How to shortlist homes using online viewings

While the housing market is still open in England, Scotland and Wales, that hasn’t stopped agents adapting to new ways of working to help you stay safe when you’re moving home.

This means that many of them are now offering online viewings of a property first, before you go and view the property in person.

Online and virtual viewings can be a great way to get a feel for a home before weighing up whether it’s still worth looking at in person.

You may be able to tell straight away whether the house does, or does not, tick the boxes you need it to. If it doesn’t, you’ll save yourself, the seller, and the agent some time and trouble.

We know that moving home is a necessity for many people right now, but we can all play our part in slowing the spread of the virus.

By doing an online viewing first, it’ll reduce the number of viewings you have to go on.

It could also save you time, because you’ll have a better idea of whether a house is worth seeing or not, and you’ll build up a shortlist of properties that you really want to visit.

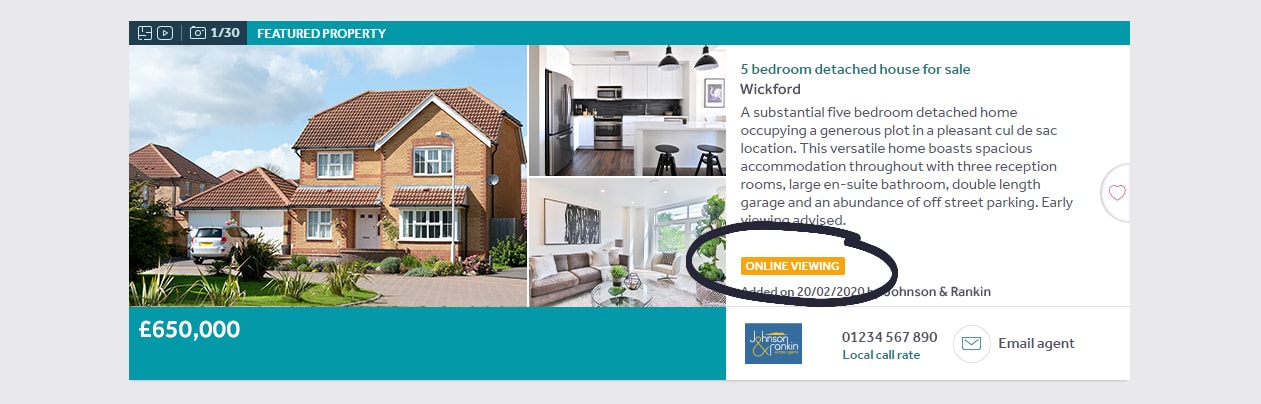

On Rightmove, over 10,000 agents have added an ‘ONLINE VIEWING’ label to their property listings to let you know they have one available.

Even if there is no label, we still recommend asking an agent if they are offering this service.

If you’ve viewed a home online, and you’re serious about visiting in person, you can then book a physical viewing by making an appointment with the estate agent.

For more information on how to view property safely, you can read our latest advice here.

READ MORE: Five questions to ask to help you stay safe on a viewing

READ MORE: Housing market remains open during lockdown