Q4 2025

Average rents rise by 2% in 2025, predicted to rise by further 2% in 2026

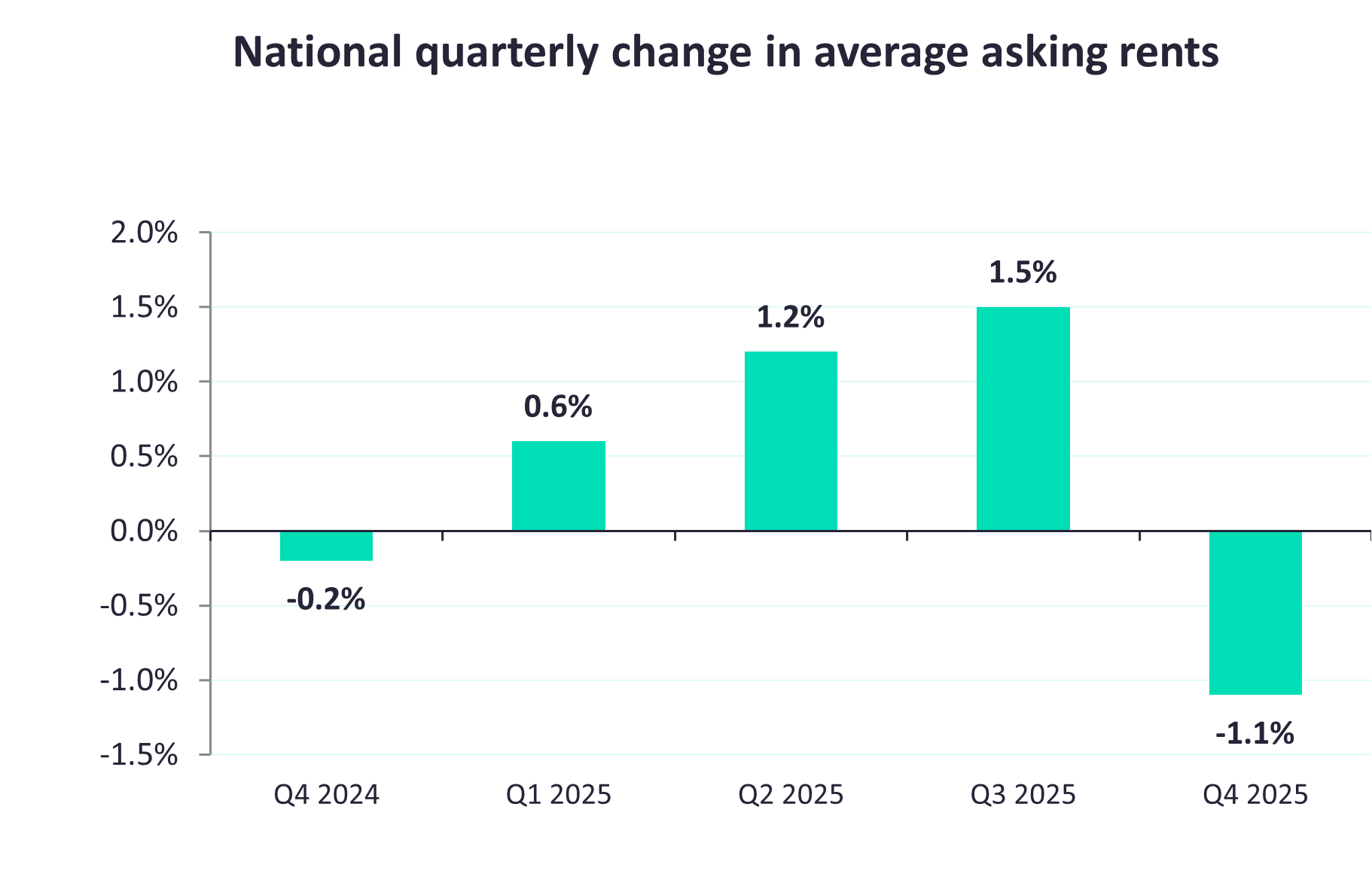

- The average advertised rent of homes outside of London fell in Q4 2025 by 1.1% (-£15), dropping to £1,370 per calendar month. It’s only the second time in five years that quarterly rents have fallen:

- Across the whole of 2025, average advertised rents rose by 2.2% compared to 2024

- As the market settles into a better balance, competition for rental homes is less fierce than in recent years:

- 2025’s average of ten enquiries for every available rental home is higher than the pre-pandemic 2019 average of six, but lower than 2024’s figure of fourteen

- The number of available homes to rent is 9% higher than last year, but still a third (-33%) lower than ten years ago

- The latest snapshot of UK Finance data, which runs year to October, suggests encouraging signs for rental supply, and the most positive rate of landlord investment since 2022

- Some markets are busier than others. While London had an average of seven enquiries per property last year, the North West & Scotland had over double the amount at sixteen

- Rightmove’s new daily buy-to-let mortgage tracker highlights that affordability is improving for landlord investors, which could help to support an increase in rental supply:

- The average two-year buy-to-let mortgage rate for a landlord with a 25% deposit is 4.84%, compared with 5.51% last year

- Rightmove predicts that average rents will rise by a further 2% in 2026. The balance between supply and demand is improving, however the chronic shortage of rental homes is still placing some pressure on rents

What’s happening with rental prices?

