From the challenges of market closure and letting property during a pandemic, to the peak of record rental competition in 2022, where the average property was getting an unmanageable 29 enquiries, the last five years have been eventful.

Add in legislative changes like the Renters’ Rights Bill and EPC requirements for rental properties, and it’s easy to understand why 64% of landlords feel the market is more challenging now than it was a decade ago.

However, there are positive signals in buy-to-let mortgage data, and more than 70% of landlords told us they intend to maintain or increase the size of their property portfolio over the next 12 months.

So just what is going on in the private rental sector? And what do you, as a landlord, need to know?

These insights were created using survey responses from over 4,000 landlords, agents and tenants alongside data from over 70 million listings.

Market trends

Rental price growth

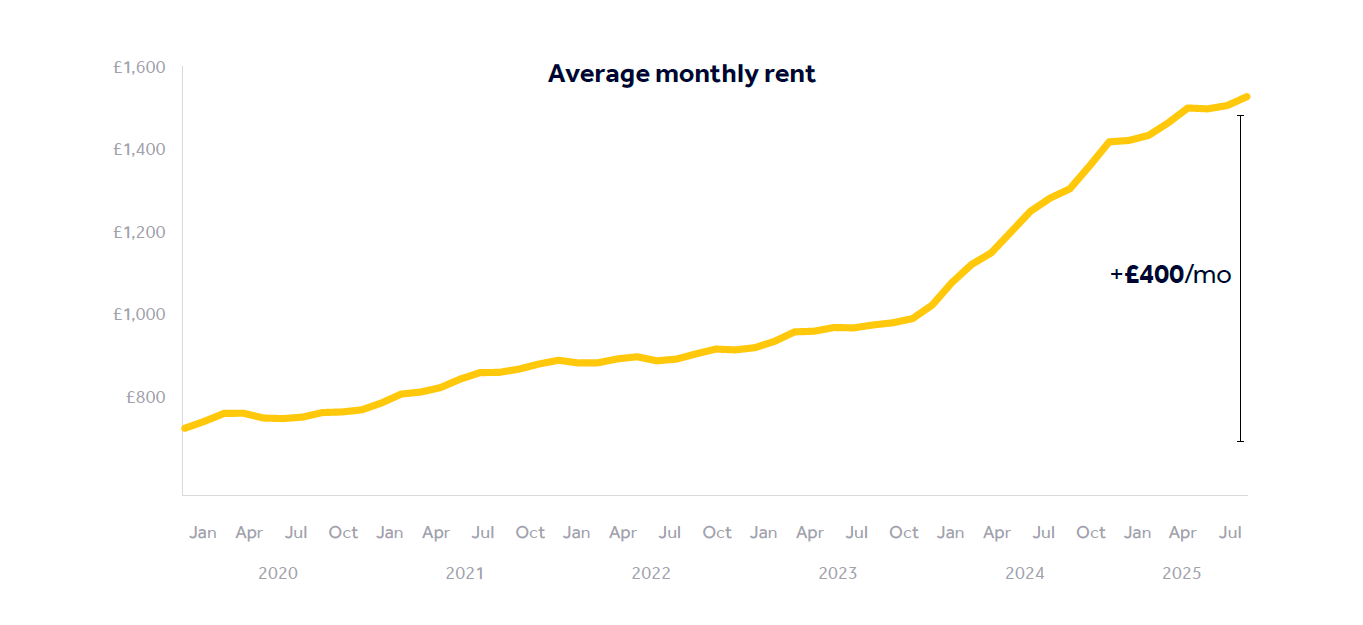

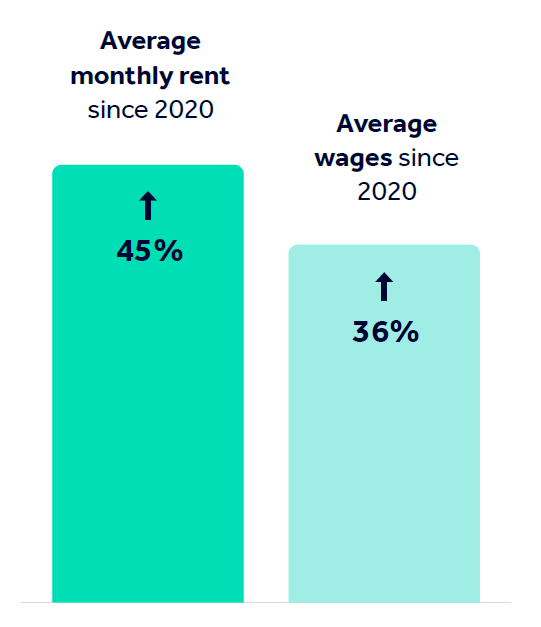

With the exception of a few months in late 2023 and early 2024, advertised rents have risen year-on-year in every month since the start of 2020. The average monthly rent for a new tenant has risen by more than £400 since 2020.

