November 2025 housing market update

Key takeaways from November’s House Price Index

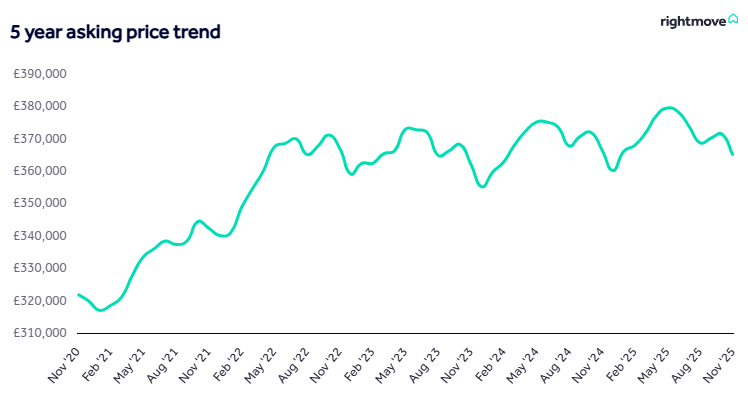

- Average new seller asking price: £364,833 (-1.8% month-on-month, -0.5% year-on-year)

- Agreed sales year-to-date: +4% versus same period in 2024

- November price fall: -1.8%, the largest fall at this time of year since 2012

- Upper-end impact: Sales agreed for £2m+ homes down 13% year-on-year, while £500k-£2m homes down 8%

- Price reductions: 34% of homes on the market have had asking price cuts, which is the highest since February 2024

The latest data shows asking prices down 1.8% since last month and 0.5% below this time last year, as Budget rumours and a decade-high number of homes for sale mean some would-be movers are opting for a ‘wait and see’ approach.

The housing market at a glance

November usually brings a seasonal slowdown in both activity and prices as the market heads towards the quieter Christmas period, but this year the drop has arrived earlier and more sharply than usual. Average new seller asking prices have fallen by 1.8% (-£6,591) to £364,833, which compares to an average drop of 1.1% over the previous 10 years at this time. It’s the largest November fall we’ve seen since 2012.

The reason is pretty clear: the decade-high level of property choice means sellers don’t have much pricing power, and many are being cautious about not over-pricing compared to their competition. What’s more, the Budget – which is later in the year than usual – has been a big distraction, with many would-be buyers waiting to see how their finances will be impacted before making their move.

When you look at the year-to-date picture though, there are still figures that show lots of people are still making moves. The number of sales agreed so far in 2025 is still up 4% on the same period in 2024, showing that underlying demand remains solid once you look past the headline stats.

