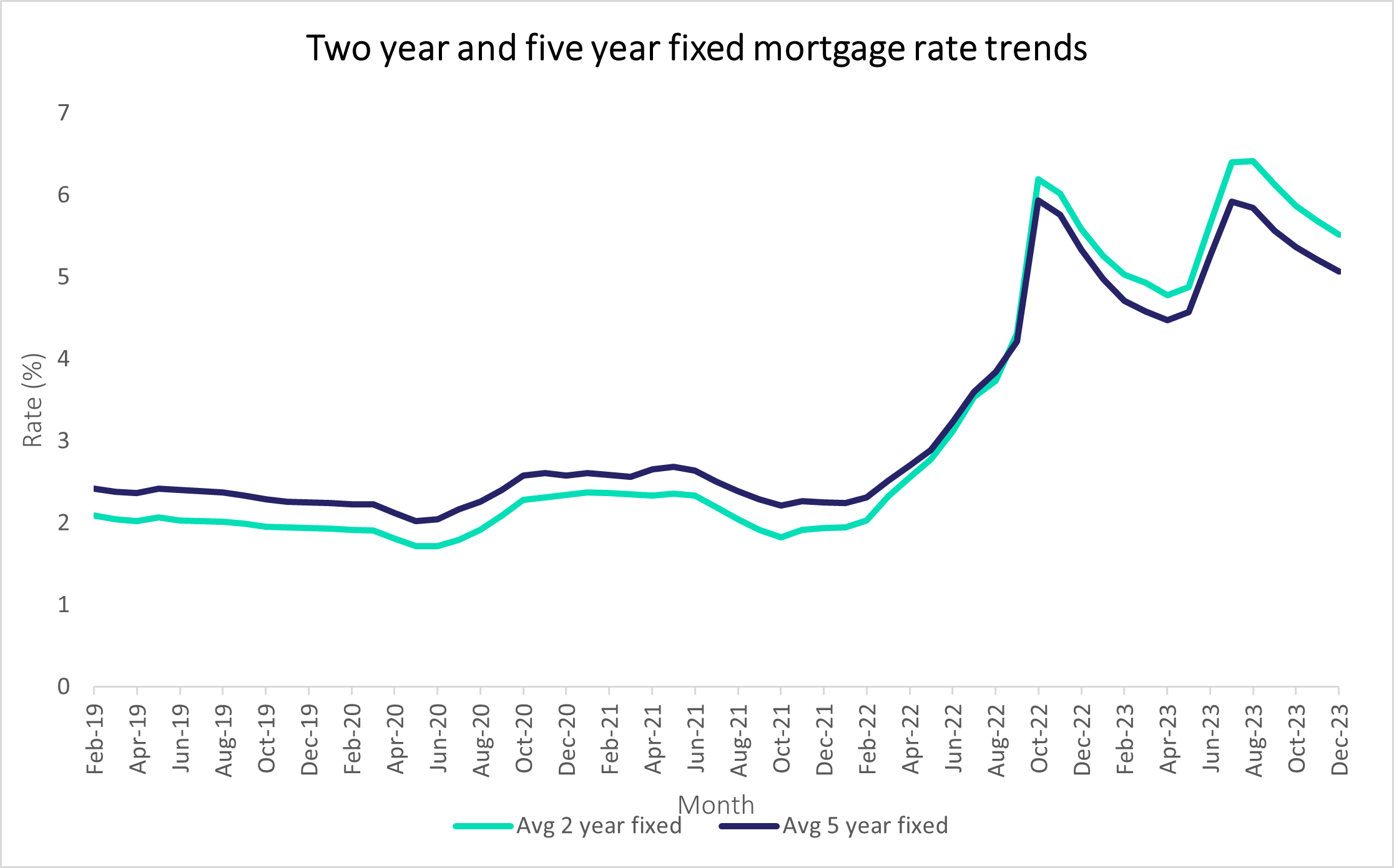

Average 5 year fixed mortgage rate drops from 6.11% at peak to 5.07% – Rightmove’s weekly mortgage tracker

Please find below the latest average mortgage rates from Rightmove and comment from Rightmove’s mortgage expert Matt Smith.