The average advertised rent of homes coming onto the market outside of London fell in Q4 by 1.1% (-£15). It’s only the second quarter in the last five years where rents have fallen, with the average advertised rent now standing at £1,370 per calendar month.

The latest data means that at the end of 2025, average rents outside of London were 2.2% (+£29) higher than in 2024. This is the lowest that annual rental growth has been at the end of a year since 2018.

It’s the same story for the capital. Within London, average rents fell by 0.7% (-£20) in Q4 compared to the quarter before, taking the average advertised rent in London to £2,716. Average rents in London rose by 0.8% in 2025, the lowest annual rate of growth since 2020, when rents fell in London following the pandemic starting.

In 2025, rents rose the least in the North East (+0.4%) and London (+0.8%) and the most in the North West (+3.6%) and Yorkshire & The Humber (+3.1%).

What’s happening with rental market activity?

The total number of available homes to rent is currently 9% higher than last year. However, looking longer term, the number of available rental properties has dropped by a third (-33%) compared with ten years ago, illustrating the chronic shortage of rental property.

There are some positive indicators for the future supply of rental homes. The latest available snapshot of UK Finance data, which tracks both remortages and new buy-to-let mortgages, suggests that the rate of rental investment activity is the most positive its been since 2022.

The number of new buy-to-let mortgages taken out to purchase rental homes in the year to October was 13% in 2025 versus the same period in 2024, while the number of remortgages increased by 23%. It’s a positive sign that there is both new investment, and landlords choosing to keep existing rental homes.

In terms of buying activity, the competition between tenants for rental homes has cooled and is less fierce than the pandemic years. 2025’s average of ten enquiries for every available rental home is higher than the pre-pandemic 2019 average of six, but lower than 2024’s figure of fourteen.

However, the balance between supply and demand is likely to feel tighter in some areas more than others. While London had an average of seven enquiries per property in 2025, the North West & Scotland had over double this number at sixteen.

What’s happening with buy-to-let mortgage rates?

Rightmove’s new daily buy-to-let mortgage tracker highlights the improving affordability for landlords looking to invest in rental property, which could support an increase in rental supply to the benefit of tenants.

The average two-year buy-to-let mortgage rate for a landlord with a 25% deposit is 4.84%, compared with 5.51% last year.

What’s the outlook for 2026?

Looking ahead to the rest 2026, Rightmove predicts that average advertised rents will rise by a further 2% across the year. The balance between supply and demand has significantly improved since the pandemic years, which has been a key driver of 2025’s lower than usual yearly rent growth.

However, there is still a fundamental shortage of rental properties, which Rightmove expects to keep rents ticking upwards in 2026.

Rightmove’s property expert Colleen Babcock says: “There is still a long-term shortage of available rental homes, but it looks like landlords are taking advantage of cheaper available mortgage rates, and more available homes will benefit tenants. Existing tenants or those looking to rent their own home for the first time are likely to experience a much more settled and balanced market than a few years ago, when the competition to secure a home was frenetic. There is much greater availability of homes, and fewer tenants to compete with now, which should hopefully make the experience more positive for renters.”

Sarah Leslie, Lettings Manager at Jackson-Stops Sevenoaks says: “Tenants are increasingly focused on value for money. Pricing accuracy is now critical to maintaining momentum. Homes that are realistically priced for current market conditions are continuing to let well, while those that are over-priced are taking longer to secure tenants.

“Despite this shift, supply constraints are still supporting rents. Overall rental supply remains well below long-term norms, which means rental growth is moderating rather than reversing.

“Tenant priorities are becoming clearer as working patterns continue to evolve. Demand is strongest for well-located homes that offer private outdoor space and good transport links, particularly as more employers encourage a return to office-based working.

“Rents are likely to continue rising at a measured pace, supported by limited supply and ongoing demand.

“In this environment, realistic pricing and professional management are key to achieving consistent, sustainable returns.”

Christina Harris, Director, Cheffins says: “Rental prices have been growing at pace, however the slowdown in growth last year was partly caused by uncertainty in the lead up to the Budget and the release of the details of the Renters Rights Act. In general, most tenants were only moving if absolutely necessary, preferring to wait for clarity on both the Budget and new legislation.

“Rental growth had been exceptionally strong for some time, well ahead of inflation, so a period of moderation was inevitable. Towards the end of last year we also saw an increase in supply, but as wages had not kept pace with rental values, affordability became a key issue for many tenants. With tenants typically needing to earn around three times the cost of rent, average rents in cities such as Cambridge were simply out of reach for some.

“Supply remains far behind where it needs to be. The consistent shortage of good quality, well-presented rental properties will no doubt put upward pressure on rents in the coming months. People still need to move for work or schools, and as the shortage of availability continues, it is likely that prices will edge up over the next year.

“While many landlords were cautious in the lead up to the Renter’s Rights Act, in the main, rental properties continue to provide a good return on investment, better than what can be found in most savings accounts and we haven’t yet seen the exodus from the market from landlords which so many predicted.”