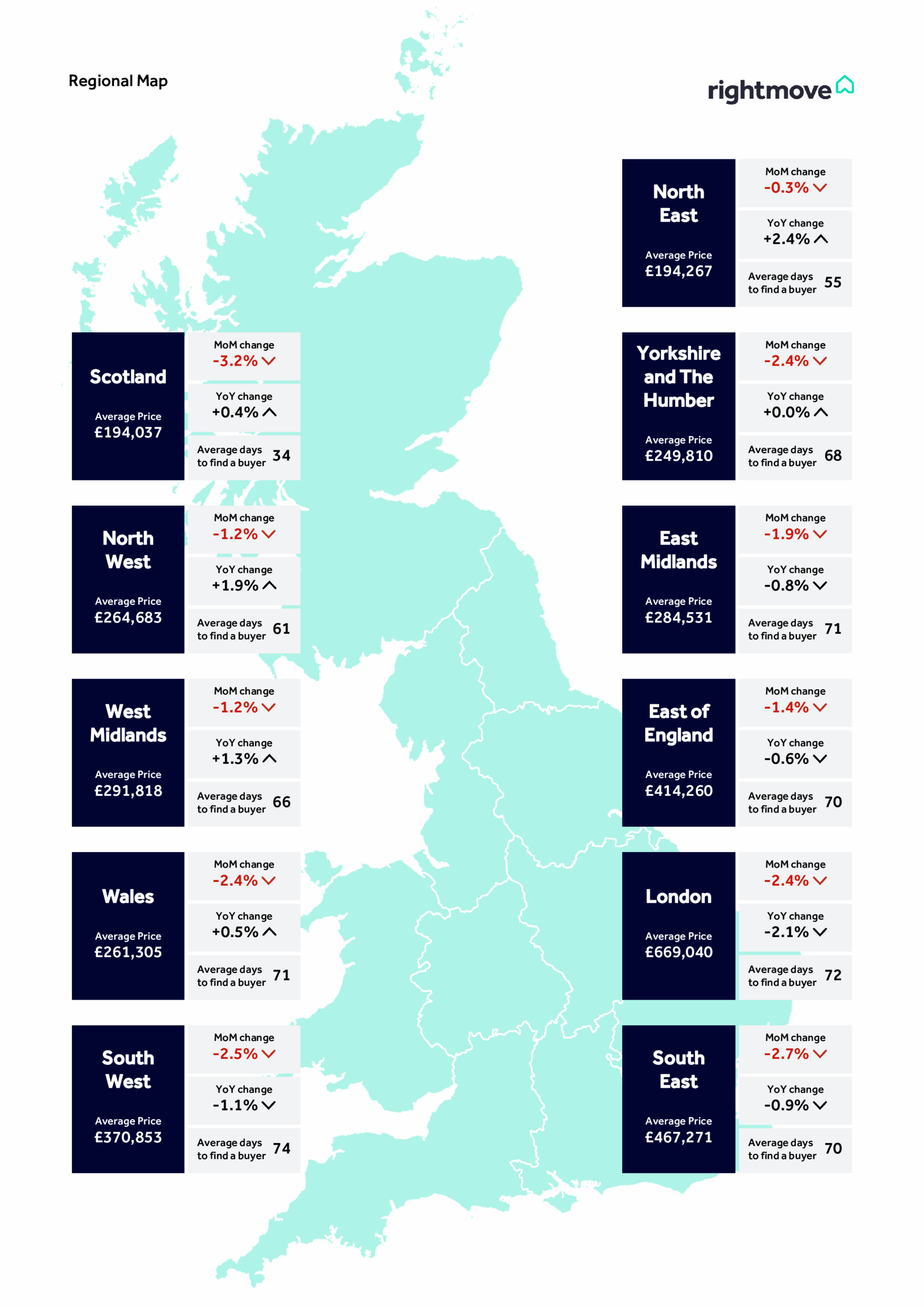

Regional house price trends

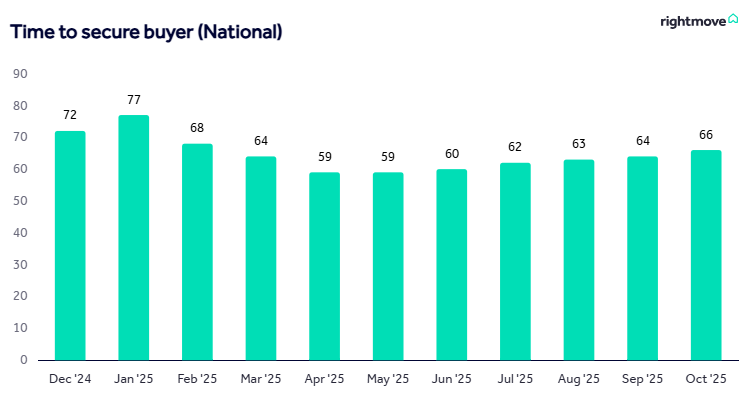

Price movements this month varied significantly across the country, with all regions seeing monthly falls. Scotland saw the largest monthly drop at -3.2%, though it maintained positive annual growth of +0.4%. London fell by -2.4% month-on-month and -2.1% annually, while Yorkshire and The Humber dropped -2.4% monthly but remained flat on an annual basis.

| Region | Annual change | Key observation |

|---|---|---|

| London | -2.10% | Budget uncertainty particularly impacting upper end |

| Scotland | +0.40% | Fastest time to secure buyers (34 days) |

| North East | +2.40% | Highest annual growth across all regions |

| Yorkshire and The Humber | +0.00% | Flat annual change after largest monthly fall |

Source: Rightmove House Price Index, November 2025

What’s driving the market?

The upcoming Budget, and the long run up to it, has created hesitancy. Speculation about potential property tax changes that would disproportionately affect the upper end of the market has grabbed headlines in recent months, and our data shows the current hesitancy is within this sector. Sales agreed for £2 million+ homes, which have been the subject of potential mansion tax rumours, are down 13% year-on-year. Homes priced between £500,000 and £2 million, which could be impacted by rumoured stamp duty changes in England or capital gains tax adjustments, have seen sales agreed drop by 8% year-on-year.

What’s more, with property choice at its highest level in a decade, buyers definitely have the upper hand. Over a third (34%) of homes currently on the market have had an asking price reduction, with the average size of reduction being 7%. Both figures are the highest since February 2024, making this very much a buyers’ market at the moment.

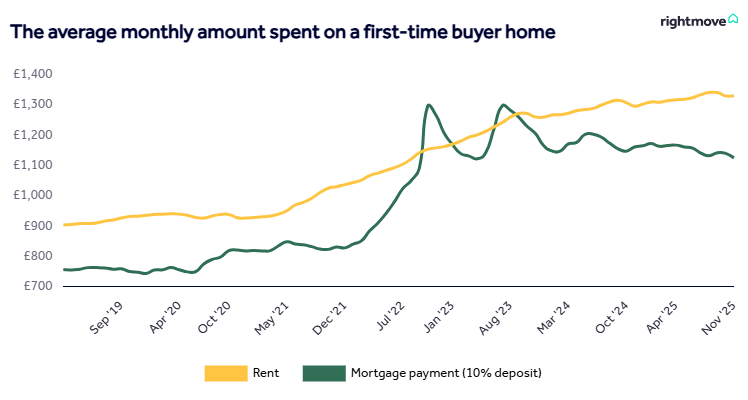

Meanwhile, the average two-year fixed mortgage rate is currently 4.41%, compared to 5.06% at this time last year. While the Bank of England held the Base Rate in November, the markets are currently predicting a 0.25% cut at the final meeting of 2025, in December.

What do the experts think?

Our property expert, Colleen Babcock, says: “The decade-high number of homes available on the market continues to restrict price growth, with many new sellers keen to avoid standing out by over-pricing compared with their competition. The Budget is a big distraction, and is later in the year than usual, with many would-be buyers waiting to see how their finances will be impacted. It appears that the usual lull we’d see around Christmas time has arrived early this year, and sellers who are keen to move are having to work especially hard to entice buyers with competitive pricing. This means that average new seller asking prices are now 0.5%, or £1,759, cheaper than a year ago.”

Matt Smith, our mortgage expert, adds: “The Bank opted to maintain the status quo ahead of the widely anticipated Budget, but there’s still a good chance of another rate cut before the end of the year. We’re starting to see some notable weekly drops in rates, with some mortgage lenders offering headline-grabbing cheap rates as they compete for end-of-year business. Home-movers can expect some small drops in average mortgage rates to continue over the next few weeks. The Budget has created a lot of uncertainty and has had a big build-up, so once the announcements are out the way, home-movers can focus on planning with more confidence.”

How have asking prices changed over the past 5 years?

How much are first-time buyers spending each month on average?