Growth in advertised rents is slowing

Although we’ve seen a rise in rents, much of this growth occurred during the frenetic pandemic years of 2021 and 2022. Since 2023, yearly rent rises have been gradually slowing. While prices continue to reach new records, June 2025 saw just a 3.9% year-on-year increase in average rental price.

Balance of supply and demand

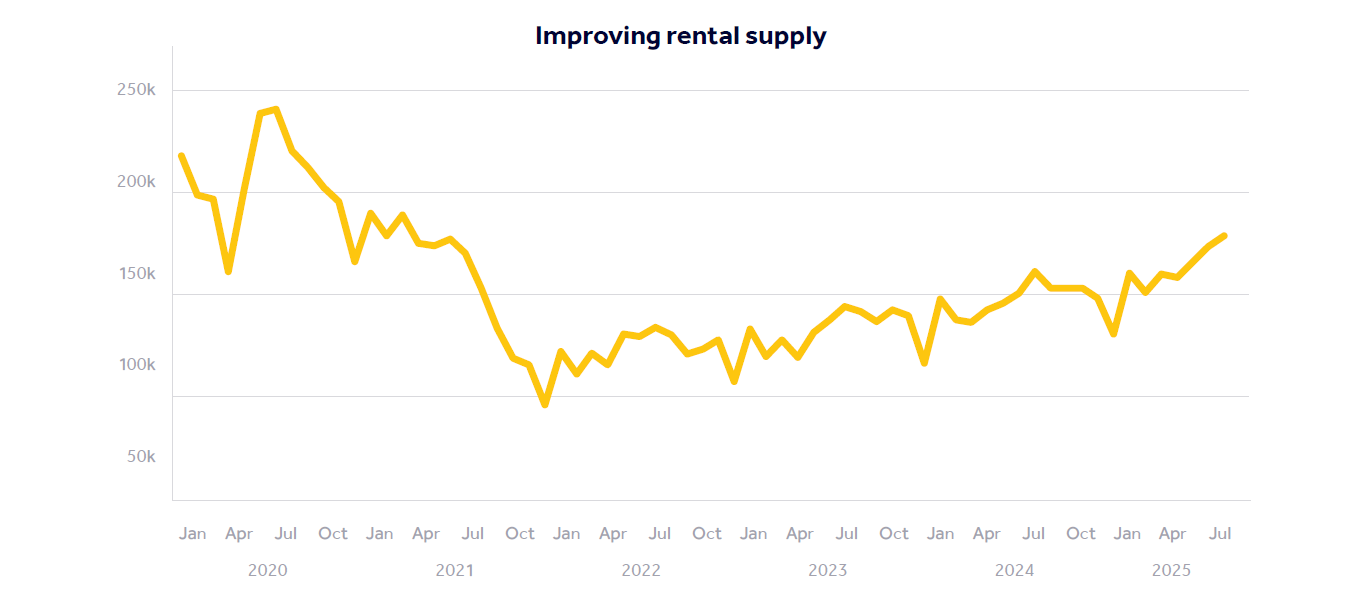

We’re currently seeing the best balance between supply and demand in the rental market since 2020, as the market continues to recalibrate after the pandemic years.

The total number of available rental listings is up 11% in 2025 to date, versus the same period in 2024. While new listings are up 6% versus the same period in 2024, 9% versus 2023, and 11% versus 2022.

Meanwhile unique demand, the number of individuals submitting property enquiries, is down 12% in 2025 to date versus the same period in 2024.

