Record price jump: Housing market update January 2026

Key takeaways

- The housing market has made a positive start to 2026, with a record January price jump and strong buyer demand

- The average new seller asking price is £368,031 – that’s 2.8% higher than in December and 0.5% up on last year.

- Buyer demand rose 57% in the two weeks after Christmas, compared with the two weeks before.

- The number of homes listed for sale on Rightmove increased by 81% in the two weeks after Christmas.

- The two-year average fixed mortgage rate* is 4.29%, down from 5.03% last year.

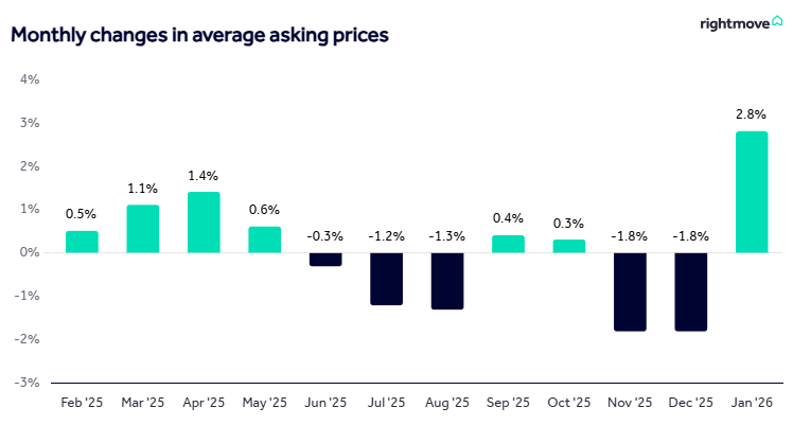

Asking prices are up 2.8% month-on-month in January 2026 – the largest increase seen in the month of January on record, according to our latest house price data

National market overview

January house price figures indicate an active market, suggesting many of us are already exploring our options for a move in 2026. The average price of homes listed for sale rose to £368,031 in January 2026, up 2.8% from December 2025 (+£9,893). It’s the largest price increase on record for the month of January, and the largest rise for any month since June 2015.

This bounce brings average asking prices close to where they were in August 2025, with the market having recovered from the uncertainty that surrounded the November Budget. National property prices are now slightly higher than this time last year (+0.5%).

The January rise also follows Rightmove’s busiest ever Boxing Day for visits to the platform, jumping 93% compared with Christmas Day. In the five days after Christmas, buyer enquiries also rose 67% compared to the five days before, while new listings increased by 143%.

What does this mean for sellers?

The recent uptick in property prices suggests that seller confidence is high. However, new sellers should listen to the guidance of their agents when it comes to pricing, and avoid getting carried away with the new year enthusiasm.

The number of homes listed for sale has increased by 81% in the two weeks after Christmas compared with the two weeks before, making the number of homes available for sale now the highest it’s been at this time of year since 2014.

Potential buyers have a lot of choice right now, and a third of existing homes for sale have reduced their original asking price. So, if you’re thinking of selling, you should look to strike a balance between price ambition and market realism when setting your asking price, to have the best chance of finding a buyer and getting your home sold.

What does this mean for buyers?

This time last year we saw a flurry of buyers looking to complete their purchases before the April stamp duty rise in England. While this makes year-on-year comparisons less useful, current figures for buyer demand in January are largely in line with 2024 levels.

It’s an encouraging early snapshot, with buyer demand having increased 57% in the two weeks after Christmas compared with the two weeks before. As the year progresses, it will become clear if this momentum can be maintained into the peak Spring selling season.

Many buyers, and particularly first-time buyers, will be keeping a keen eye on recent price increases. However, asking prices are only back to where they were in the summer of 2025 before the Budget rumours began surfacing, which unsettled the market and dented confidence.

