Find out where demand has doubled since stamp duty holiday

It’s only been two weeks since the government temporarily axed stamp duty on homes up to £500,000 in England and Northern Ireland, but already certain areas have seen demand sky-rocket.

If you live in the southern commuter belt and outer areas of London, the recent changes to stamp duty could mean you now have an increased chance of selling.

That’s because homes in this region are typically higher priced properties and is therefore where people are set to make the biggest savings.

For example, we’ve seen a 49% surge in phone calls and emails to agents for homes priced between £400,000-£500,000 – compared to an overall uplift of 14%.

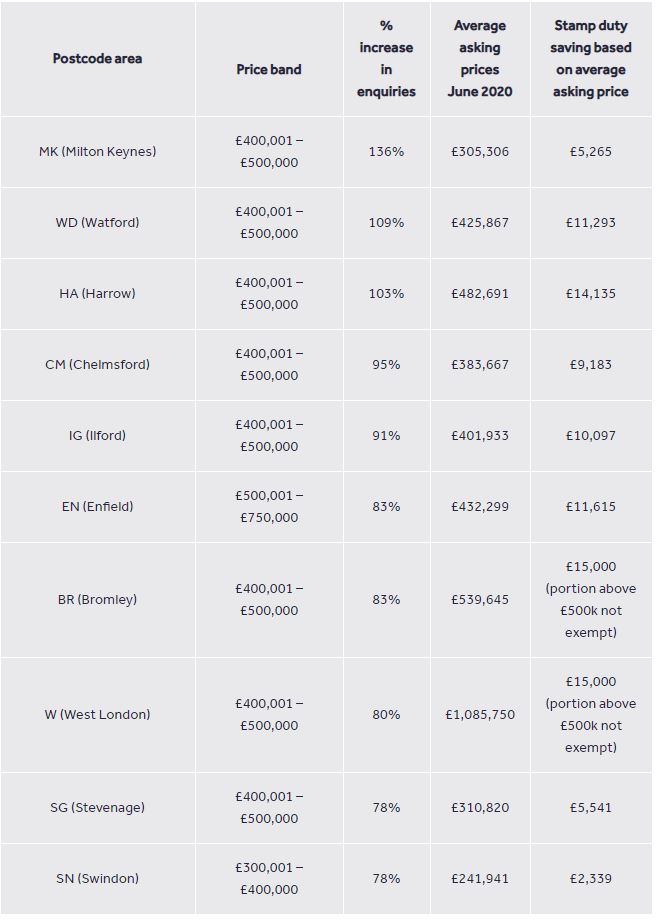

Where has seen the biggest uplift in demand?

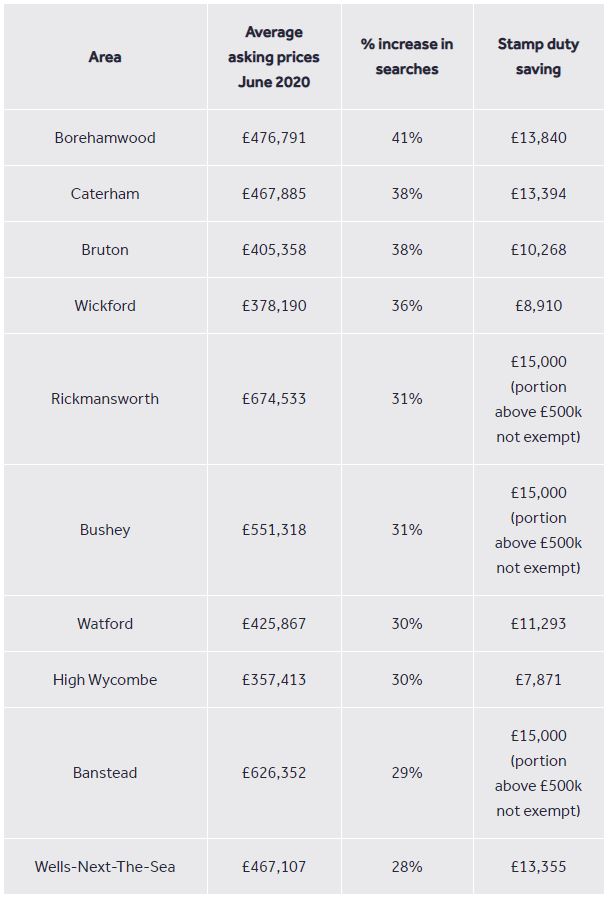

Which places have had the biggest rise in searches?

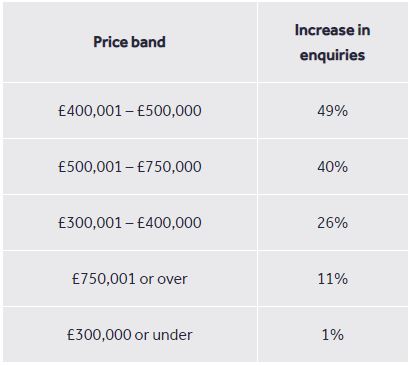

Which price bands have become more popular?

What are the headline figures?

Since the stamp duty holiday announcement:

- There has been a 49% surge in calls and emails to agents for homes priced between £400,000-£500,000, compared to an overall uplift of 14%

- The tax saving of £15,000 has also increased demand for properties priced £500,001-£750,000, with enquiries up 40%

- Sales agreed in the week following the announcement saw the biggest annual increase in the upper end sector, up 54%, compared to an overall average of +35%

What do the experts say?

Our resident property expert Miles Shipside explained that the stamp duty holiday should help all parts of the property chain get moving.

He said: “The uplift in enquiries is likely a mixture of people looking in new areas to see what they can now afford, changing their search criteria to bigger, slightly more expensive homes, and new movers coming into the market because they now have enough extra budget to move home.

“The savings of £15,000 on property above £500,000 may also help some people to trade up more easily.

”Our analysis shows that this is going to help the mid-market the most, but all parts of a property chain are vital to keep the market moving.

“Although low deposit mortgage options are slowly coming back to the market, first-time buyers who were already exempt from stamp duty up to £300,000 may find that they will be competing with some buy-to-let investors also looking to make the most of the stamp duty savings in this sector of the market.”

Take a look at what’s on the market between £400,001 – £500,000:

Milton Keynes

This beautifully renovated three-bedroom Victorian home is the perfect property for a young family to call home.

It has a mixture of period features and modern appliances, and boasts a smart back garden and off-street parking. It could be yours for £475,000.

This property is listed for sale with Michael Graham.

Watford

Another fabulously renovated Victorian property, this three-bedroom terraced house has an incredible open-plan living space and is on the market for £475,000.

It’s located just a short walk from Watford Junction Station and also has easy access to the M1.

This property is listed for sale with Sewell & Gardner.

Harrow

This cosy, mews-style home is nestled midway between Hatch End and Stanmore and has a wonderfully colourful garden.

This three-bedroom house, which is up for sale for £499,950, features a modern upstairs bathroom and a private garage in a nearby block.

This property is listed for sale with Robertson Phillips.