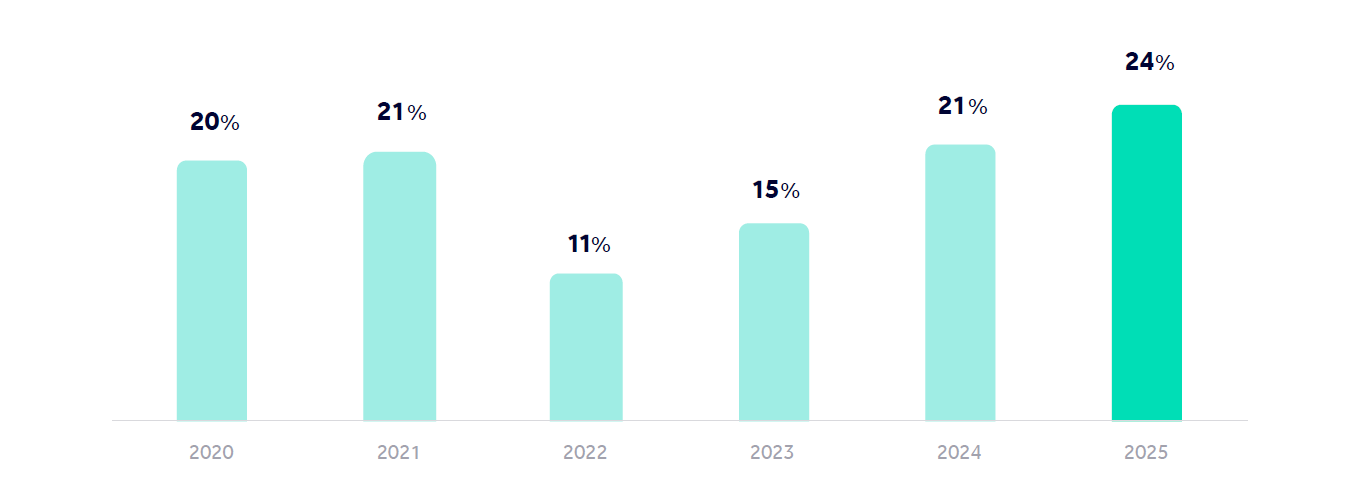

Increase in reductions

In 2025 so far, an average of 24% of rental listings have had their price reduced. That’s the highest proportion of rental properties reduced in this decade.

Tenants

Tenants are being stretched financially and not feeling overly optimistic

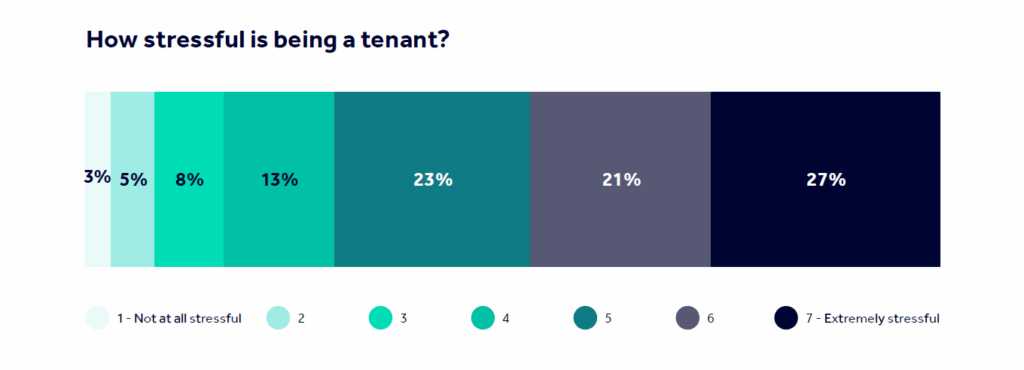

27%

of tenants describe finding renting extremely stressful, with rental fees and prices listed as their number one concern.

66%

believe that there is less on the market that they can afford now than there was the last time they searched for a property to rent.

44%

believe there are more applicants per

property than the last time they were in the

market for a rental property.

Tenants and Rightmove

Independent data from Street and based on a sample of tenancies agreed between January 2024 to April 2025, shows that 3 in every 4 originated from a Rightmove enquiry when compared with the next largest portal.

So we know that 3 out of every 4 renters find their home on Rightmove. But what about perception?

92%

of tenants said they’d visit Rightmove first when looking for a property to rent

86%

of tenants believe Rightmove has the most properties available for rental in their area

89%

of tenants surveyed believe Rightmove has the best properties available for rental

Landlords

Landlord sentiment under strain

One in three landlords are actively considering exiting the market, and 64% feel less supported

by the government now than they did a decade ago.

