December 2025 housing market update

Key takeaways from December’s House Price Index

- Average new seller asking price in December 2025: £358,138 (-1.8% month-on-month, -0.6% year-on-year)

- Agreed sales year-to-date: +3% versus same period in 2024

- December price fall: -1.8% – larger than the 10-year average drop of 1.4%

- Budget impact: First half of 2025 saw new sellers up 9% and buyer demand up 3% versus 2024, but this reversed to -4% and -6% in the second half of the year, as people waited to see what was announced in the late-November Budget

- Next year: Rightmove predicts asking prices will rise by 2% in 2026

Our latest data shows asking prices are down 1.8% month-on-month and 0.6% below last year, as 2025 ends with the Budget uncertainty behind us and an improved affordability picture. This sets the stage for a stronger 2026.

National market overview

December usually brings a seasonal slowdown in both activity and prices as the market heads into the Christmas period, but this year the drop mirrors November’s fall. Average new seller asking prices have fallen by 1.8% (-£6,695) to £358,138, which compares to an average drop of 1.4% over the previous 10 years at this time. It means that 2025 ends with average asking prices 0.6% (-£2,059) lower than a year ago.

Budget-related uncertainty amplified the seasonal slowdown that we’d usually see in December. When you look at the full year though, things are more positive than recent months suggest. The number of sales agreed in 2025 is 3% higher than in 2024, showing that despite the Budget build up, the underlying market remained resilient.

