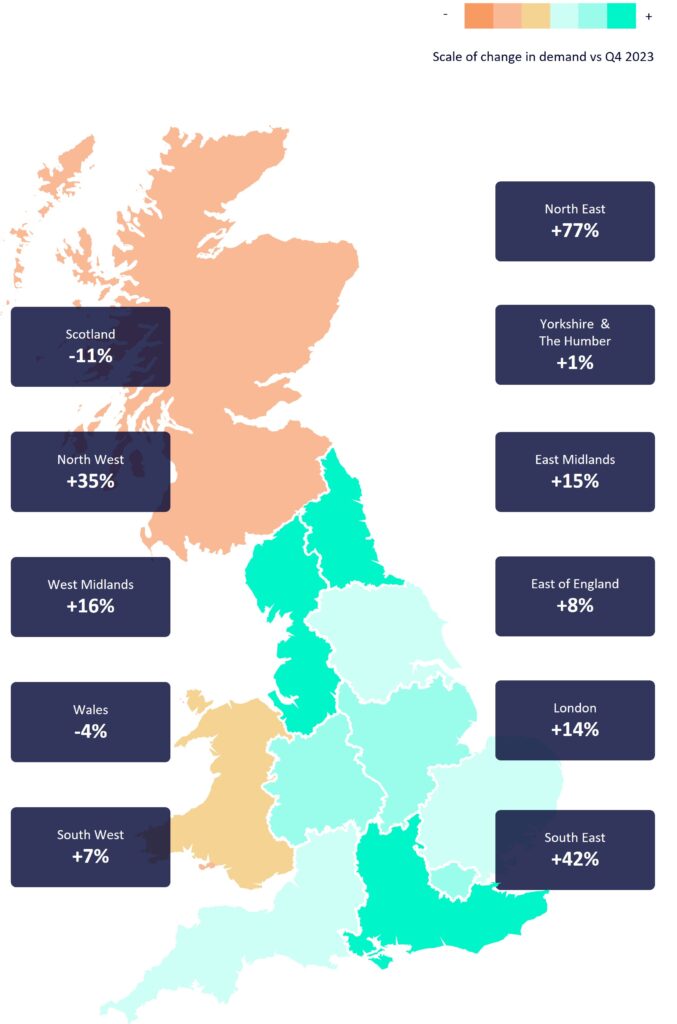

Leisure demand

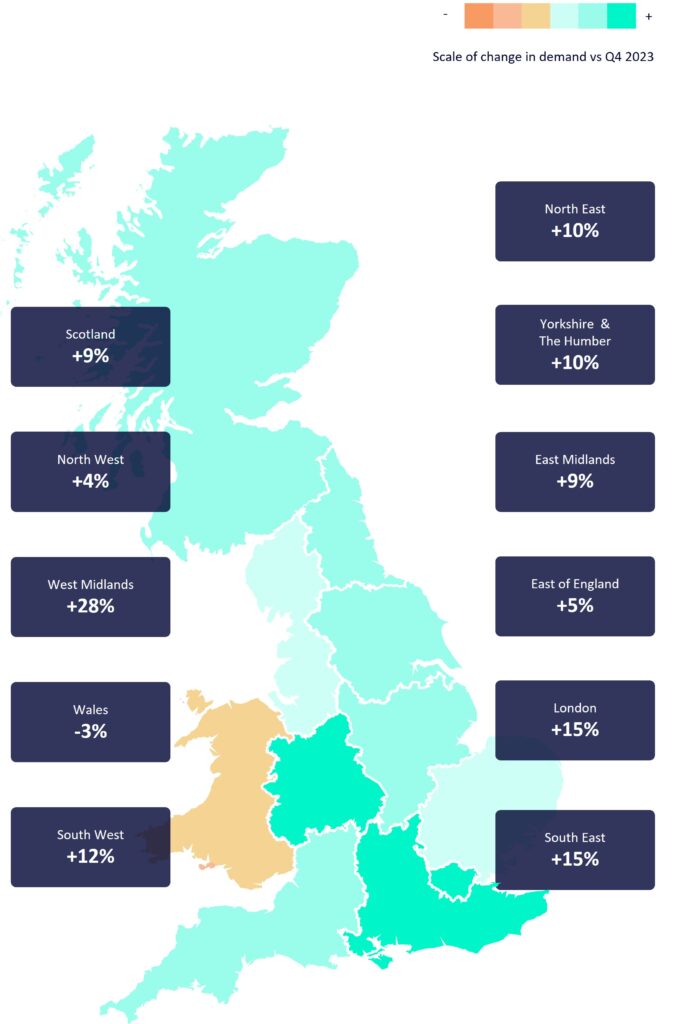

Office demand

Retail demand

London office demand

Investment Trends

Investment demand

About the Commercial Insights Tracker

- All data compares 1st October 2024 – 31st December 2024 with the same period a year agoDemand definition: all enquiries to commercial agents about listings for lease, or to invest in via Rightmove

- Supply definition: the number of available commercial real estate listings for lease or investment on Rightmove, adjusted to strip out the effect of any growth in our partner base

- Colour key: Teal colours represent areas with more growth in demand or available listings than a year ago, while red shaded areas represent less demand or available listings than a year ago

- We acknowledge that some market participants will look at demand and supply differently, for example as an aggregate of active searches by tenant representatives, measured in square feet. We aim to provide an alternative lens that makes the best use of our unique dataset.