Among those considering selling, 77% are full-time landlords, highlighting how even seasoned

investors are questioning the value of staying in the sector. Changing legislation and reduced profitability being the two main reasons landlords provided for potentially selling up.

Positive signals in mortgage data

The latest snapshot of buy-to-let lending from UK Finance shows that there has been a 17%

increase in total number of loans to property investors. This includes a 28% uplift for newly

purchased rental homes.

This is perhaps an early signal that landlords are returning to the market, or that a new

generation of landlords is coming to the Private Rental Sector (PRS).

Optimising your portfolio

Breakdown of the portfolio composition

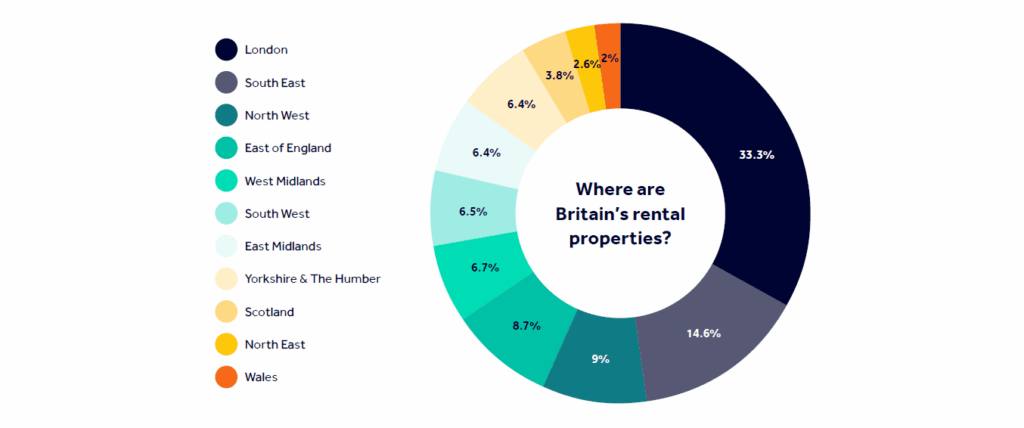

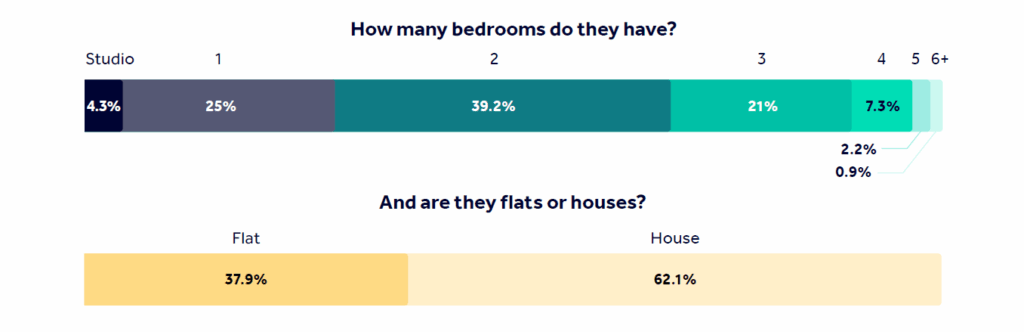

Hundreds of thousands of properties are advertised for rent every year, representing around a quarter of all properties advertised in 2025. But what are these properties? And where are they?

What this highlights is the wide range of properties available within the PRS. It’s not just urban flats – there’s a huge variety of properties, appealing to a wide range of different renters, in a multitude of different circumstances.