National average house price

| Month | Average asking price | Monthly change | Annual change |

|---|---|---|---|

| December 2025 | £358,138 | -1.8% | -0.6% |

| November 2025 | £364,833 | -1.8% | -0.5% |

National average house prices by property type

| Sector | December 2025 | November 2025 | Monthly change | Annual change |

|---|---|---|---|---|

| First time buyers | £221,950 | £225,128 | -1.4% | -1.4% |

| Second steppers | £334,297 | £340,515 | -1.8% | -0.5% |

| Top of the ladder | £642,131 | £657,758 | -2.4% | -0.2% |

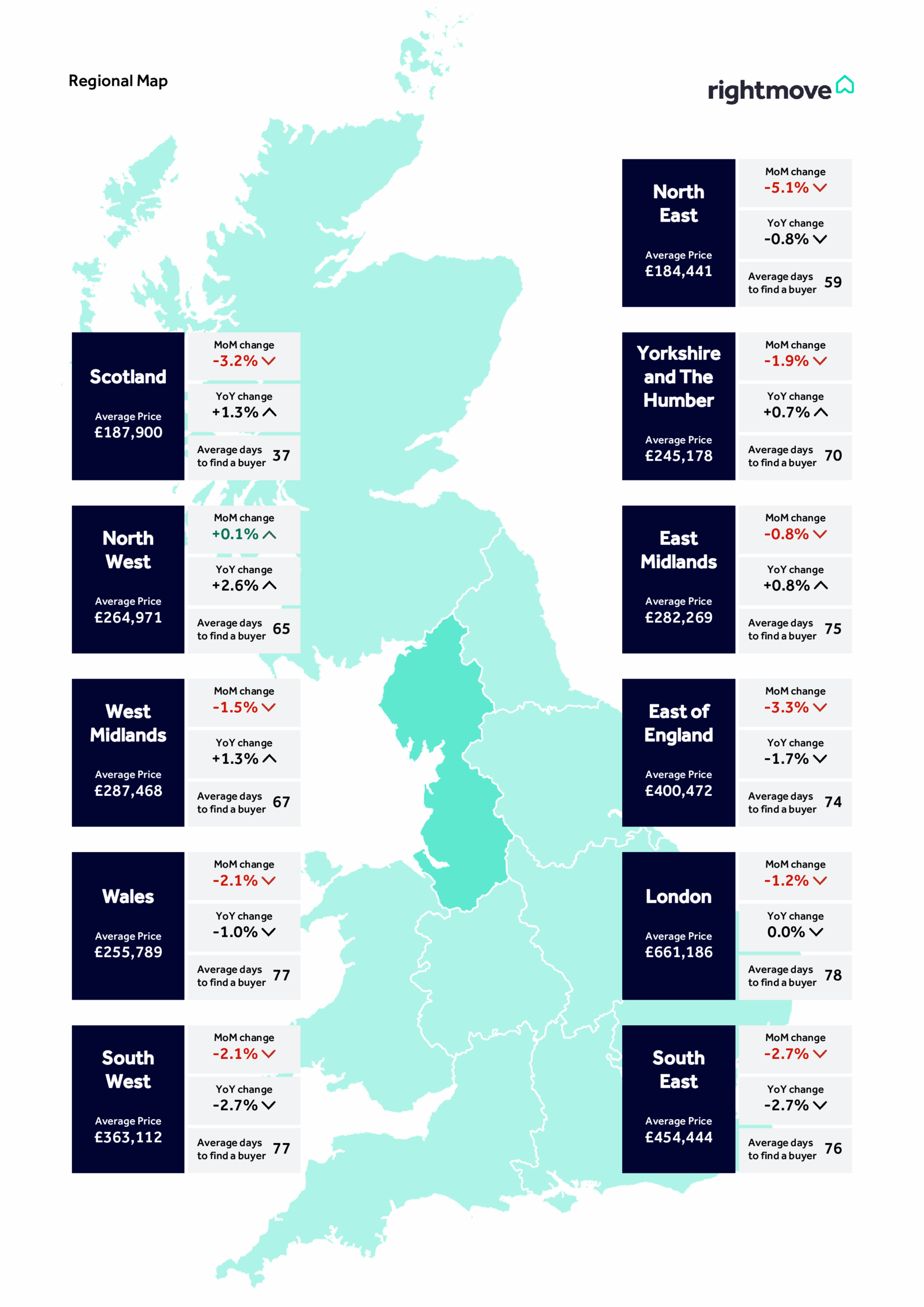

Regional house price trends

Almost all regions experienced price falls in December, with the North West standing out as the only region to record growth, up 0.1% month-on-month. The North West also leads the country with the strongest annual price growth of 2.6%.

The North East experienced the sharpest monthly decline at (-5.1%), while Scotland saw a significant monthly drop of 3.2%, though it maintained positive annual growth of 1.3%. Despite the monthly fall, Scotland continues to be by far the quickest market in Great Britain, with properties taking just 37 days on average to find a buyer – significantly faster than the 59-78 days typical across England and Wales.

London prices fell by 1.2% month-on-month and finished the year flat at 0.0% annually. This reflects the ongoing challenges in the capital as buyers and sellers adjust to stamp duty changes and anticipate the upcoming mansion tax.

Source: Rightmove House Price Index Dec ’25

Source: Rightmove House Price Index Dec ’25

What’s driving the market?

The data highlights the stark contrast between the first and second halves of 2025, with Budget speculation impacting the latter part of the year. The number of new sellers coming to market in the first half of 2025 was 9% ahead of the same period in 2024. By contrast, the number of new sellers in the second half was 4% below the same period last year.

What’s more, the impact extended to buyers too. Buyer demand was 3% higher than 2024 across the first half of the year but turned around to be 6% behind across the second half. Our survey of over 10,000 potential movers revealed that nearly one in five were waiting for the outcome of the Budget to resume their moving plans.

Reading between the lines

Looking at individual months, the weaker year-on-year trends in the second half have been exacerbated by comparing against a strong 2024 period when buyers rushed to complete before April’s stamp duty increases in England. This comparison effect has made recent months look weaker than the underlying market reality.

There is good news ahead. Mortgage rates continue their downward trend, with the average two-year fixed mortgage rate now at 4.33%, compared to 5.08% at this time last year. What’s more, the relaxing of mortgage lending criteria and wage growth continuing to run ahead of inflation will support affordability in 2026.

What do the experts think?

Our property expert Colleen Babcock says: “Lower pricing supported buyer affordability and drove activity in the first half of the year, even after the April stamp duty deadline in England. In the second half of 2025, uncertainty caused by rumours of property tax changes in November’s Budget swirled, some from as early as August. This had an impact on pricing and activity, as sellers had to try to entice nervous buyers. The market will soon benefit from the traditional boost in home-moving activity from Boxing Day. Rightmove’s Boxing Day Bounce is an annual event where we see many begin or resume their plans to move after the distraction of Christmas. With the turkey and trimmings barely off the table, each year we see people heading straight to Rightmove to browse the fresh listings for sale and imagine how different next Christmas could look.”

