Revealed: first-time buyer prices in your region

If you’re hoping to get on the property ladder this year, we can reveal how much first-time buyer properties are on the market for in your region.

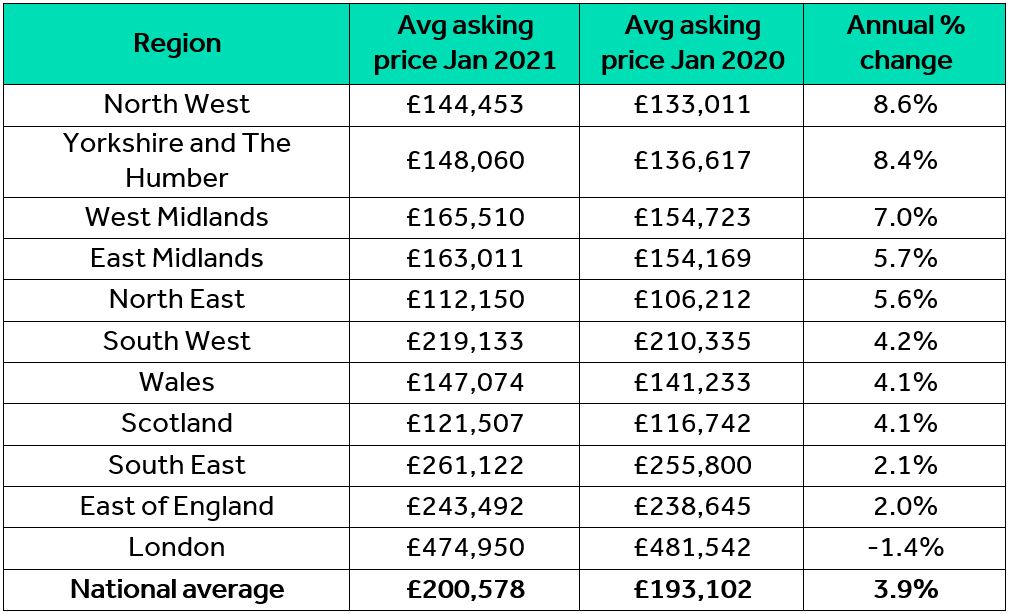

Our latest study shows that the North West has seen the biggest annual rise in property prices for first-time buyer homes (two-beds or fewer), with average asking prices up 8.6% over the past 12 months.

This is a bigger annual increase than any other region in Great Britain.

Yorkshire and The Humber saw the second biggest annual increase in average asking prices for first-time buyer homes (8.4%), followed by the West Midlands (7.0%).

However, Yorkshire and The Humber is where average asking prices for first-time buyer homes have increased the most in cash value, up £11,443 compared to a year ago.

The national average asking price of first-time buyer properties is £200,578, which is up 3.9% compared to 12 months ago and equates to an annual rise of £7,475.

This means that the first-time buyer sector is marginally outperforming the market as a whole, which has seen average asking prices rise 3.3% annually.

What are first-time buyer prices in your region?

First-time buyer homes are currently most expensive in London, with average asking prices of £474,950, whilst the North East (£112,150) is where average asking prices are cheapest.

London is also the only region where average asking prices for first-time buyer homes exceed £400,000, with the South East (£261,122) and East of England (£243,492) next on the list.

The capital is, however, the only region where average asking prices for first-time buyer properties have fallen year-on-year, with prices in London down 1.4% compared to a year ago.

What do the experts say?

Our resident property data expert Tim Bannister explained that people hoping to buy their first home in London have a chance to secure a good deal in the current market.

He said: “Many people are deciding that 2021 is the year to get their foot on the property ladder, and this research provides an insightful snapshot into the first-time buyer sector across the British property market right now.

“What’s interesting for me is that, despite the higher asking prices in London, first-time buyers in the capital appear to have a window of opportunity to negotiate a good deal, with this being the only region to have seen average first-time buyer asking prices fall over the past 12 months.

“Conversely, sellers in the North West who are looking to trade up and move into a bigger home are in a strong position, with average asking prices for first-time buyer properties having jumped by 8.6% during the same period, which is a good indicator of a strong market.”

What are local agents seeing?

Richard Powell, Director at Ryder & Dutton (a 24-branch network across East Lancashire, North Manchester and West Yorkshire), said: “I think first-time buyer homes have seen a boom in property prices because demand is outstripping supply. We’ve less properties for sale per branch than at any time since the late 1980s, which of course causes prices to rise. Having said that, people still want to buy homes and in many cases it’s no more expensive to buy in the North West than to rent, especially with low mortgage rates available.

“The North West possibly has a greater stock of properties that are more easily accessible for first-time buyers – places such as Oldham, Rochdale, Bury and Blackburn – these big, former mill towns have lots of terraced properties around the £100,000 to £200,000 mark that are available to buy. And coupled with more Help to Buy schemes and new-build developments, it’s probably easier to become a first-time buyer in this part of the world than many other regions, which also helps to push prices up.

“We’ve also seen a reluctance from people in their first homes to move up the ladder because they haven’t had confidence in the market to do so. Over the past four years or so with Brexit and now Covid, we’re seeing a lot of pent-up supply as well as pent-up demand.”

Neil Ewen, Director at Central Estate in Walthamstow, added: “We’re based towards the outskirts of London, where people can get a bit more space and the neighbourhoods are a little greener, and we’re seeing huge levels of demand for first-time buyer properties. About 80% of our business is with first-time buyers and even as recently as January we were seeing really high levels of demand for property.

“As more people are working from home, it’s a good time to move from a rental property in Central London to a place of your own in somewhere like Walthamstow. I think the London percentages in Rightmove’s data are being pulled down by Central London, because there’s no real incentive to want to buy in a city centre right now and lots of people are moving out of Central London. So I think it’s a good time to get on the ladder in Walthamstow – it’s a cool place with lots going on and even our properties that were previously struggling to find a buyer are now being snapped up.”

READ MORE: Housing market sees busiest ever January on record

The header image for this article comes courtesy of William H. Brown.