What you need to know about the market this month

Homes are taking longer to sell at the moment because of delays in the process, with our latest data showing there are a massive 613,000 properties trying to reach completion.

The temporary stamp duty holiday that came on 8th July last year is due to end on 31st March, so we’ve put together some advice if you’re just starting out or if you’re in the middle of a move right now.

How long is the process taking?

The latest study from our data analysts shows that it is now taking 126 days from the time an offer is accepted until legal completion, which is just over four months.

If you’ve just put your home on the market, the average time from advertising a home until it has an offer is accepted is 57 days, so on average the total process is around 26 weeks.

But remember these are averages, and it will depend on a number of things such as if you’re a cash buyer and so can move more quickly, if you’re in a chain, and how long your local searches will take.

If you’re starting out the year looking for a home, we’d advise that you don’t factor in any stamp duty savings from the temporary holiday, unless you’re a first-time buyer and are buying a home for £300,000 or less.

What if I’ve already factored in stamp duty savings?

We estimate that based on the current situation, around 100,000 sales going through are going to miss out on the stamp duty savings.

If you think you’re in danger of falling into this group, speak early to your estate agent and ask for their advice on making sure the sale doesn’t fall through, as it may be possible to re-negotiate with the seller.

Is the market busy?

The good news for sellers is that buyer activity is even higher than it was a year ago, and last January was particularly strong because the market had some post-election certainty of a majority government.

Many people have reassessed their housing priorities following their experience of lockdown, and with another long lockdown upon us, there are early signs that we are surpassing 2020’s new-year surge in activity.

The number of prospective buyers contacting agents between 2nd and 12th January was up by 12% and sales agreed numbers were up by 9% on the comparable period last year.

Visits to our site have also continued to increase since the start of January, and are up by 33% on the same period in 2020.

Will things change when the stamp duty holiday ends?

We anticipate a slower second quarter once the stamp duty holiday is over, but it should also be remembered that the surge in buyer demand after the first lockdown in 2020 was initially driven by movers’ changed housing needs.

This means that the momentum we saw last year actually started a couple of months before the July introduction of the stamp duty holiday.

The combination of the two resulted in an amazing recovery in 2020 activity despite the pandemic, with the number of sales agreed up by 10% compared to the whole of 2019.

The stamp duty holiday has undoubtedly added extra momentum to the market, but all regions have seen far greater average price increases than the average savings in stamp duty.

What do the experts say?

Our resident property data expert Tim Bannister explained that the housing market is in the midst of a processing logjam, with some home-movers likely to miss out on their stamp duty savings.

He said: “As we enter the new year and a new lockdown, the housing market remains open but is focused on the imminent end of the stamp duty holiday and on the challenges of the pandemic.

While the tax savings were an added incentive, movers’ desire for more inside and outside space seems to be continuing, and this new lockdown could be a spur to act in 2021 for those who can and who did not do so in 2020.

“However, there are still a huge number of sales agreed in 2020 that are stuck in the processing logjam and awaiting legal completion, with many hoping to beat the impending tax deadline.

“For those who fail to do so, there may be difficulties if they have factored the tax savings into their budget calculations.

“The challenge of processing so many transactions in less than three months is made even tougher by the new lockdown restrictions, Covid-19 sickness and home-schooling further reducing capacity in conveyancing, legal searches and mortgage lending.”

What are estate agents seeing?

Matthew Smith, Sales and Lettings Director at Thornley Groves in Manchester, said: “The Manchester suburbs, places such as Sale and Altrincham, are absolutely flying.

“People are looking for more outside space, and there’s much more activity at the higher end of the market – i.e. properties being sold at £500,000 and over – compared to 12 or 18 months ago.

“Many people have outgrown their homes, and with more people now working from home, and undertaking home-schooling, it has really focused their attention on getting their properties ready to sell.

“Many home-movers are financially motivated, so the stamp duty holiday has definitely been a sweetener to kick people into action.

“Savings of up to £15,000 aren’t to be sniffed at, but I don’t think the high levels of activity we’re currently seeing are exclusively due to the tax holiday. It’s simply given people the impetus to be alert to moving home, which in turn has led to more demand.”

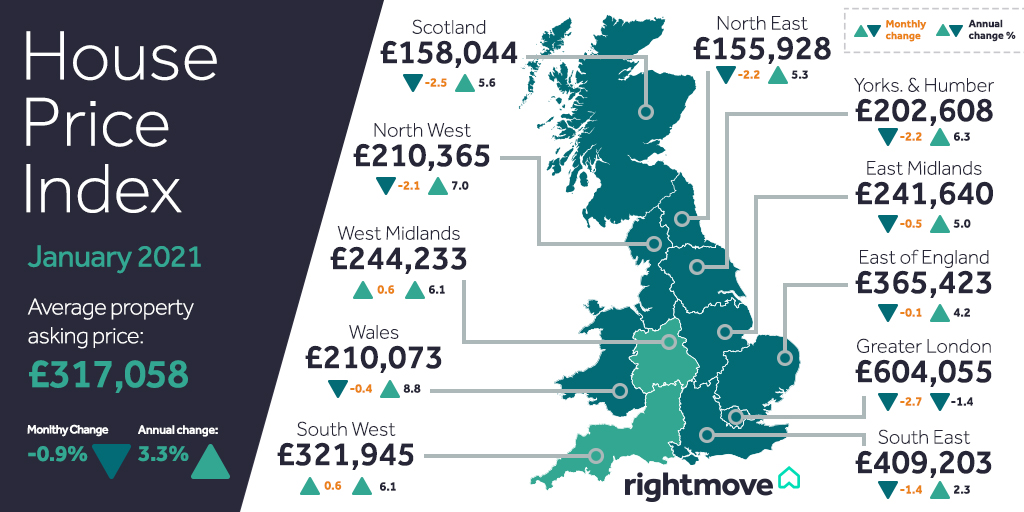

Managing Partners Sue Macey and Cathy Morris-Adams of Lodestone Property in Bruton, Wells and Shaftesbury, added: “Our Shaftesbury and Bruton offices sit in the heart of the rural south west, and as Rightmove’s latest data shows our region is one of the few areas where asking prices have continued to climb over the past month due to the demand from buyers.

“In 2020 nearly half of our properties for sale went for asking price or above and as we move into the new year demand is continuing to outstrip supply as people look to set up a new life in the country.

“For months now we’ve been offering prospective buyers the chance to view properties online, including live video tours hosted by our vendors. It’s a great way for interested buyers to ask questions and look at the property as if they were walking around in person and it’s proven to be a big hit.”

To read January’s House Price Index in full, click here.

READ MORE: How to shortlist homes using online viewings

The header image for this article comes courtesy of Balgores.