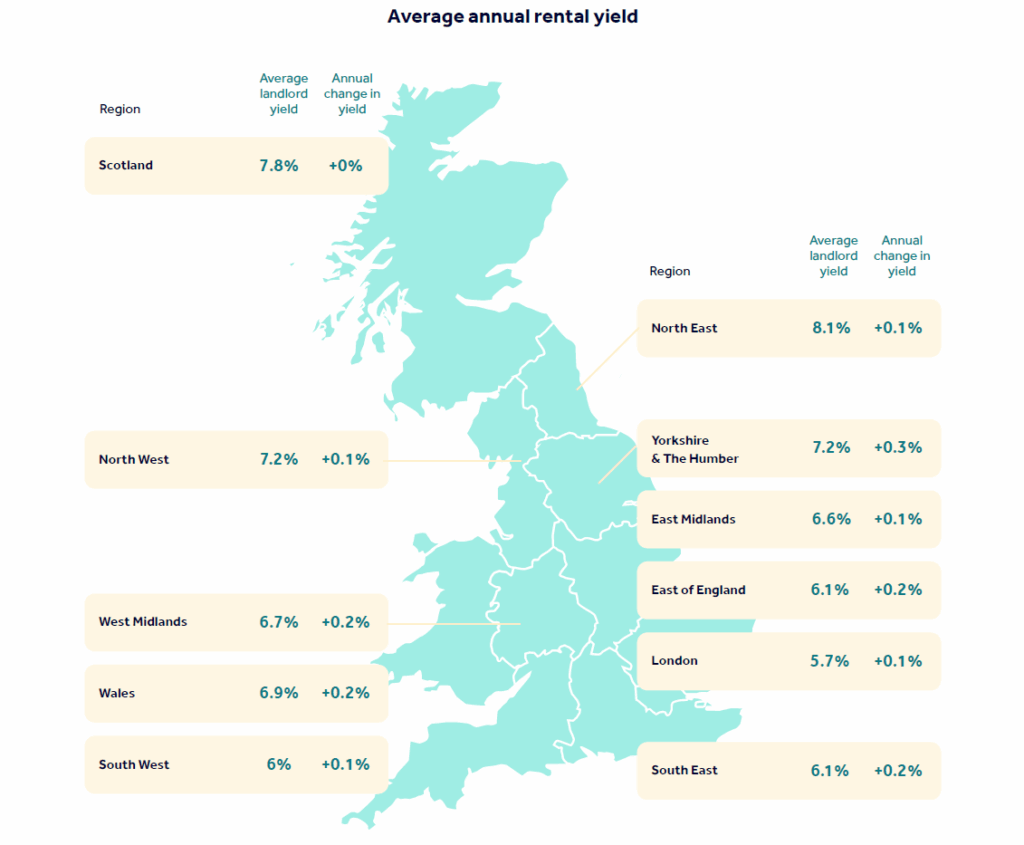

Regional yield variations

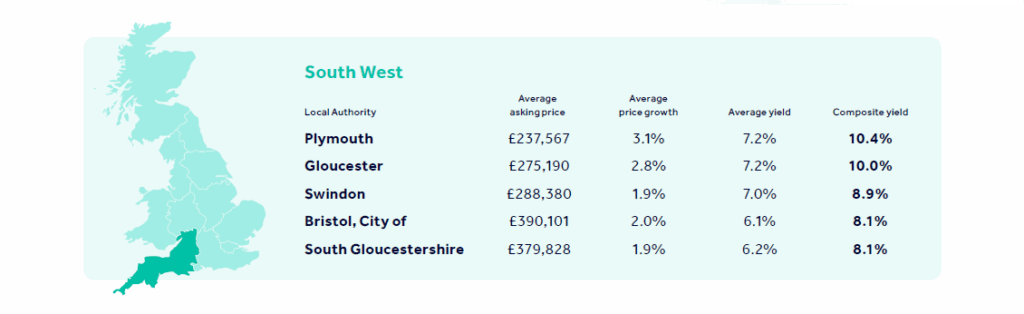

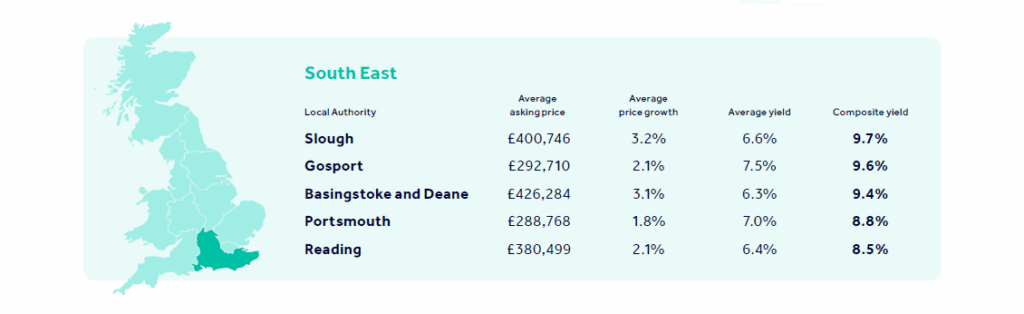

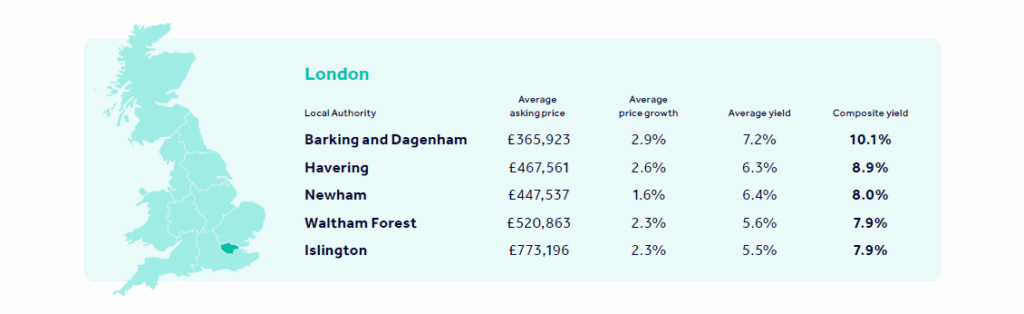

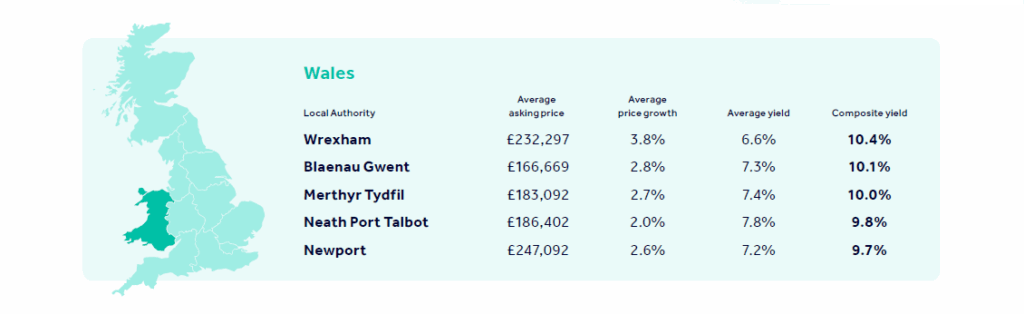

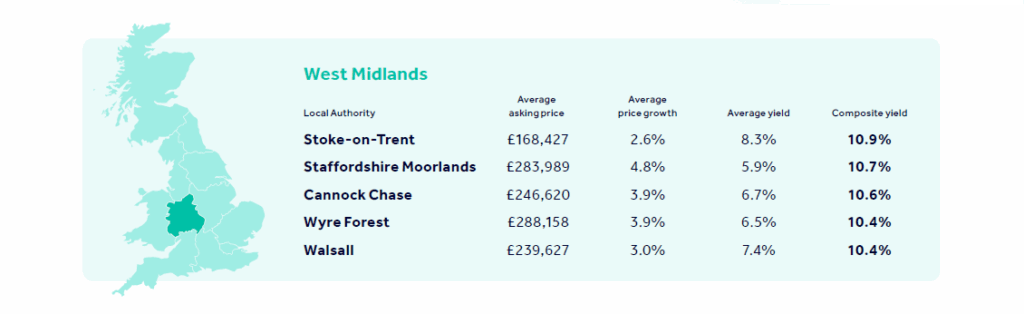

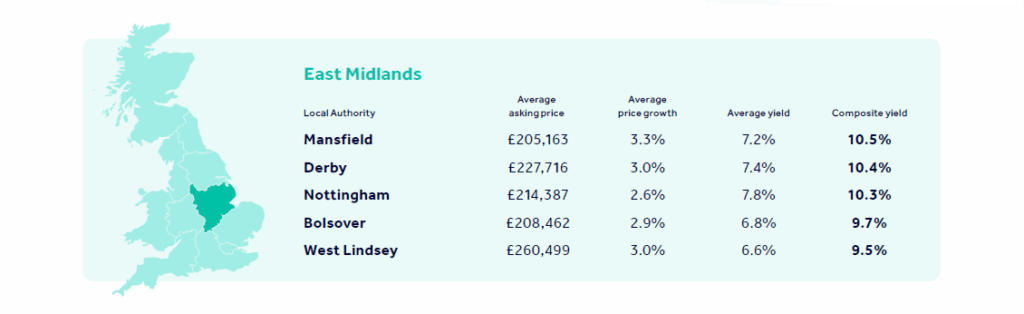

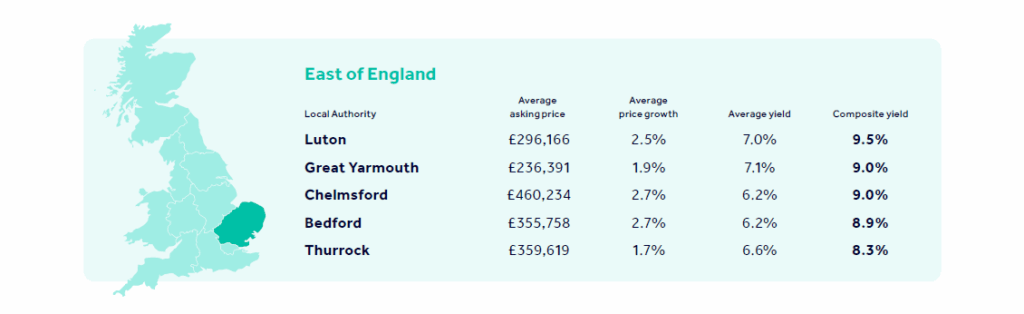

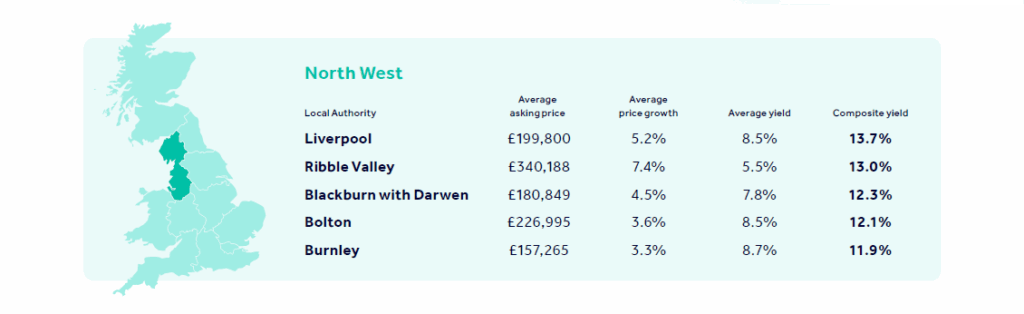

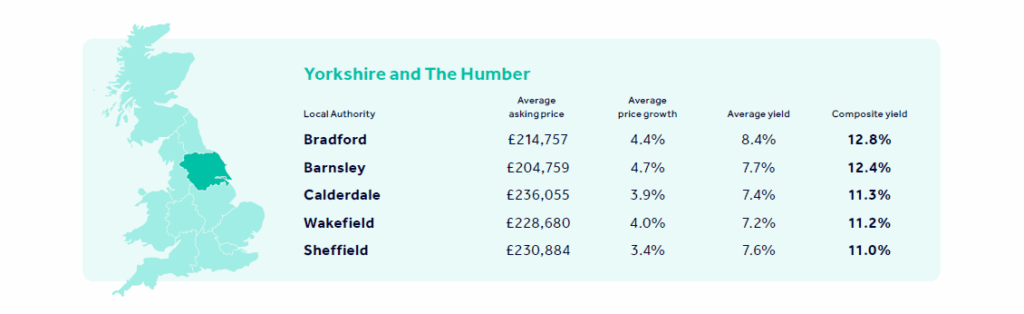

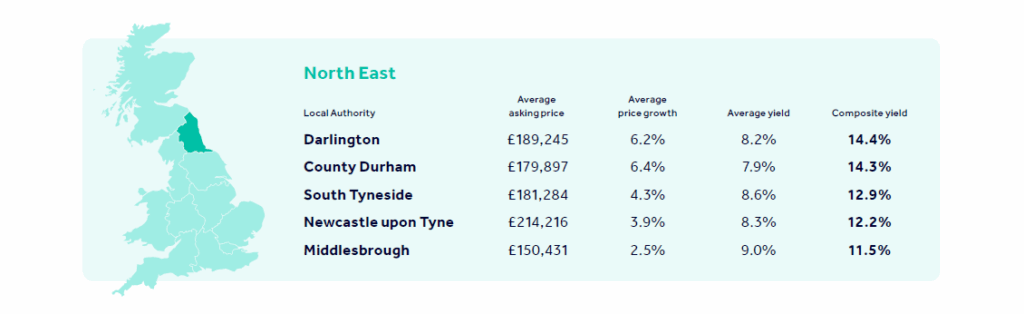

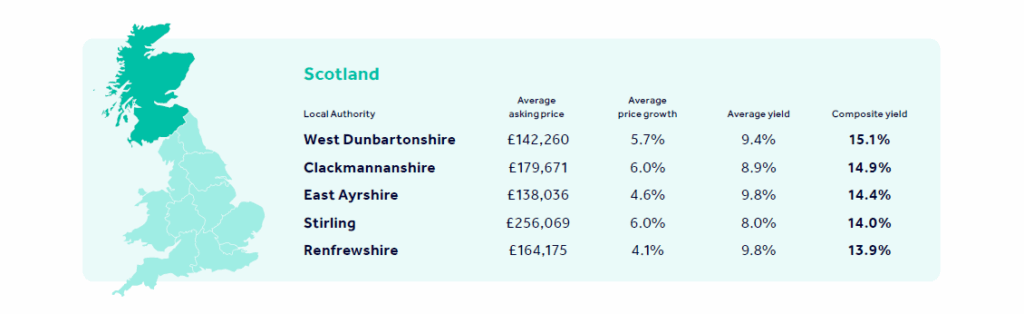

One in five landlords are looking to expand their portfolio and we know landlords are looking for a return on their investment, but as you’d expect the average yield varies regionally and locally. So where are the best bets for those looking to expand their rental portfolio?

The average annual rental yield was 6.3% in Q2 2025, ranging from 5.7% in London up to 8.1% in the North East.

We measure this based on the average asking price of properties listed for rent as a proportion of the average property value in any given local authority area.