On the outlook, Colleen adds: “With market conditions supporting higher levels of activity, and a hopefully more certain economic environment, we forecast a better year for price growth in 2026 with a strong rebound in activity to kick start the year. However, with buyer choice remaining high, sellers will still need to come to the market at tempting prices to attract attention and do all that they can to ensure that their property is presented as well as possible. A more stable 2026 would be good for buyer confidence, which in turn would further boost activity levels, leading to a modest price increase.”

Matt Smith, our mortgage expert, adds: “We’re expecting to end the year with a Bank Rate cut, which would be good for confidence heading into the Rightmove Boxing Day Bounce. It’s unlikely that it will cause much movement in mortgage rates – the markets are very much expecting December’s cut to go ahead, and lenders have shown their hand early, cutting rates and competing to secure end-of-year business. The headline is that home-movers will be entering 2026 looking at cheaper average mortgage rates than they were at the beginning of 2025, helping affordability. Those who are seeing slightly lower house prices in their area compared to last year and may have also had an end-of-year pay rise, will see their affordability improved further. Many home-movers will also see that the amount that they can borrow has increased, as lenders have been rolling out the Loan-To-Income and stress rate changes that were permitted by the regulator earlier this year.”

What does 2026 look like?

We are now anticipating a bigger-than-usual Boxing Day bounce, as many of those who paused their plans due to Budget uncertainty join the traditional start of the busier home-moving season. There are already some very early signs of a post-Budget market rebound in some segments. In London, the number of new sellers coming to market at the top-end, which was hardest hit by Budget speculation, was up by 24% in the week after the Budget compared with the week before.

The 2026 market will be more like the encouraging first half of this year rather than the second half, where confidence was affected by Budget speculation. Buyer affordability is set to improve, and the good choice of homes for sale continues to run at a decade-high level. For these reasons, we predict stronger housing market activity and the average price of properties coming on the market to rise by 2% in 2026.

Regional variations will be noticeable. Scotland, Wales and northern England are expected to be more resilient, with better affordability and healthier supply-demand balance supporting price growth. London and southern England are likely to lag behind as they continue adjusting to stamp duty changes and prepare for the mansion tax on properties over £2 million from April 2028.

For sellers, the message remains the same: price realistically from the start. With high levels of choice available and buyers in the driving seat, competitive pricing will be essential to attract attention and secure a sale. The market is finding its balance, and 2026 looks set to be a year of modest growth built on improved affordability and renewed confidence.

How have asking prices changed over the past 5 years?

Source: Rightmove House Price Index Dec ’25

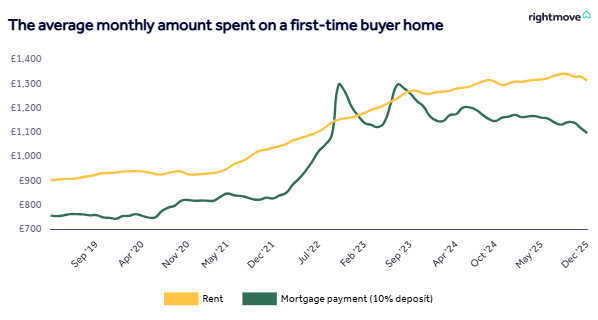

How much are first-time buyers spending each month on average?

Source: Rightmove House Price Index Dec ’25

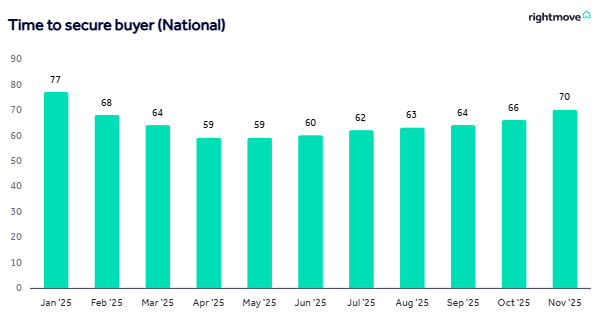

How long does it take to find a buyer for a home on average?