Matt Smith, Rightmove’s mortgage expert said: “No news is often good news when it comes to the mortgage market, and yet another week – the 20th in a row – of marginal percentage point drops is positive news for home-movers. Swap rates have also remained steady this week, but fell further on the back of the UK GDP data published today: a good indicator that the markets are confident about how tomorrow’s Base Rate announcement will play out.

“After the chunky drop in inflation was announced in mid-November, it looked even more likely that tomorrow will bring a third consecutive Base Rate hold. And while these pauses come off the back of falling inflation and a more positive economic outlook, the Bank has indicated that we’re unlikely to see any Base Rate drops until we’re well into 2024. However, markets are currently forecasting that the first Base Rate reduction may arrive in late Spring next year.

“A hold tomorrow could provide some room for lenders to offer further mortgage rate drops – though it’s likely that lenders may hold back offering these to borrowers this side of Christmas, to take advantage of the seasonal jump in demand that usually happens in January.”

Headlines

- Since the peak in July, the average 5 year fixed mortgage rate has reduced from 6.11%, to 5.07%, while the average 2-year rate has reduced from 6.61% to 5.48%

- The average 5-year fixed, 85% Loan-To-Value mortgage has reduced from 6.16% at the peak in July, to 5.16% now:

- The means that for someone taking out this type of mortgage, the monthly mortgage payment on an average home has reduced from £2,068 in July, to £1,793 now

- For first-time buyers taking out this type of mortgage, the monthly mortgage payment on a typical first-time buyer home has reduced from £1,254 in July, to £1,111 now

Key stats this week

- The average 5-year fixed mortgage rate is now 5.07%, down from 5.30% a year ago

- The average 2-year fixed mortgage rate is now 5.48%, down from 5.55% a year ago

- The average 85% LTV 5-year fixed mortgage rate is now 5.16%, down from 5.34% a year ago

- The average 60% LTV 5-year fixed mortgage rate is now 4.46%, down from 4.98% a year ago

- The average monthly mortgage payment on a typical first-time buyer type property when taking out an average five-year fixed, 85% LTV mortgage, is now £1,111 per month, down from £1,139 per month a year ago

Latest rates data

|

LTV (loan to value) |

Term

|

Average rate 12th December 2023 | Lowest rate 12th December 2023 |

Average rate a year ago |

|

95%

|

2 year fixed | 5.90% | 5.72% | 6.04% |

|

95%

|

5 year fixed | 5.48% | 5.24% | 5.76% |

|

90%

|

2 year fixed | 5.76% | 5.29% | 5.87% |

|

90%

|

5 year fixed | 5.22% | 4.79% | 5.57% |

|

LTV (loan to value) |

Term |

Average rate 12th December 2023 | Lowest rate 12th December 2023 |

Average rate a year ago |

|

85%

|

2 year fixed |

5.61% |

5.05% |

5.60% |

|

85%

|

5 year fixed

|

5.16% |

4.62% |

5.34% |

|

75%

|

2 year fixed |

5.31% |

4.70% |

5.35% |

|

75%

|

5 year fixed

|

4.99% | 4.41% | 5.10% |

|

60%

|

2 year fixed

|

4.86% | 4.65% | 5.22% |

|

60%

|

5 year fixed |

4.46% | 4.29% | 4.98% |

Rightmove can provide average monthly mortgage payments based on the latest available asking price and mortgage rate data. For example, the average monthly mortgage payment on a first-time buyer type property which is currently £219,984, for someone taking out an average five-year fixed, 85% LTV mortgage, is now £1,111 per month if repaying over 25 years, compared with £1,139 per month a year ago.

Average mortgage rates to be credited to Rightmove. The data is provided by specialist mortgage technology provider Podium Solutions. The data covers 95% of mortgage lending, to exclude specialist lenders. All rates are based on products with a circa £999 fee. If you would like further data on different LTVs or fixed terms, please contact us.

You may also like

Contact our press team

Email: press@rightmove.co.uk

Financial PR team

Powerscourt: Rob Greening / Elly Williamson

Tel: 0207 250 1446

Email: rightmove@powerscourt-group.com