National and sector breakdown

| Market segment | Avg. Price | MoM Change | YoY change |

|---|---|---|---|

| Overall | £368,031 | +2.8% | +0.5% |

| First-time buyers | £225,544 | +1.6% | -0.7% |

| Second-steppers | £341,131 | +2.0% | +0.5% |

| Top of the ladder | £658,658 | +2.6% | +0.5% |

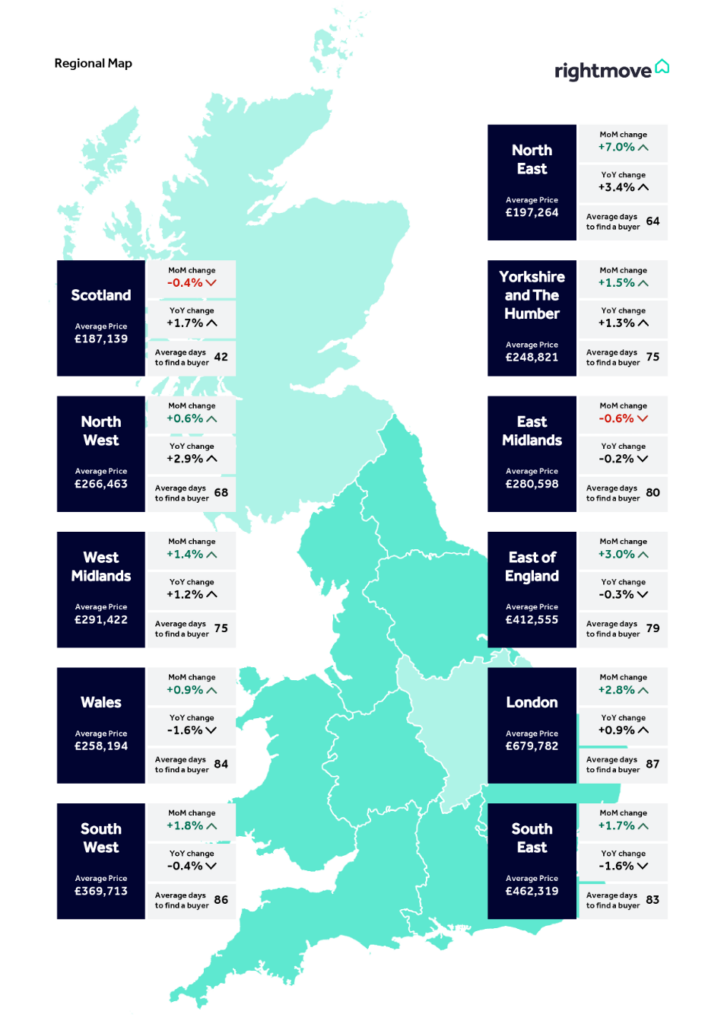

Regional trends

While January’s recovery brings average asking prices close to where they were in August 2025, price trends in regions and local markets across Great Britain show greater variance.

While most regions saw a monthly increase in property prices in January 2026, several areas such as the South East and East of England have seen a drop in average property prices versus this time last year.

| Region | Annual change | Notes |

|---|---|---|

| London | +0.9% | The capital is performing strongly, driven by a +2.8% monthly increase |

| North East | +3.4% | Largest annual price increase for any region, driven by a +7.0% monthly increase |

| East of England | -0.3% | Annual price fall despite a +3.0% monthly increase |

| South East | -1.6% | Joint largest annual fall, despite a +1.7% monthly increase |

| Scotland | +1.7% | Annual price rise despite a -0.4% monthly decrease |

What’s happening with mortgage rates?

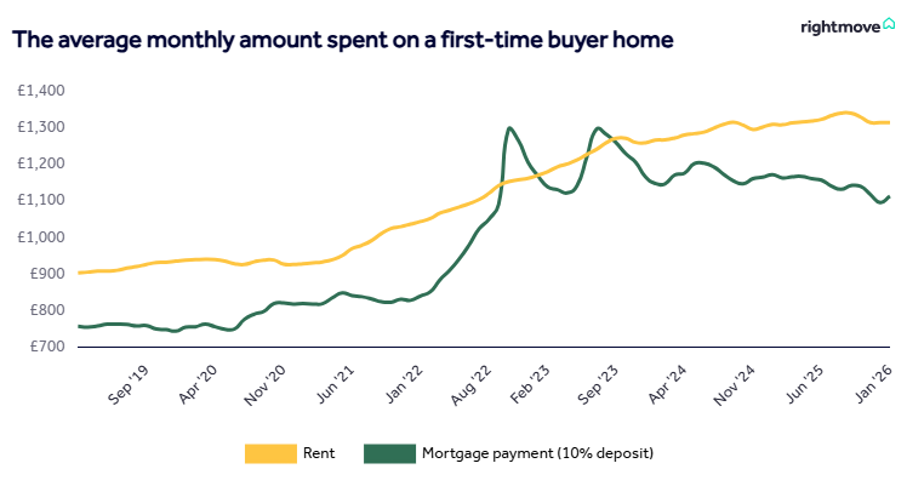

While mortgage rates didn’t fall as far or as fast as some had predicted at the start of 2025, a slow and steady drop in interest rates allowed for a more stable and consistent market last year.

Some headline-grabbing rate cuts from major lenders at the end of 2025 and beginning of 2026 mean that the average two-year fixed mortgage rate is now at its lowest since 2022 (prior to the disruptive mini-Budget).

- The average two-year fixed mortgage rate* in January 2026 is 4.29%, compared with 5.03% at this time last year.

- The cheapest available two-year mortgage rate* for those with a larger deposit is 3.47%.

To put that into context, this drop in the average mortgage rate means that someone buying a home at the national average asking price and with a 20% deposit could save over £100 a month on their mortgage compared to last year. But remember, actual savings will depend on individual circumstances, loan term, product availability and lender criteria.

What do the experts think?

Colleen Babcock, property expert at Rightmove:

“It’s early days but there are encouraging signs that more home-movers are now planning a 2026 move as we head towards the important Spring buying and selling season. A record number of visits to Rightmove on Boxing Day and a big bounce in activity following a quieter festive period have set the tone for a positive start to the year. Many buyers have seen their affordability improve with average wage rises outstripping average property prices.”

Matt Smith, Rightmove’s mortgage expert:

“Mortgage rates have slowly but surely been coming down, to the extent that the average rate a typical home-buyer is likely to see is now the lowest since before the disruptive 2022 mini-Budget. However, the financial markets are currently expecting no more rate cuts until the second quarter of the year, with the Bank of England Base Rate likely to be held during the next rate decision in February. Mortgage rates are therefore likely to be steady for the next few months, with only minor changes up or down. Those who have been waiting for cheaper mortgage rates before acting might currently be seeing some of the best deals that will be around for a while.”

Rightmove is not authorised to give financial advice; the information and opinions provided in these articles are not intended to be financial advice and should not be relied upon when making financial decisions. Please seek advice from a regulated mortgage adviser.

Monthly average spend on rent and mortgage payments (properties with a 10% deposit, since September 2019)

Looking ahead

The market is off to a busy start in 2026, with many new homes coming to market being well positioned to take advantage of the recent uptick in buyer demand. The recent flurry of activity suggests that buyers and sellers alike are keen to push on in early 2026 and secure their next steps now, rather than waiting for the spring market, with improving affordability through mortgage rate cuts driving this process.

While it remains to be seen whether this strong start to the year will carry through to the peak selling season of Spring, the market remains active, and sensibly priced homes will likely attract high levels of attention.

Data source: Rightmove House Price Index, January 2026

*Mortgage rate data is provided by Podium and is an average based on 95% of the mortgage market. All rates are based on products with a circa £999 fee.