Composite yield and investment hotspots

By combining the average rental yield with the price growth of properties for sale in a given local authority, we can go one step further and provide a composite view of where a landlord is likely to see the greatest return on their investment.

You can see the top performing Local Authorities in each region below.

Key takeaways for landlords

Although it’s been a frenetic few years for the lettings sector, and there are challenges in the form of legislative changes and affordability concerns for landlords and tenants alike, it’s not all doom and gloom and there are still opportunities for landlords to optimise their lettings business.

Key points:

- Rental price growth continues to slow

- We’re seeing a better balance between supply and demand

- Rightmove is the preferred destination for tenants

- Positive signals in buy-to-let data suggests new landlords coming to market

- Regional and local variations present opportunities for landlords

Support for landlords from agents:

Letting agents are extremely well placed to support landlords going forwards, with expertise in compliance and the legislative landscape as well as local market intelligence that could help identify opportunities for your portfolio.

Our research shows, that landlords who use an agent are 15% more likely to review their rent annually, and are 9% less likely to experience rental arrears. And over 50% of landlords using a letting agent, said they did so to ensure their lettings business was compliant.

Support for landlords from Rightmove:

Do you get our landlord newsletter?

Our quarterly rental market update is a must-have newsletter for landlords, investors and property professionals.

Visit our Landlord guides

Discover expert tips for landlords, from managing rental properties and choosing letting agents, to staying up to date with the latest legislation.

Sources:

- Agent data: Rightmove’s agent survey data taken from quarterly survey, most recently conducted in July 2025, with approximately 600 respondents per quarter.

- Landlord data: Survey of Rightmove newsletter subscribers from April to May 2025, with 963 respondents in England including full-time, investment and accidental landlords.

- Market data: Rightmove Data Services, derived from more than 70 million UK residential property listing records and 150 million transactional data points dating back to 2000.

- Street data: Independent data, based on a sample of tenancies agreed Jan 2024 to Apr 2025, shows that 3 in every 4 originated from a Rightmove enquiry when compared with the next largest portal. More info here.

- Tenant data: Survey of Rightmove newsletter subscribers conducted from April to May 2025, with 2,375 respondents covering a range of ages, regions, and property types.

Copyright © 2000-2026 Rightmove Group Limited. All rights reserved. Rightmove prohibits the scraping of its content. You can find further details here.